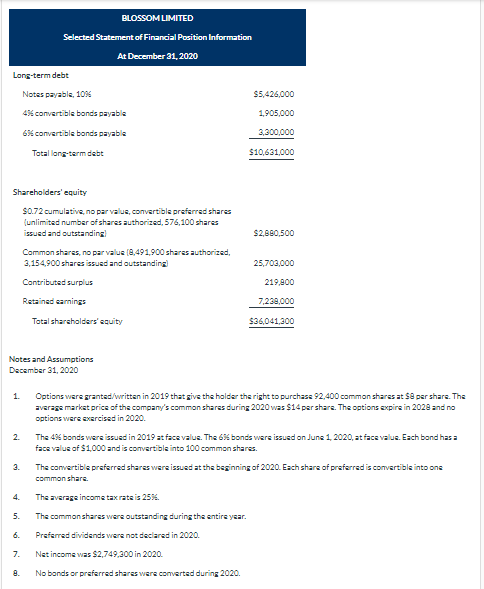

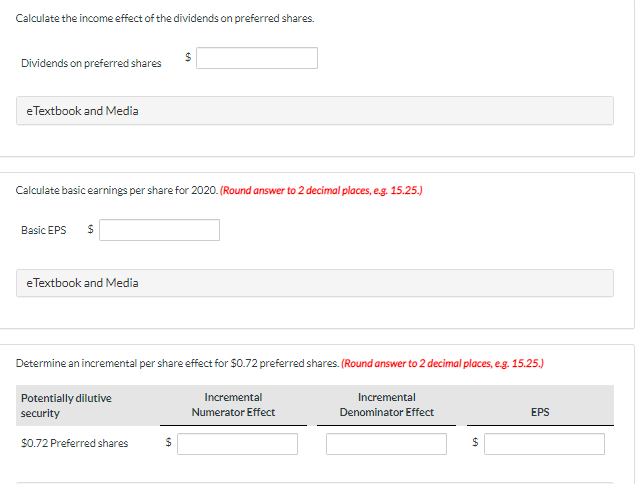

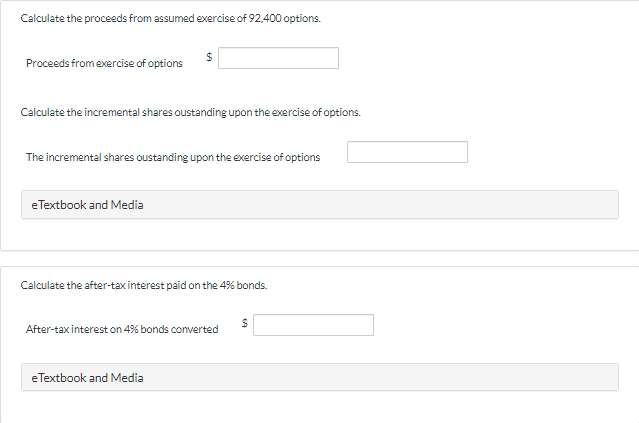

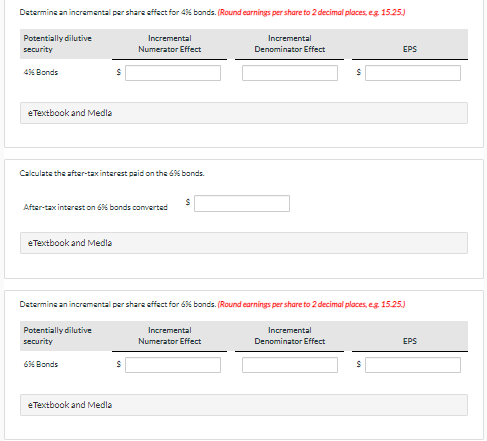

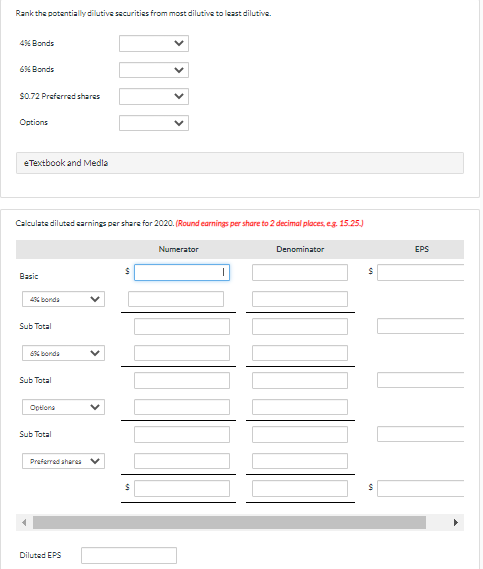

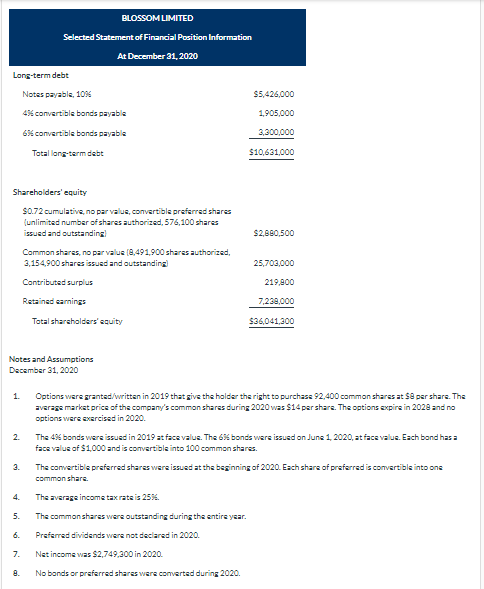

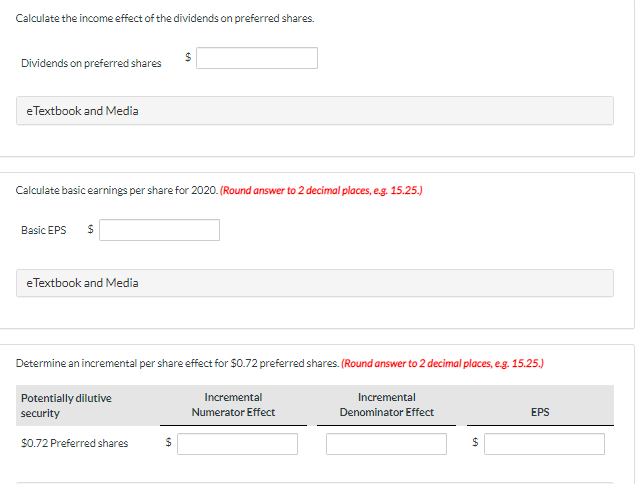

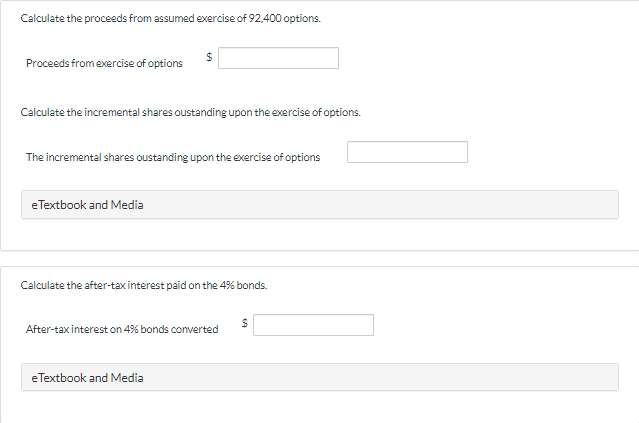

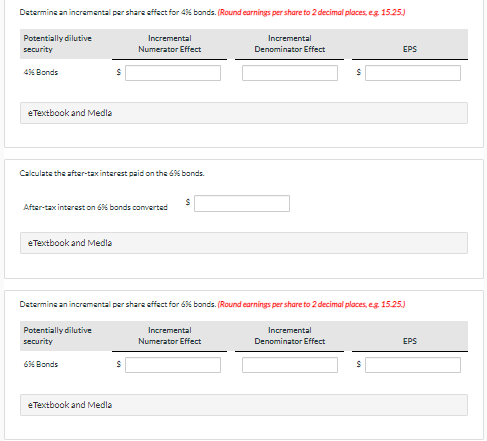

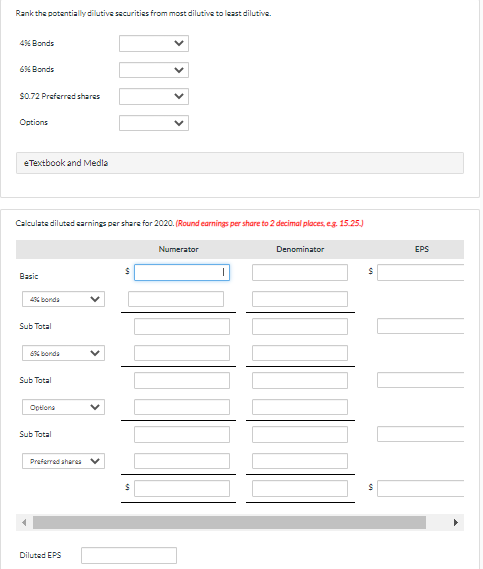

BLOSSOM LIMITED Selected Statement of Financial Position Information At December 31, 2020 Long-term debt Notes payable, 10% $5,426,000 456 convertible bonds payable 1,905,000 656 convertible bonds payable 2.300,000 Total long-term debt $10,631,000 Shareholders' equity $0.72 cumulative no par value, convertible preferred shares (unlimited number of shares authorized, 576,100 shares issued and outstanding] $2,880,500 Common shares, no par value (8,491,900 shares authorized 3,154,900 shares issued and outstanding 25,703,000 Contributed surplus 219,900 7,239,000 Retained earnings Total shareholders' equity $36,041,300 Notes and Assumptions December 31, 2020 1. 