Answered step by step

Verified Expert Solution

Question

1 Approved Answer

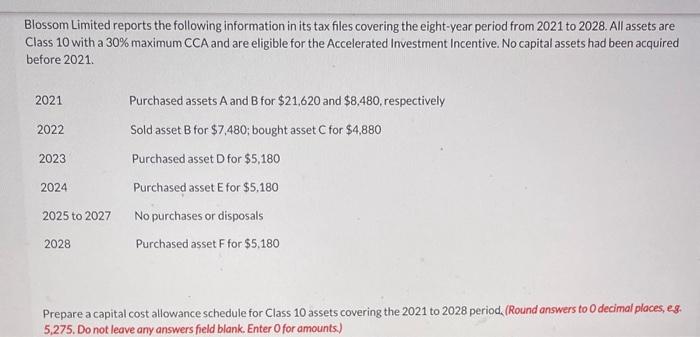

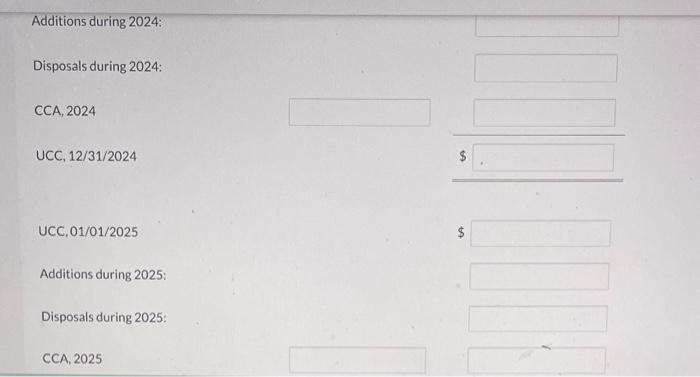

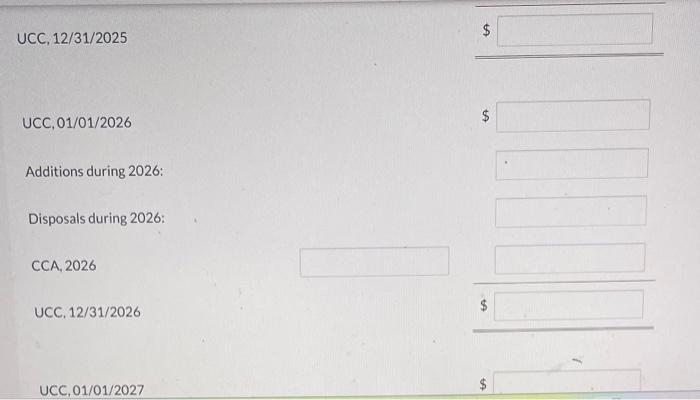

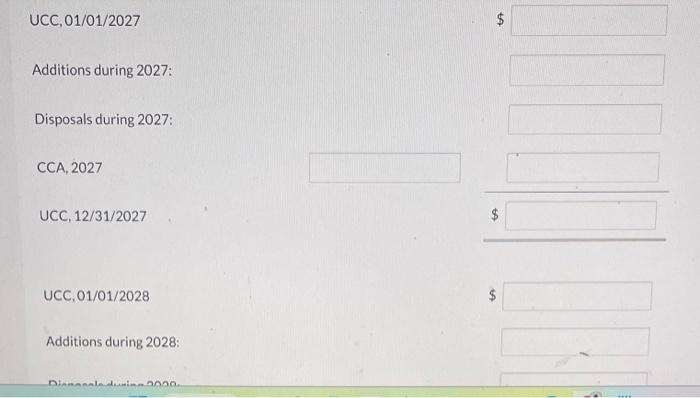

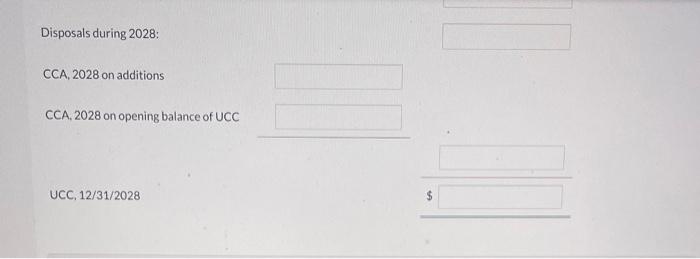

Blossom Limited reports the following information in its tax files covering the eight-year period from 2021 to 2028. All assets are Class 10 with

