Question

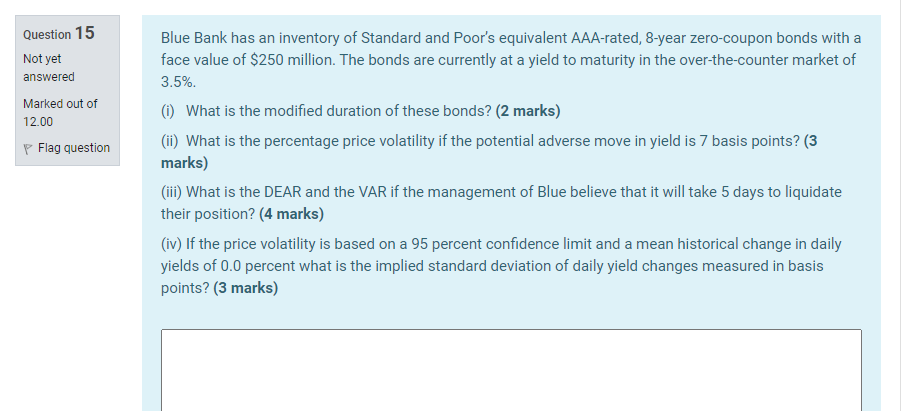

Blue Bank has an inventory of Standard and Poors equivalent AAA-rated, 8-year zero-coupon bonds with a face value of $250 million. The bonds are currently

Blue Bank has an inventory of Standard and Poors equivalent AAA-rated, 8-year zero-coupon bonds with a face value of $250 million. The bonds are currently at a yield to maturity in the over-the-counter market of 3.5%.

(i) What is the modified duration of these bonds? (2 marks)

(ii) What is the percentage price volatility if the potential adverse move in yield is 7 basis points? (3 marks)

(iii) What is the DEAR and the VAR if the management of Blue believe that it will take 5 days to liquidate their position? (4 marks)

(iv) If the price volatility is based on a 95 percent confidence limit and a mean historical change in daily yields of 0.0 percent what is the implied standard deviation of daily yield changes measured in basis points? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started