Question

Blossom uses a variety of alternatives to finance its acquisitions. Record the acquisition of each of these assets, assuming that Blossom prepares financial statements in

Blossom uses a variety of alternatives to finance its acquisitions. Record the acquisition of each of these assets, assuming that Blossom prepares financial statements in accordance with IFRS. Use the net amount to record the note. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Round capitalization rate to 2 decimal places, e.g. 52.75% and final answers to 0 decimal places, e.g. 5,275.)

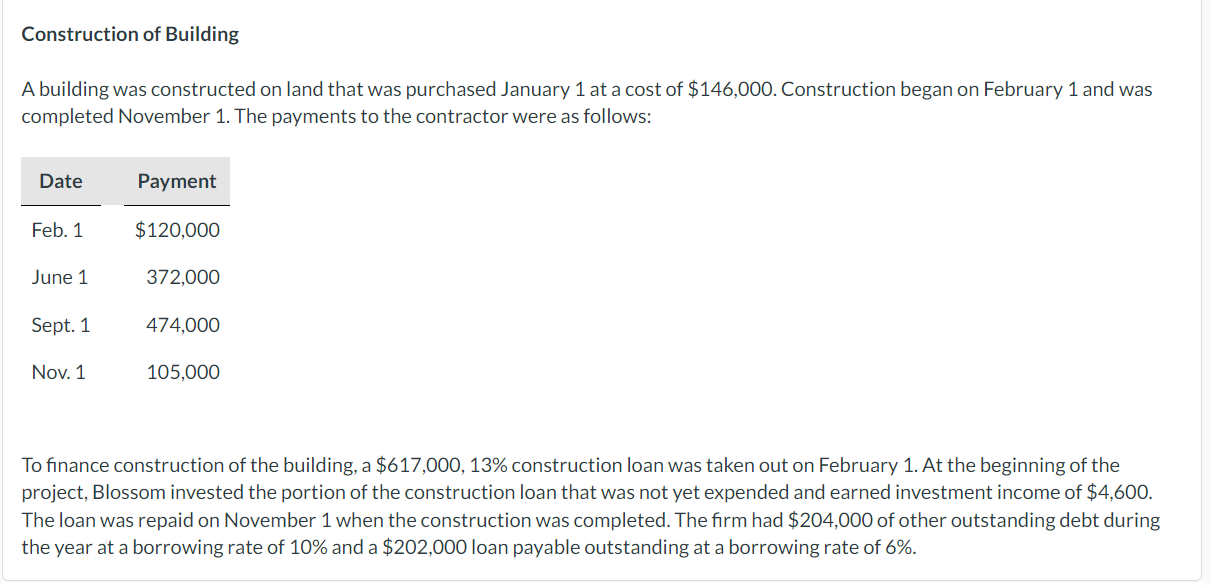

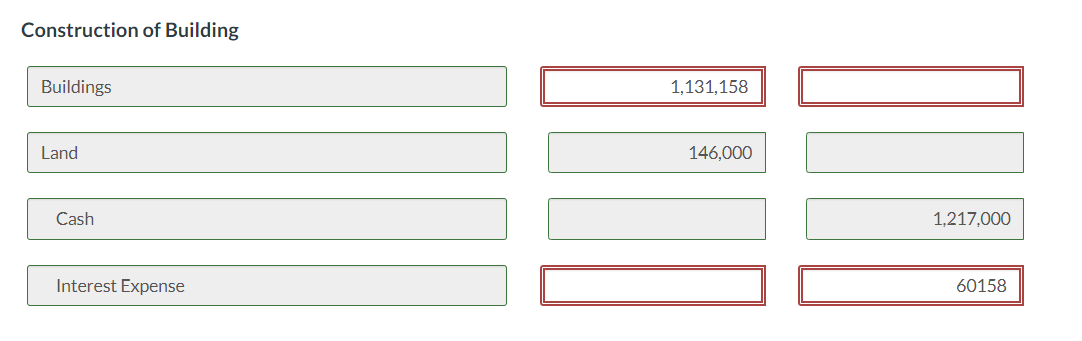

Construction of Building A building was constructed on land that was purchased January 1 at a cost of $146,000. Construction began on February 1 and was completed November 1 . The payments to the contractor were as follows: To finance construction of the building, a $617,000,13% construction loan was taken out on February 1 . At the beginning of the project, Blossom invested the portion of the construction loan that was not yet expended and earned investment income of $4,600. The loan was repaid on November 1 when the construction was completed. The firm had $204,000 of other outstanding debt during the year at a borrowing rate of 10% and a $202,000 loan payable outstanding at a borrowing rate of 6%. Construction of Building Buildings Land Cash Interest Expense 1,217,000 \begin{tabular}{|r|r} \hline 60158 \\ \hline \end{tabular}

Construction of Building A building was constructed on land that was purchased January 1 at a cost of $146,000. Construction began on February 1 and was completed November 1 . The payments to the contractor were as follows: To finance construction of the building, a $617,000,13% construction loan was taken out on February 1 . At the beginning of the project, Blossom invested the portion of the construction loan that was not yet expended and earned investment income of $4,600. The loan was repaid on November 1 when the construction was completed. The firm had $204,000 of other outstanding debt during the year at a borrowing rate of 10% and a $202,000 loan payable outstanding at a borrowing rate of 6%. Construction of Building Buildings Land Cash Interest Expense 1,217,000 \begin{tabular}{|r|r} \hline 60158 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started