Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blue Hen Brewery (BHB) wants to launch a new product called Blue Hen Lite to offer a lower calorie beer to its customers. BHB

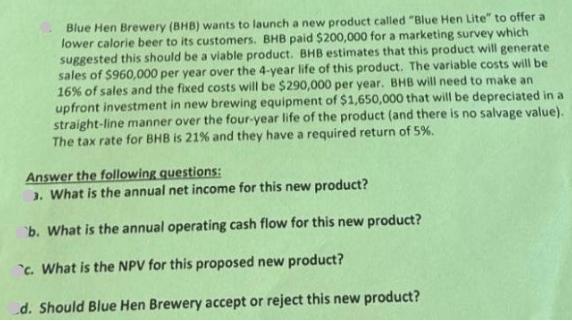

Blue Hen Brewery (BHB) wants to launch a new product called "Blue Hen Lite" to offer a lower calorie beer to its customers. BHB paid $200,000 for a marketing survey which suggested this should be a viable product. BHB estimates that this product will generate sales of $960,000 per year over the 4-year life of this product. The variable costs will be 16% of sales and the fixed costs will be $290,000 per year. BHB will need to make an upfront investment in new brewing equipment of $1,650,000 that will be depreciated in a straight-line manner over the four-year life of the product (and there is no salvage value). The tax rate for BHB is 21% and they have a required return of 5%. Answer the following questions: 3. What is the annual net income for this new product? b. What is the annual operating cash flow for this new product? c. What is the NPV for this proposed new product? d. Should Blue Hen Brewery accept or reject this new product?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 What is the annual net income for this new product To calculate the annual net income we need to consider the revenue variable costs fixed costs dep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started