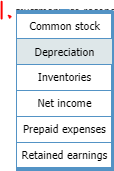

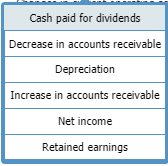

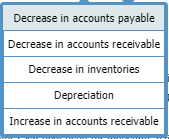

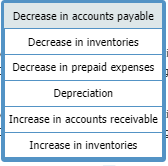

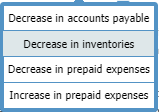

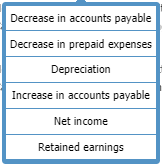

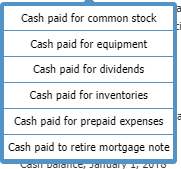

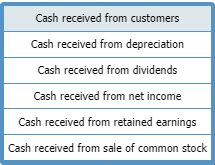

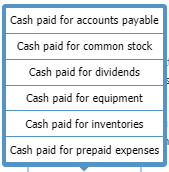

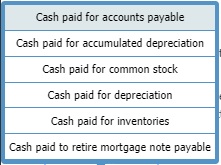

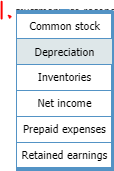

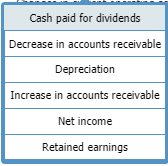

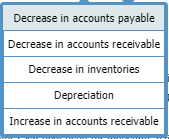

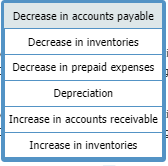

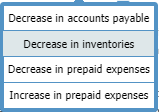

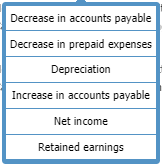

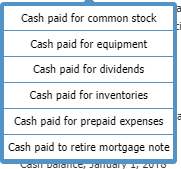

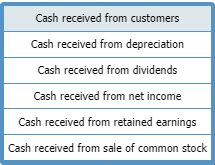

BLUE LINES HAVE DROP DOWN MENUS:

