Answered step by step

Verified Expert Solution

Question

1 Approved Answer

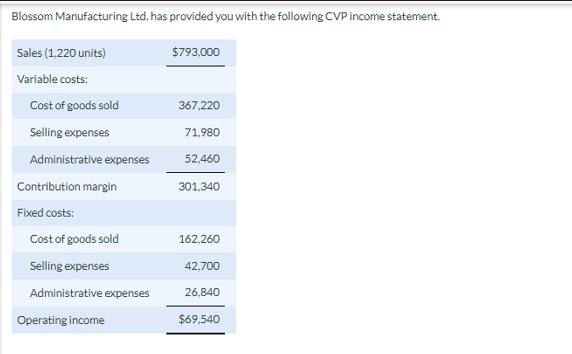

Blossom Manufacturing Ltd. has provided you with the following CVP income statement. Sales (1,220 units) Variable costs: Cost of goods sold Selling expenses Administrative

Blossom Manufacturing Ltd. has provided you with the following CVP income statement. Sales (1,220 units) Variable costs: Cost of goods sold Selling expenses Administrative expenses Contribution margin Fixed costs: Cost of goods sold Selling expenses Administrative expenses Operating income $793,000 367,220 71,980 52,460 301,340 162,260 42,700 26,840 $69.540 Calculate the contribution margin ratio. (Round answer to 2 decimal places, e.g. 15.25%.) Calculate the break-even point in sales dollars and number of units. (Round answers to O decimal places, e.g. 1,525.) Blossom Manufacturing Ltd. has provided you with the following CVP income statement. Sales (1,220 units) Variable costs: Cost of goods sold Selling expenses Administrative expenses Contribution margin Fixed costs: Cost of goods sold Selling expenses Administrative expenses Operating income $793,000 367,220 71,980 52,460 301,340 162,260 42,700 26,840 $69.540 Calculate the contribution margin ratio. (Round answer to 2 decimal places, e.g. 15.25%.) Calculate the break-even point in sales dollars and number of units. (Round answers to O decimal places, e.g. 1,525.) Blossom Manufacturing Ltd. has provided you with the following CVP income statement. Sales (1,220 units) Variable costs: Cost of goods sold Selling expenses Administrative expenses Contribution margin Fixed costs: Cost of goods sold Selling expenses Administrative expenses Operating income $793,000 367,220 71,980 52,460 301,340 162,260 42,700 26,840 $69.540 Calculate the contribution margin ratio. (Round answer to 2 decimal places, e.g. 15.25%.) Calculate the break-even point in sales dollars and number of units. (Round answers to O decimal places, e.g. 1,525.) Blossom Manufacturing Ltd. has provided you with the following CVP income statement. Sales (1,220 units) Variable costs: Cost of goods sold Selling expenses Administrative expenses Contribution margin Fixed costs: Cost of goods sold Selling expenses Administrative expenses Operating income $793,000 367,220 71,980 52,460 301,340 162,260 42,700 26,840 $69.540 Calculate the contribution margin ratio. (Round answer to 2 decimal places, e.g. 15.25%.) Calculate the break-even point in sales dollars and number of units. (Round answers to O decimal places, e.g. 1,525.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the contribution margin ratio we divide the contribution margin by the sales r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started