2. Options were granted/written in 2019 that give the holder the right to purchase 92.400 common shares at Sper share. The average market price of the company's common shares during 2020 was 14 per share. The options expire in 2028 and no options were exercised in 2020. The 49% bonds were issued in 2019 at face value. The 65 bonds wers sued June 1, 2020, at face value. Each band has a face value of $1,000 and is convertible into 100 common shares. The convertible preferred shares were issued at the beginning of 2020. Each share of prefarred is convertible into one common share 3. The average income tax rate is 25%. 5. 6. The common shares were outstanding during the entire year. Preferred dividends were not declared in 2020 Net income was $2,749,300 in 2020. 7. No bands or preferred shares were converted during 2020. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares eTextbook and Media Calculate basic earnings per share for 2020. (Round answer to 2 decimal places, eg. 15.25.) Basic EPS $ e Textbook and Media Determine an incremental per share effect for $0.72 preferred shares. (Round answer to 2 decimal places, eg. 15.25.) Potentially dilutive security Incremental Numerator Effect Incremental Denominator Effect EPS $0.72 Preferred shares $ $ Calculate the proceeds from assumed exercise of 92.400 options. Proceeds from exercise of options $ Calculate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options e Textbook and Media Calculate the after-tax interest paid on the 4% bonds. $ After-tax interest on 4% bonds converted eTextbook and Media Determine an incremental per share effect for 45 bonds. (Round earnings per share to 2 decimal places, eg 1525.) Potentially dilutive security Incremental Numerator Effect Incremental Denominator Effect EPS 45 Bonds s e Textbook and Media Calculate the after-tax interest paid on the 69 bands. S After-tax interest on 656 bands converted e Textbook and Media Determine an incremental per share affect for 65 bonds. (Round earnings per share to 2 decimal places, eg 15.25.) Potentially dilutive security Incremental Numerator Effect Incremental Denominator Effect EPS 656 Bonds S S e Textbook and Media Rank the potentially dilutive securities from most dilutive to least dilutive. 456 Bonds 656 Bonds S0.72 Preferred shares V Options e Textbook and Media Calculate diluted earnings per share for 2020. (Round earnings per share to 2 decimal places, es 15.25.) Numerator Denominator EPS S Basic 1 45 borda Sub Total 66 borda Sub Total Options Sub Total Preferred ahures S S Diluted EPS