Question

Blossom Corporation owned a manufacturing facility. Blossom had purchased the building for $11,400,000, and had recorded $5,040,000 depreciation on the facility. On January 1, 2020,

Blossom Corporation owned a manufacturing facility. Blossom had purchased the building for $11,400,000, and had recorded $5,040,000 depreciation on the facility. On January 1, 2020, Blossom sold the building to HMD Ltd. for $7,416,000, and then immediately signed a 35-year agreement to lease back the building for annual payments of $699,057, due at the start of each year. Title to the building would return to Blossom at the conclusion of the lease. HMDs implied interest rate, which was known to Blossom, was 10%.

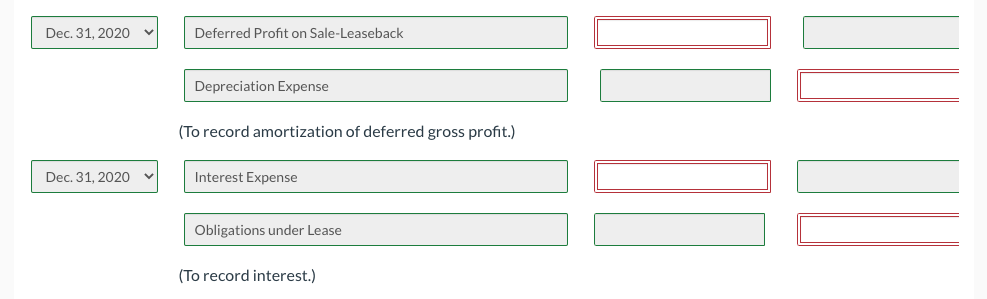

What are the values for the attached journal entries.

Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started