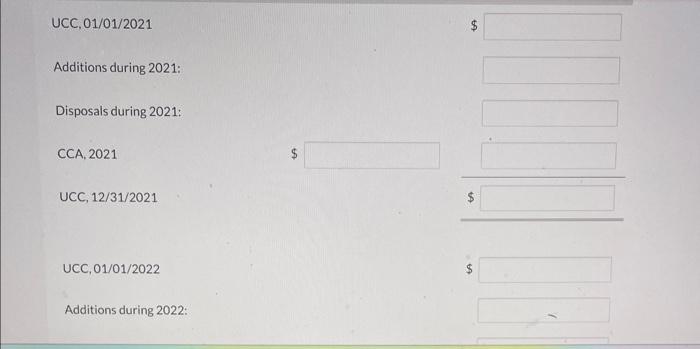

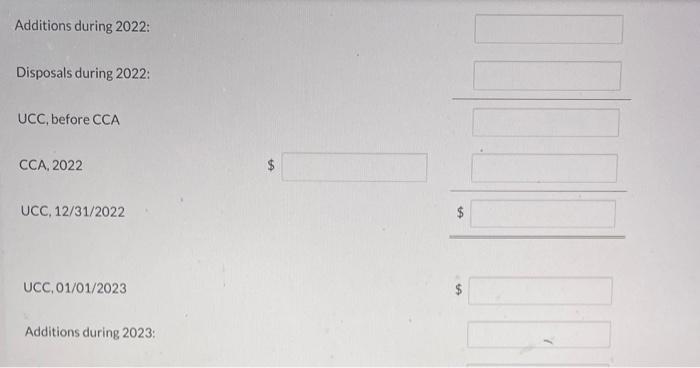

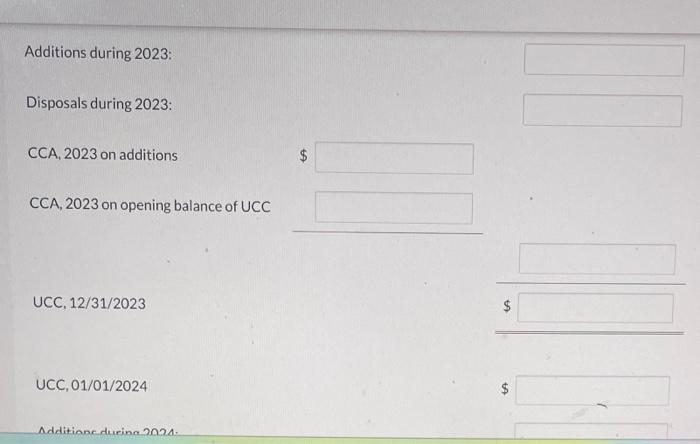

Blossom Limited reports the following information in its tax files covering the eight-year period from 2021 to 2028. All assets are Class 10 with a 30% maximum CCA and are eligible for the Accelerated Investment Incentive. No capital assets had been acquired before 2021. 2021 2022 2023 2024 2025 to 2027 2028 Purchased assets A and B for $21,620 and $8,480, respectively Sold asset B for $7,480; bought asset C for $4,880 Purchased asset D for $5,180 Purchased asset E for $5,180 No purchases or disposals Purchased asset F for $5,180 Prepare a capital cost allowance schedule for Class 10 assets covering the 2021 to 2028 period, (Round answers to 0 decimal places, e.g. 5,275. Do not leave any answers field blank. Enter O for amounts.) UCC, 01/01/2021 Additions during 2021: Disposals during 2021: CCA, 2021 UCC, 12/31/2021 UCC, 01/01/2022 Additions during 2022: LA 69 LA Additions during 2022: Disposals during 2022: UCC, before CCA CCA, 2022 UCC, 12/31/2022 UCC, 01/01/2023 Additions during 2023: GA Additions during 2023: Disposals during 2023: CCA, 2023 on additions CCA, 2023 on opening balance of UCC UCC, 12/31/2023 UCC, 01/01/2024 Additions during 2024 $ LA $ +A Additions during 2024: Disposals during 2024: CCA, 2024 UCC, 12/31/2024 UCC, 01/01/2025 Additions during 2025: Disposals during 2025: CCA, 2025 tA UCC, 12/31/2025 UCC, 01/01/2026 Additions during 2026: Disposals during 2026: CCA, 2026 UCC, 12/31/2026 UCC, 01/01/2027 +A +A 69 UCC, 01/01/2027 Additions during 2027: Disposals during 2027: CCA, 2027 UCC, 12/31/2027 UCC, 01/01/2028 Additions during 2028: Diamanale din 2020.. to 69 SA Disposals during 2028: CCA, 2028 on additions CCA, 2028 on opening balance of UCC UCC, 12/31/2028

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Blossom Limited Capital Cost Allowance Schedule for Class 10 Assets 20212028 Year UCC Beginning of Y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started