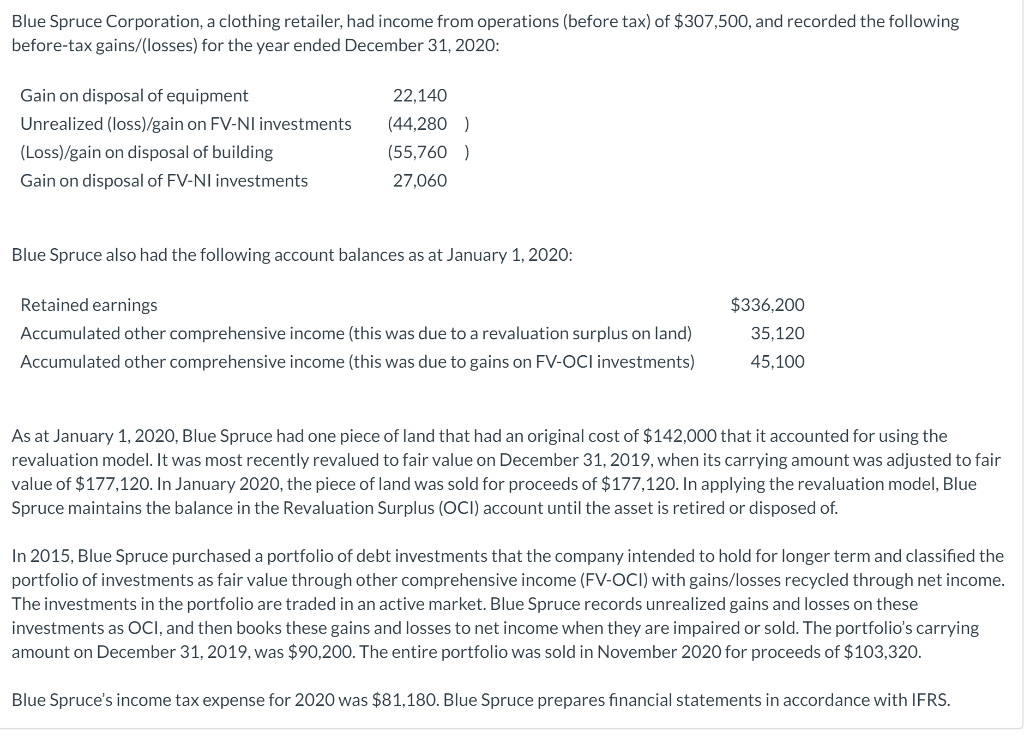

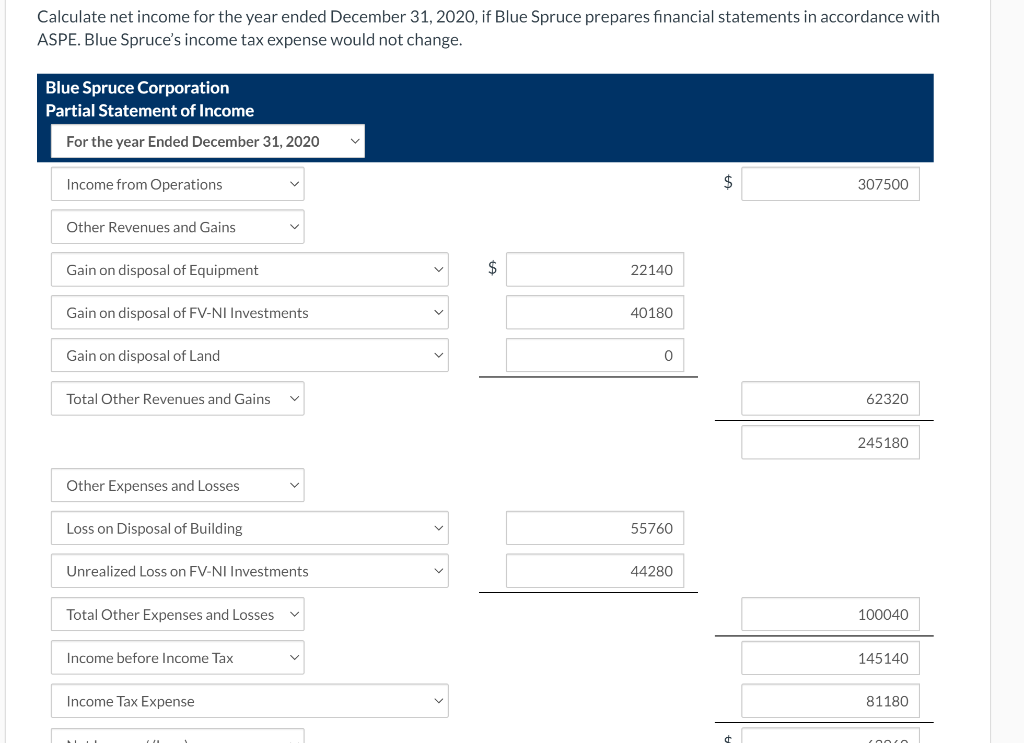

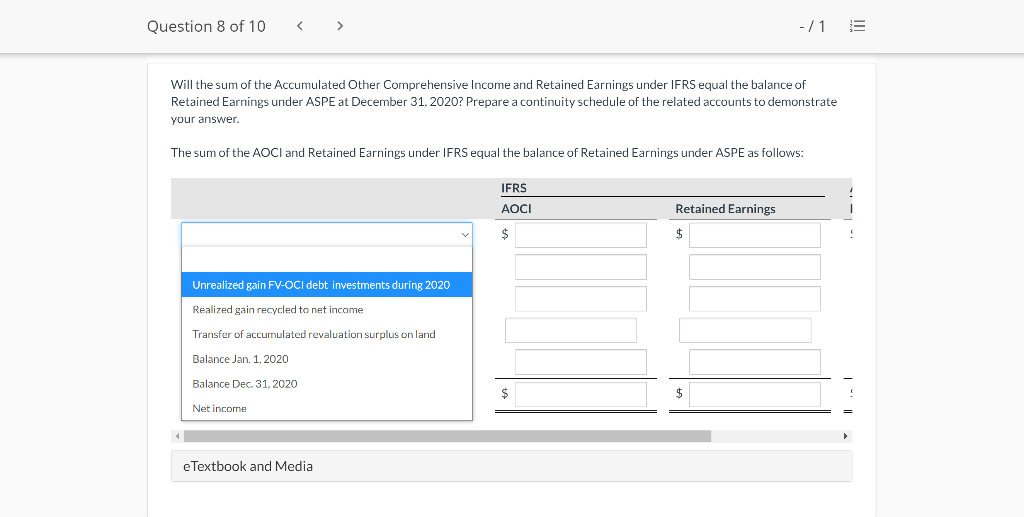

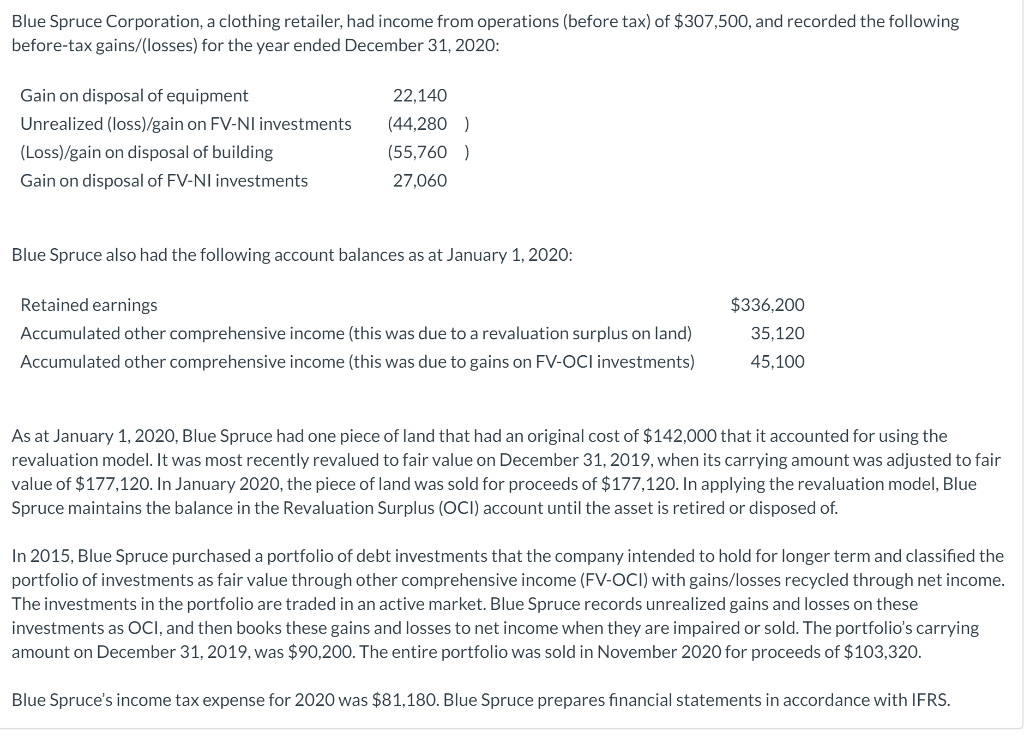

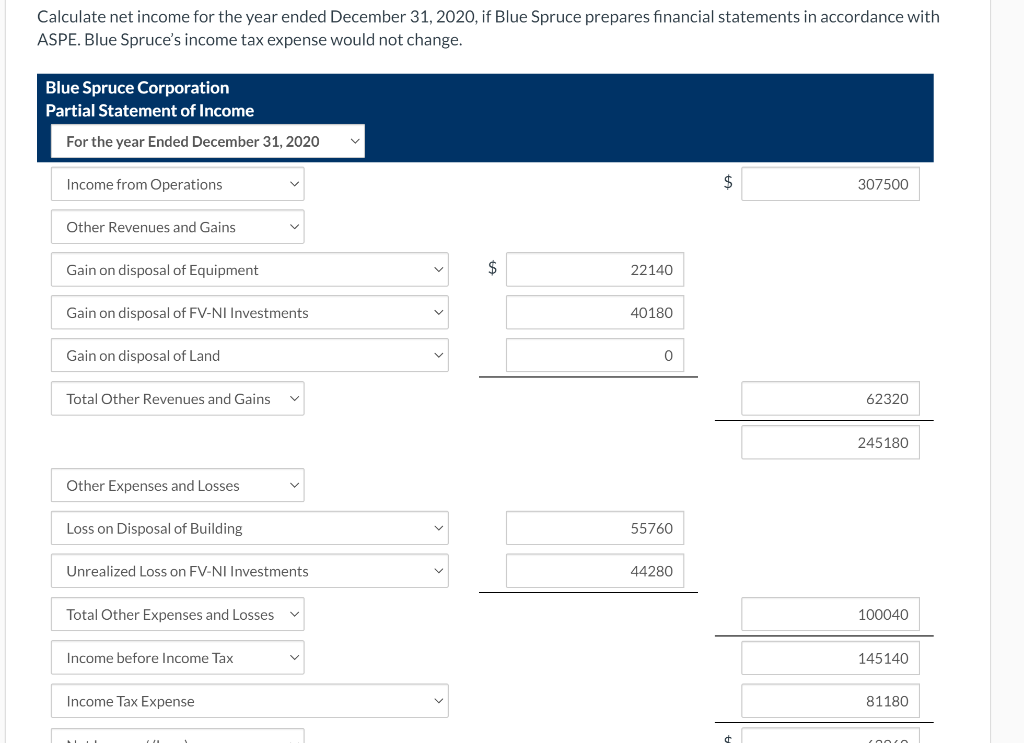

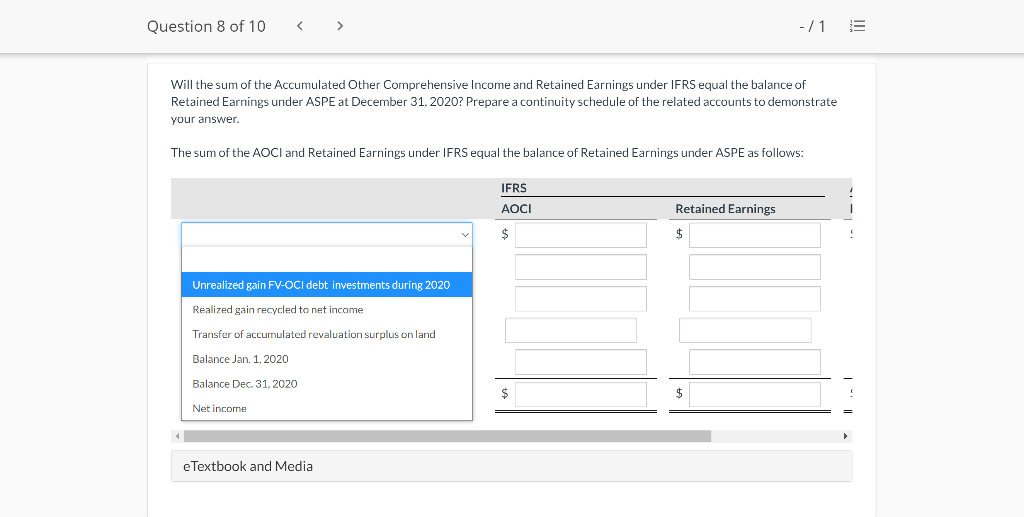

Blue Spruce Corporation, a clothing retailer, had income from operations (before tax) of $307,500, and recorded the following before-tax gains/(losses) for the year ended December 31, 2020: Gain on disposal of equipment Unrealized (loss)/gain on FV-NI investments (Loss)/gain on disposal of building Gain on disposal of FV-Nl investments 22,140 (44,280) (55,760) 27,060 Blue Spruce also had the following account balances as at January 1, 2020: Retained earnings Accumulated other comprehensive income (this was due to a revaluation surplus on land) Accumulated other comprehensive income (this was due to gains on