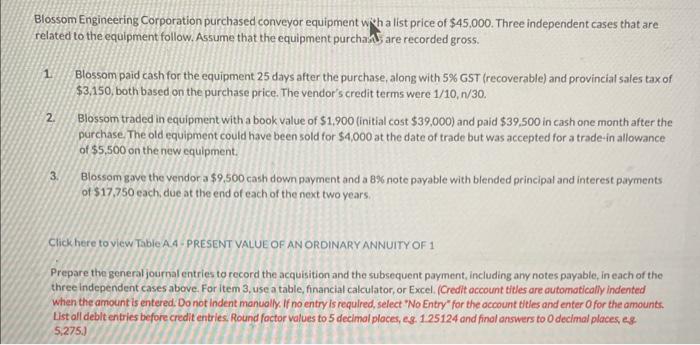

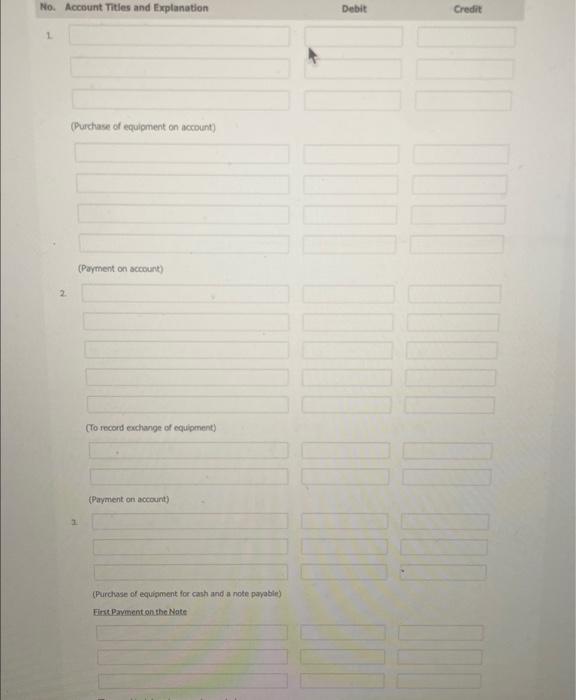

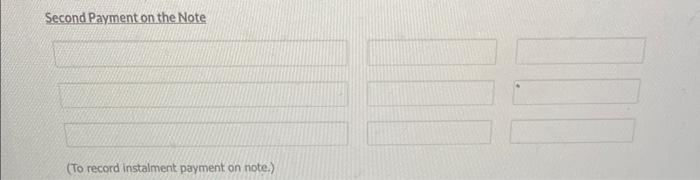

Blossom Engineering Corporation purchased conveyor equipment w th a list price of $45,000. Three independent cases that are related to the equipment follow. Assume that the equipment purchaA 5 are recorded gross. 1 Blossom paid cash for the equipment 25 days after the purchase, along with 5% GST (recoverable) and provincial sales tax of $3,150, both based on the purchase price. The vendor's credit terms were 1/10,n/30. 2. Blossom traded in equipment with a book value of $1,900 (initial cost $39,000 ) and paid $39,500 in cash one month after the purchase. The old equipment could have been sold for $4,000 at the date of trade but was accepted for a trade-in allowance of $5.500 on the new equipment. 3. Blossom gave the vendor a $9,500 cash down payment and a 8% note payable with blended principal and interest payments of $17,750 each, due at the end of each of the next two years. Click here to yiew TabIe A.4 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 Prepare the general journal entries to record the acquisition and the subsequent payment, including any notes payable, in each of the three independent cases above. For item 3, use a table, financial calculator, or Excel. (Gredit occount titles are cutomoticolly indented when the amount is entered. Do not indent manuolly. If no entry is requlred, select "No Entry" for the occount titles and enter O for the amounts. List all deblt entries before credit entries, Round foctor values to 5 decimal places, es. 1.25124 and finol answers to 0 decimal places, es. 5.275.) No. Account Titles and Explanation Debit Credit 1. (Purchase of equigment on acrount) (Payment on sccourt) 2. (To record exchange of equpment) (Payment on accourt) 1. (Purchase of equipment for cash and a note pyyable) Eint Pavment on the Nate Second Payment on the Note (To record instalment payment on note.) Blossom Engineering Corporation purchased conveyor equipment w th a list price of $45,000. Three independent cases that are related to the equipment follow. Assume that the equipment purchaA 5 are recorded gross. 1 Blossom paid cash for the equipment 25 days after the purchase, along with 5% GST (recoverable) and provincial sales tax of $3,150, both based on the purchase price. The vendor's credit terms were 1/10,n/30. 2. Blossom traded in equipment with a book value of $1,900 (initial cost $39,000 ) and paid $39,500 in cash one month after the purchase. The old equipment could have been sold for $4,000 at the date of trade but was accepted for a trade-in allowance of $5.500 on the new equipment. 3. Blossom gave the vendor a $9,500 cash down payment and a 8% note payable with blended principal and interest payments of $17,750 each, due at the end of each of the next two years. Click here to yiew TabIe A.4 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 Prepare the general journal entries to record the acquisition and the subsequent payment, including any notes payable, in each of the three independent cases above. For item 3, use a table, financial calculator, or Excel. (Gredit occount titles are cutomoticolly indented when the amount is entered. Do not indent manuolly. If no entry is requlred, select "No Entry" for the occount titles and enter O for the amounts. List all deblt entries before credit entries, Round foctor values to 5 decimal places, es. 1.25124 and finol answers to 0 decimal places, es. 5.275.) No. Account Titles and Explanation Debit Credit 1. (Purchase of equigment on acrount) (Payment on sccourt) 2. (To record exchange of equpment) (Payment on accourt) 1. (Purchase of equipment for cash and a note pyyable) Eint Pavment on the Nate Second Payment on the Note (To record instalment payment on note.)