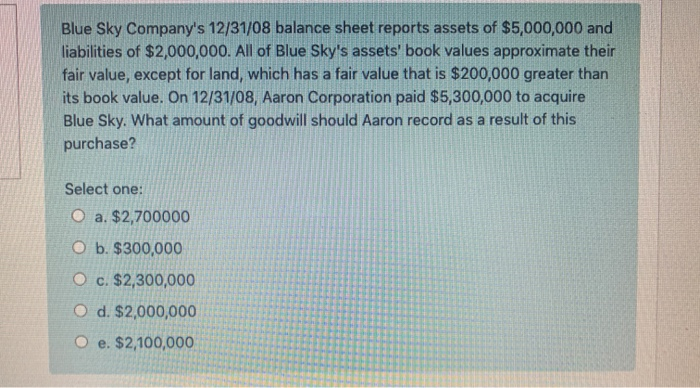

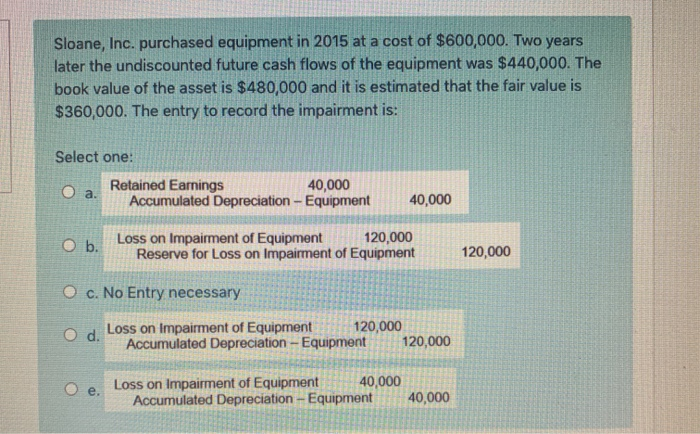

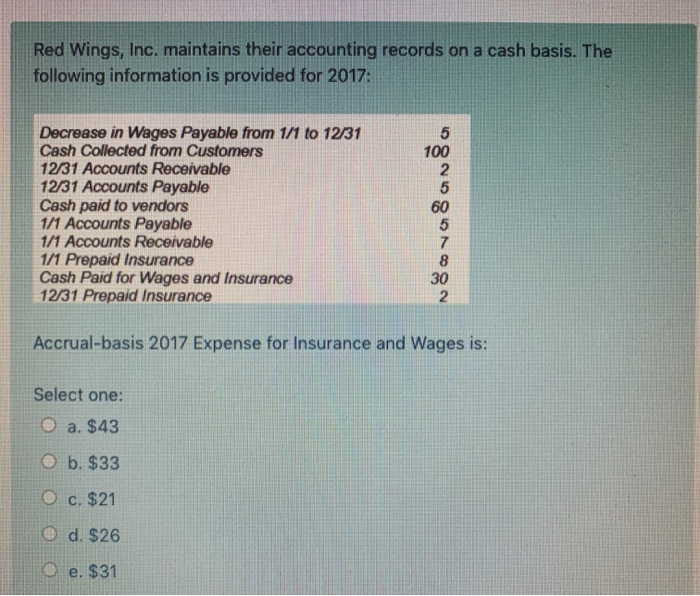

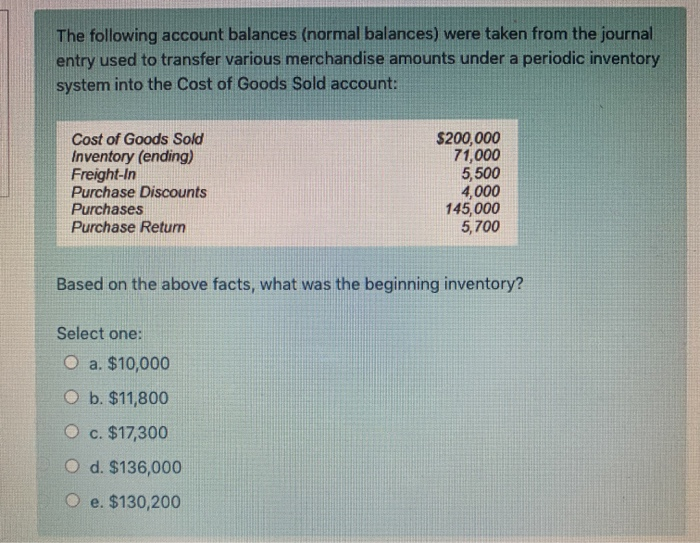

Blue Sky Company's 12/31/08 balance sheet reports assets of $5,000,000 and liabilities of $2,000,000. All of Blue Sky's assets' book values approximate their fair value, except for land, which has a fair value that is $200,000 greater than its book value. On 12/31/08, Aaron Corporation paid $5,300,000 to acquire Blue Sky. What amount of goodwill should Aaron record as a result of this purchase? Select one: O a. $2,700000 O b. $300,000 O c. $2,300,000 O d. $2,000,000 O e. $2,100,000 Sloane, Inc. purchased equipment in 2015 at a cost of $600,000. Two years later the undiscounted future cash flows of the equipment was $440,000. The book value of the asset is $480,000 and it is estimated that the fair value is $360,000. The entry to record the impairment is: Select one: Retained Earnings 40,000 Accumulated Depreciation - Equipment a. 40,000 b. Loss on Impairment of Equipment 120,000 Reserve for Loss on Impairment of Equipment 120,000 O c. No Entry necessary O d. Loss on Impairment of Equipment 120,000 Accumulated Depreciation - Equipment 120,000 O e. Loss on Impairment of Equipment 40,000 Accumulated Depreciation - Equipment 40,000 Red Wings, Inc. maintains their accounting records on a cash basis. The following information is provided for 2017: Decrease in Wages Payable from 1/1 to 12/31 Cash Collected from Customers 12/31 Accounts Receivable 12/31 Accounts Payable Cash paid to vendors 1/1 Accounts Payable 1/1 Accounts Receivable 1/1 Prepaid Insurance Cash Paid for Wages and Insurance 12/31 Prepaid Insurance 5 100 2 5 60 5 7 8 30 2 Accrual-basis 2017 Expense for Insurance and Wages is: Select one: a. $43 b. $33 O c. $21 d. $26 O e. $31 The following account balances (normal balances) were taken from the journal entry used to transfer various merchandise amounts under a periodic inventory system into the Cost of Goods Sold account: Cost of Goods Sold Inventory (ending) Freight-In Purchase Discounts Purchases Purchase Return $200,000 71,000 5,500 4,000 145,000 5,700 Based on the above facts, what was the beginning inventory? Select one: O a. $10,000 O b. $11,800 O c. $17,300 O d. $136,000 O e. $130,200