Answered step by step

Verified Expert Solution

Question

1 Approved Answer

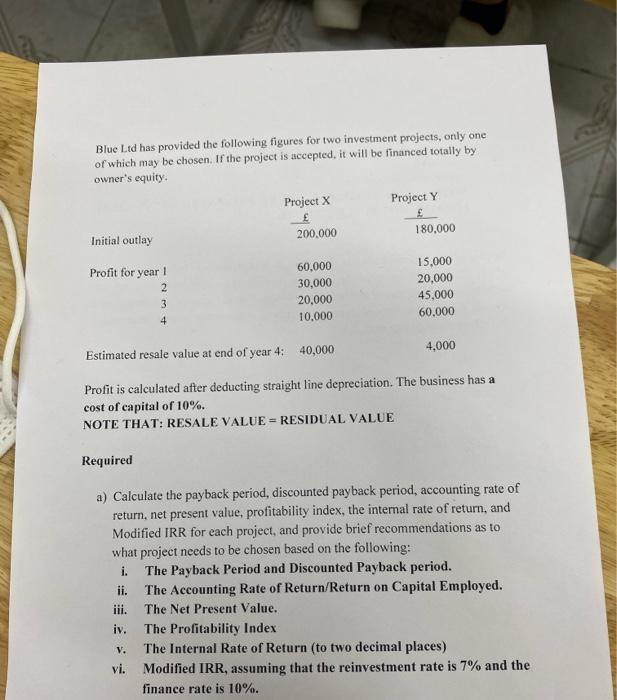

Blue Ltd has provided the following figures for two investment projects, only one of which may be chosen. If the project is accepted, it

Blue Ltd has provided the following figures for two investment projects, only one of which may be chosen. If the project is accepted, it will be financed totally by owner's equity. Initial outlay Profit for year 1 2 3 4 ii. Project X iii. iv. 200,000 60,000 30,000 20,000 10,000 Project Y 180,000 Estimated resale value at end of year 4: 40,000 4,000 Profit is calculated after deducting straight line depreciation. The business has a cost of capital of 10%. NOTE THAT: RESALE VALUE = RESIDUAL VALUE 15,000 20,000 45,000 60,000 Required a) Calculate the payback period, discounted payback period, accounting rate of return, net present value, profitability index, the internal rate of return, and Modified IRR for each project, and provide brief recommendations as to what project needs to be chosen based on the following: i. The Payback Period and Discounted Payback period. The Accounting Rate of Return/Return on Capital Employed. The Net Present Value. The Profitability Index V. The Internal Rate of Return (to two decimal places) vi. Modified IRR, assuming that the reinvestment rate is 7% and the finance rate is 10%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculations for Project X and Project Y 1 Payback Period Project X 3 years 10000 30000 333 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started