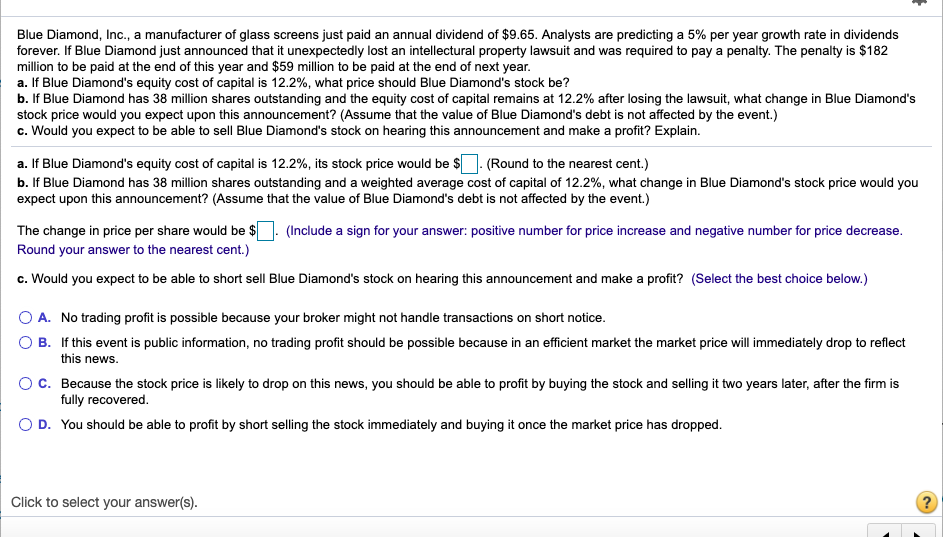

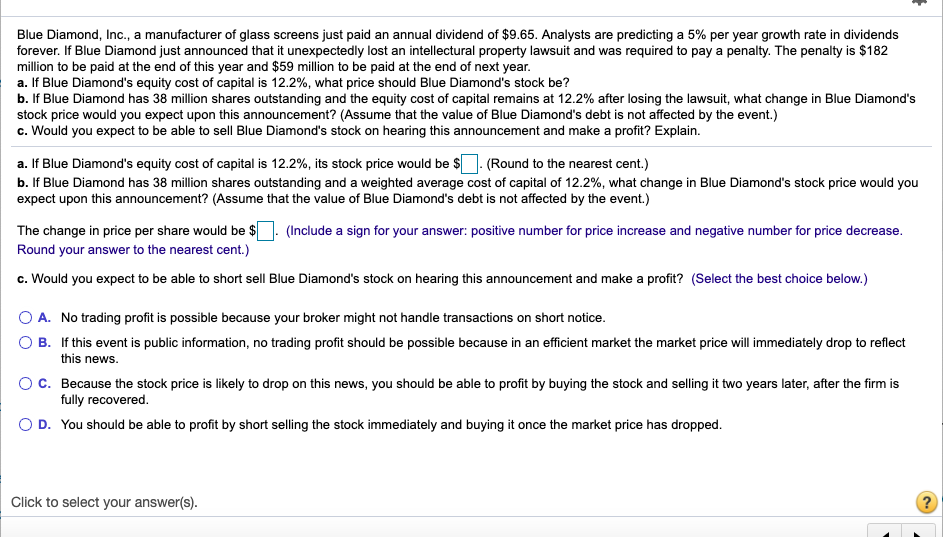

Blue Diamond, Inc., a manufacturer of glass screens just paid an annual dividend of $9.65. Analysts are predicting a 5% per year growth rate in dividends forever. If Blue Diamond just announced that it unexpectedly lost an intellectural property lawsuit and was required to pay a penalty. The penalty is $182 million to be paid at the end of this year and $59 million to be paid at the end of next year. a. If Blue Diamond's equity cost of capital is 12.2%, what price should Blue Diamond's stock be? b. If Blue Diamond has 38 million shares outstanding and the equity cost of capital remains at 12.2% after losing the lawsuit, what change in Blue Diamond's stock price would you expect upon this announcement? (Assume that the value of Blue Diamond's debt is not affected by the event.) c. Would you expect to be able to sell Blue Diamond's stock on hearing this announcement and make a profit? Explain. a. If Blue Diamond's equity cost of capital is 12.2%, its stock price would be $ . (Round to the nearest cent.) b. If Blue Diamond has 38 million shares outstanding and a weighted average cost of capital of 12.2%, what change in Blue Diamond's stock price would you expect upon this announcement? (Assume that the value of Blue Diamond's debt is not affected by the event.) The change in price per share would be $ (Include a sign for your answer: positive number for price increase and negative number for price decrease. Round your answer to the nearest cent.) c. Would you expect to be able to short sell Blue Diamond's stock on hearing this announcement and make a profit? (Select the best choice below.) O A. No trading profit is possible because your broker might not handle transactions on short notice. B. If this event is public information, no trading profit should be possible because in an efficient market the market price will immediately drop to reflect this news. C. Because the stock price is likely to drop on this news, you should be able to profit by buying the stock and selling it two years later, after the firm is fully recovered. OD. You should be able to profit by short selling the stock immediately and buying it once the market price has dropped. Click to select your answer(s)