Answered step by step

Verified Expert Solution

Question

1 Approved Answer

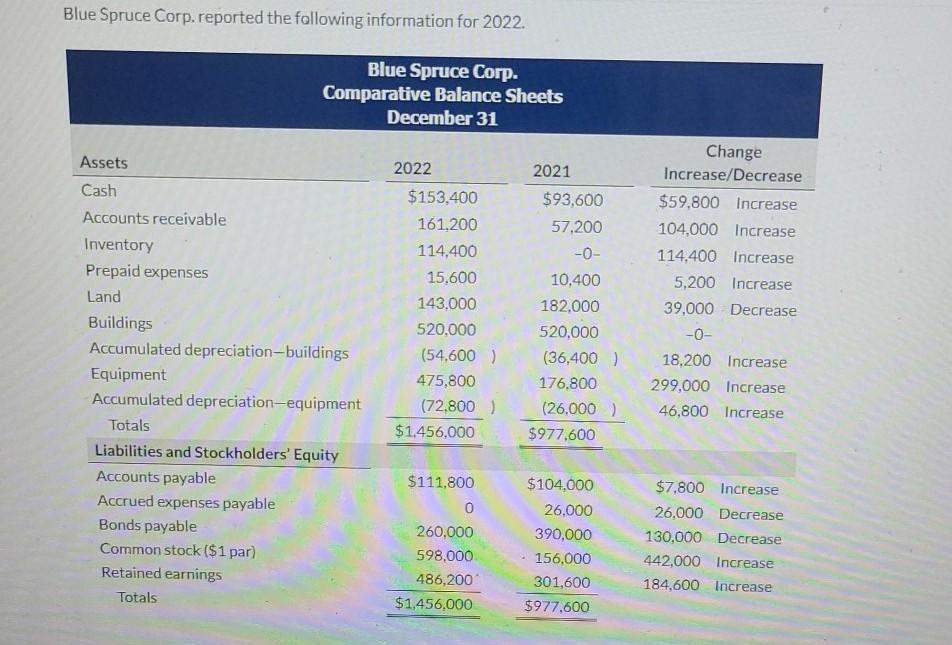

Blue Spruce Corp.reported the following information for 2022. Blue Spruce Corp. Comparative Balance Sheets December 31 Assets 2021 Cash Accounts receivable Inventory Prepaid expenses Land

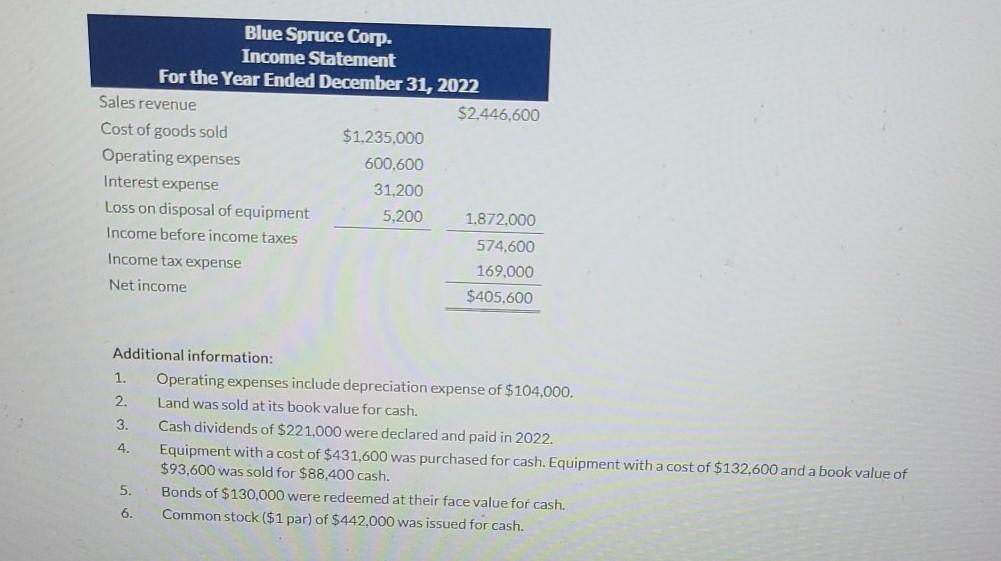

Blue Spruce Corp.reported the following information for 2022. Blue Spruce Corp. Comparative Balance Sheets December 31 Assets 2021 Cash Accounts receivable Inventory Prepaid expenses Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Totals Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock ($1 par) Retained earnings Totals 2022 $153,400 161,200 114,400 15,600 143.000 520,000 (54,600 ) 475,800 (72,800) $1.456,000 $93,600 57,200 -O- 10,400 182,000 520,000 (36,400) 176.800 (26.000) $977,600 Change Increase/Decrease $59.800 Increase 104,000 Increase 114,400 Increase 5,200 Increase 39,000 Decrease -0- 18.200 Increase 299,000 Increase 46.800 Increase $111,800 0 260.000 598,000 486,200 $1,456,000 $104.000 26.000 390,000 156.000 301,600 $977,600 $7,800 Increase 26,000 Decrease 130,000 Decrease 442,000 Increase 184,600 Increase Blue Spruce Corp. Income Statement For the Year Ended December 31, 2022 Sales revenue $2.446,600 Cost of goods sold $1.235.000 Operating expenses 600.600 Interest expense 31.200 Loss on disposal of equipment 5,200 1.872.000 Income before income taxes 574.600 Income tax expense 169,000 Net income $405,600 Additional information: 1. Operating expenses include depreciation expense of $104.000. 2. Land was sold at its book value for cash. 3. Cash dividends of $221,000 were declared and paid in 2022 4. Equipment with a cost of $431,600 was purchased for cash. Equipment with a cost of $132,600 and a book value of $93.600 was sold for $88,400 cash. 5. Bonds of $130,000 were redeemed at their face value for cash. 6. Common stock ($1 par) of $442,000 was issued for cash. Additional information: 1. Operating expenses include depreciation expense of $104,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $221,000 were declared and paid in 2022 4. Equipment with a cost of $431,600 was purchased for cash. Equipment with a cost of $132,600 and a book value of $93,600 was sold for $88.400 cash. 5. Bonds of $130,000 were redeemed at their face value for cash. 6. Common stock ($1 par) of $442,000 was issued for cash. Use this information to prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e g. -15,000 or in parenthesis eg. (15,000).) Blue Spruce Corp. Statement of Cash Flows-Indirect Method Adjustments to reconcile net income to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started