Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue colour is the official answer. Thank you QUESTION 1 I-Bench Berhad, a Malaysian listed company, engages in the business of manufacturing designer bench for

Blue colour is the official answer. Thank you

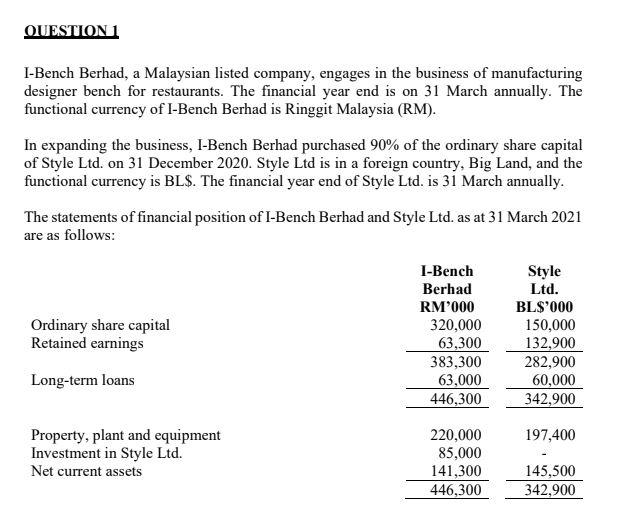

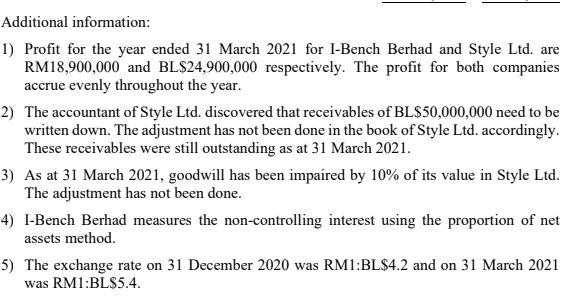

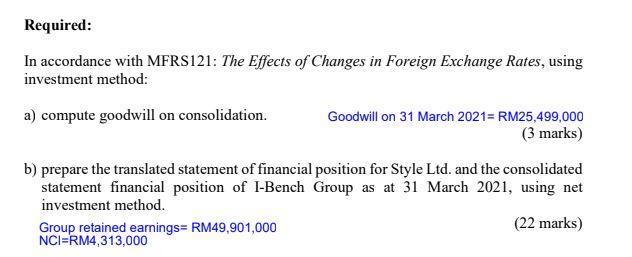

QUESTION 1 I-Bench Berhad, a Malaysian listed company, engages in the business of manufacturing designer bench for restaurants. The financial year end is on 31 March annually. The functional currency of I-Bench Berhad is Ringgit Malaysia (RM). In expanding the business, I-Bench Berhad purchased 90% of the ordinary share capital of Style Ltd. on 31 December 2020. Style Ltd is in a foreign country, Big Land, and the functional currency is BL$. The financial year end of Style Ltd. is 31 March annually. The statements of financial position of I-Bench Berhad and Style Ltd. as at 31 March 2021 are as follows: Ordinary share capital Retained earnings I-Bench Berhad RM'000 320,000 63,300 383,300 63,000 446,300 Style Ltd. BL$'000 150,000 132,900 282,900 60,000 342,900 Long-term loans 197,400 Property, plant and equipment Investment in Style Ltd. Net current assets 220,000 85,000 141,300 446,300 145,500 342,900 Additional information: 1) Profit for the year ended 31 March 2021 for I-Bench Berhad and Style Ltd. are RM18,900,000 and BL$24,900,000 respectively. The profit for both companies accrue evenly throughout the year. 2) The accountant of Style Ltd. discovered that receivables of BL$50,000,000 need to be written down. The adjustment has not been done in the book of Style Ltd. accordingly. These receivables were still outstanding as at 31 March 2021. 3) As at 31 March 2021, goodwill has been impaired by 10% of its value in Style Ltd. The adjustment has not been done. 4) I-Bench Berhad measures the non-controlling interest using the proportion of net assets method. 5) The exchange rate on 31 December 2020 was RM1:BL$4.2 and on 31 March 2021 was RM1:BL$5.4. Required: In accordance with MFRS121: The Effects of Changes in Foreign Exchange Rates, using investment method: a) compute goodwill on consolidation. Goodwill on 31 March 2021= RM25,499,000 (3 marks) b) prepare the translated statement of financial position for Style Ltd. and the consolidated statement financial position of I-Bench Group as at 31 March 2021, using net investment method. Group retained earnings= RM49,901,000 (22 marks) NCI=RM4,313,000 QUESTION 1 I-Bench Berhad, a Malaysian listed company, engages in the business of manufacturing designer bench for restaurants. The financial year end is on 31 March annually. The functional currency of I-Bench Berhad is Ringgit Malaysia (RM). In expanding the business, I-Bench Berhad purchased 90% of the ordinary share capital of Style Ltd. on 31 December 2020. Style Ltd is in a foreign country, Big Land, and the functional currency is BL$. The financial year end of Style Ltd. is 31 March annually. The statements of financial position of I-Bench Berhad and Style Ltd. as at 31 March 2021 are as follows: Ordinary share capital Retained earnings I-Bench Berhad RM'000 320,000 63,300 383,300 63,000 446,300 Style Ltd. BL$'000 150,000 132,900 282,900 60,000 342,900 Long-term loans 197,400 Property, plant and equipment Investment in Style Ltd. Net current assets 220,000 85,000 141,300 446,300 145,500 342,900 Additional information: 1) Profit for the year ended 31 March 2021 for I-Bench Berhad and Style Ltd. are RM18,900,000 and BL$24,900,000 respectively. The profit for both companies accrue evenly throughout the year. 2) The accountant of Style Ltd. discovered that receivables of BL$50,000,000 need to be written down. The adjustment has not been done in the book of Style Ltd. accordingly. These receivables were still outstanding as at 31 March 2021. 3) As at 31 March 2021, goodwill has been impaired by 10% of its value in Style Ltd. The adjustment has not been done. 4) I-Bench Berhad measures the non-controlling interest using the proportion of net assets method. 5) The exchange rate on 31 December 2020 was RM1:BL$4.2 and on 31 March 2021 was RM1:BL$5.4. Required: In accordance with MFRS121: The Effects of Changes in Foreign Exchange Rates, using investment method: a) compute goodwill on consolidation. Goodwill on 31 March 2021= RM25,499,000 (3 marks) b) prepare the translated statement of financial position for Style Ltd. and the consolidated statement financial position of I-Bench Group as at 31 March 2021, using net investment method. Group retained earnings= RM49,901,000 (22 marks) NCI=RM4,313,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started