FV-OCl investments) $336,200 35,120 45,100 As at January 1, 2020, Blue Spruce had one piece of land that had an original cost of $142,000 that it accounted for using the revaluation model. It was most recently revalued to fair value on December 31, 2019, when its carrying amount was adjusted to fair value of $177,120. In January 2020, the piece of land was sold for proceeds of $177,120. In applying the revaluation model, Blue Spruce maintains the balance in the Revaluation Surplus (OCI) account until the asset is retired or disposed of. In 2015, Blue Spruce purchased a portfolio of debt investments that the company intended to hold for longer term and classified the portfolio of investments as fair value through other comprehensive income (FV-OCI) with gains/losses recycled through net income. The investments in the portfolio are traded in an active market. Blue Spruce records unrealized gains and losses on these investments as OCI, and then books these gains and losses to net income when they are impaired or sold. The portfolio's carrying amount on December 31, 2019, was $90,200. The entire portfolio was sold in November 2020 for proceeds of $103,320. Blue Spruce's income tax expense for 2020 was $81,180. Blue Spruce prepares financial statements in accordance with IFRS. Calculate net income for the year ended December 31, 2020, if Blue Spruce prepares financial statements in accordance with ASPE. Blue Spruce's income tax expense would not change. Blue Spruce Corporation Partial Statement of Income For the year Ended December 31, 2020 Income from Operations $ 307500 Other Revenues and Gains Gain on disposal of Equipment 22140 Gain on disposal of FV-NI Investments 40180 Gain on disposal of Land 0 Total Other Revenues and Gains 62320 245180 Other Expenses and Losses Loss on Disposal of Building 55760 Unrealized Loss on FV-NI Investments 44280 Total Other Expenses and Losses 100040 Income before Income Tax 145140 Income Tax Expense 81180 no Question 8 of 10 - / 1 Will the sum of the Accumulated Other Comprehensive Income and Retained Earnings under IFRS equal the balance of Retained Earnings under ASPE at December 31, 2020? Prepare a continuity schedule of the related accounts to demonstrate your answer. The sum of the AOCI and Retained Earnings under IFRS equal the balance of Retained Earnings under ASPE as follows: IFRS AOCI Retained Earnings $ $ Unrealized gain FV-OCI debt investments during 2020 Realized gain recycled to net income Transfer of accumulated revaluation surplus on land Balance Jan. 1.2020 Balance Dec 31, 2020 $ $ Net income e Textbook and Media