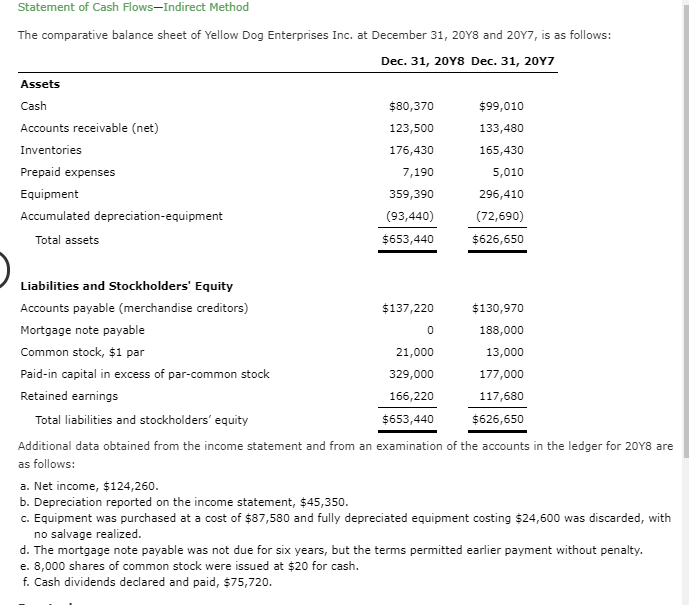

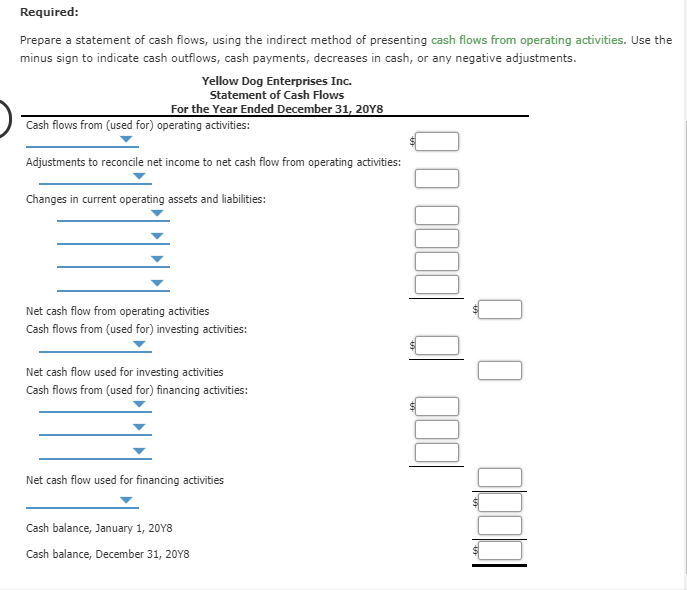

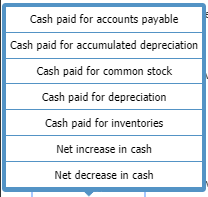

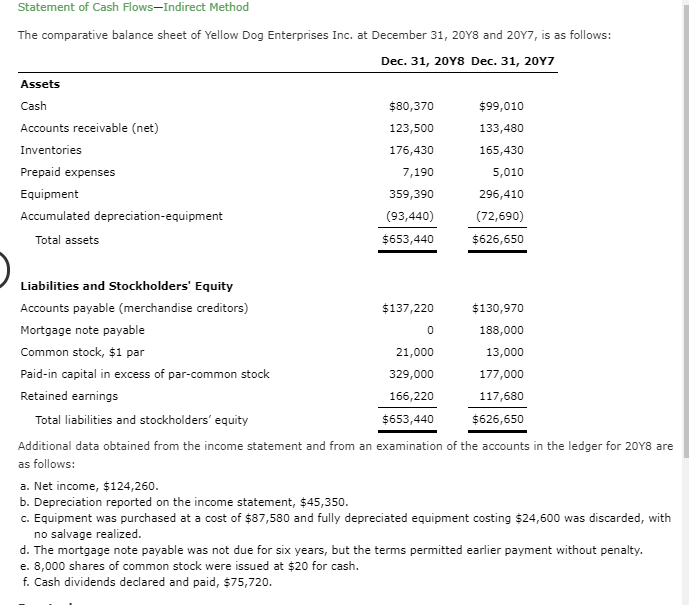

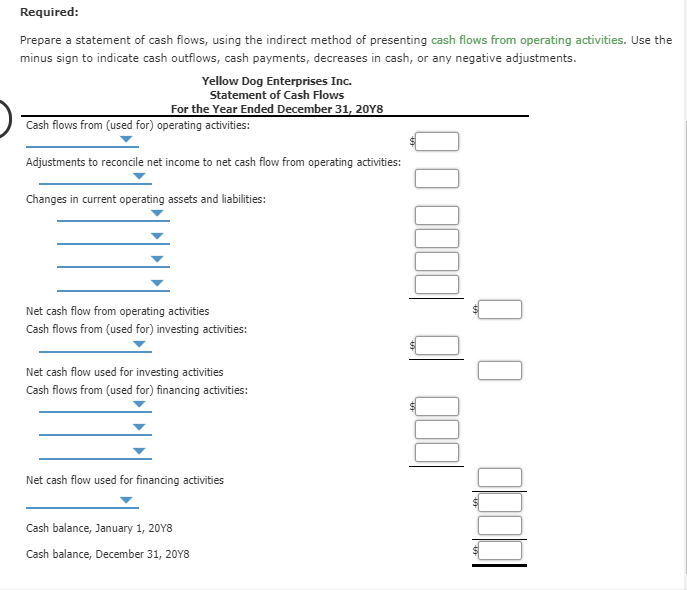

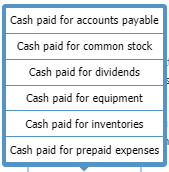

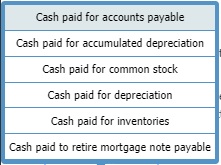

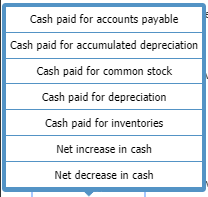

Statement of Cash Flows-Indirect Method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 2048 and 2017, is as follows: Dec. 31, 20Y8 Dec. 31, 2017 Assets Cash $80,370 $99,010 Accounts receivable (net) 123,500 133,480 Inventories 176,430 165,430 Prepaid expenses 7,190 5,010 Equipment 359,390 296,410 Accumulated depreciation equipment (93,440) (72,690) Total assets $653,440 $626,650 $137,220 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Mortgage note payable Common stock, $1 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity 21,000 329,000 166,220 $130,970 188,000 13,000 177,000 117,680 $626,650 $653,440 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $124,260. b. Depreciation reported on the income statement, $45,350. c. Equipment was purchased at a cost of $87,580 and fully depreciated equipment costing $24,600 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 8,000 shares of common stock were issued at $20 for cash. f. Cash dividends declared and paid, $75,720. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Yellow Dog Enterprises Inc. Statement of Cash Flows For the Year Ended December 31, 2048 Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Q Odbl) | DOO Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: Net cash flow used for financing activities Cash balance, January 1, 2048 Cash balance, December 31, 2048 Common stock Depreciation Inventories Net income Prepaid expenses Retained earnings Cash paid for dividends Decrease in accounts receivable Depreciation Increase in accounts receivable Net income Retained earnings Decrease in accounts payable Decrease in accounts receivable Decrease in inventories Depreciation Increase in accounts receivable Decrease in accounts payable Decrease in inventories Decrease in prepaid expenses Depreciation Increase in accounts receivable Increase in inventories Decrease in accounts payable Decrease in inventories Decrease in prepaid expenses Increase in prepaid expenses Decrease in accounts payable Decrease in prepaid expenses Depreciation Increase in accounts payable Net income Retained earnings Cash paid for common stock Cash paid for equipment Cash paid for dividends Cash paid for inventories Cash paid for prepaid expenses Cash paid to retire mortgage note Last Dallallicer January ZUTO Cash received from customers Cash received from depreciation Cash received from dividends Cash received from net income Cash received from retained earnings Cash received from sale of common stock Cash paid for accounts payable Cash paid for common stock Cash paid for dividends Cash paid for equipment Cash paid for inventories Cash paid for prepaid expenses Cash paid for accounts payable Cash paid for accumulated depreciation Cash paid for common stock Cash paid for depreciation Cash paid for inventories Cash paid to retire mortgage note payable Cash paid for accounts payable Cash paid for accumulated depreciation Cash paid for common stock Cash paid for depreciation Cash paid for inventories Net increase in cash Net decrease in cash