UKCOM is a large US owned company that was formed in 20X0 and operates only within the UK. The company has grown rapidly via acquisition

UKCOM is a large US owned company that was formed in 20X0 and operates only within the UK. The company has grown rapidly via acquisition and concentrates its activities in the rapidly growing and highly competitive mobile phone market. The acquired companies have substantial infrastructure assets with only 10% of the available network capacity being utilized in the provision of services to customers. 35%of the assets are categorized as intangible and are composed of goodwill and license acquisition expenditures. The Board has announced that it will not acquire any further companies and will maintain the same level of debt for the next decade. The Board of Directors based in the US take all the strategic decisions concerned with financing and acquisition policy but leave the operating activities to the UK based Chief Operating Executive.

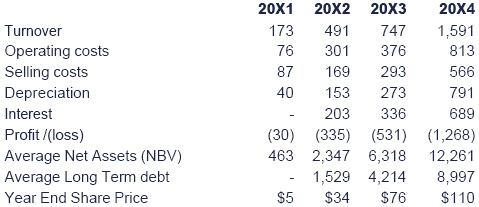

Financial highlights ($millions)

Further information:

Management have provided the following estimates of projected cash flows*:

These cash flows are based on the current level of competition and the current state of governmental legislation.

- Received and paid at the end of each year.

The cash outflows can be estimated with a high degree of certainty owing to the fixed nature of the costs. On the other hand, the cash inflow estimates are subject to considerable uncertainty because of the alternative outcomes that may arise. There are three possible market scenarios that are likely to impact on the inflows:

(1)Intensified competition – there is a 40%probability of this occurring and the consequences will be a reductionof 10% on the estimate of cash inflows.

(2)Government price regulation – there is a 20% probability of this occurring and it will reduce the estimated inflows by 20%.

(3)Less competition – this would result in cash inflows increasing by 5%. There is a 40% probability of this scenario developing.

The company's cost of capital is set at 4% above the average weighted cost of debt interest in the year prior to the first year of the forecast period (rounded up to the nearest percentage point).

Required:

(a)Provide a report on the financial performance of UKCOM from 20X1 to 20X4 from the perspective of the parent company.

(b)The UK based Chief Operating Executive maintains that his/her team's financial performance has continued to improve throughout the period. Explain how this claim might be substantiated. Your answer should include a relevant indicator of each of the year 20X1-20X4 which the COE could use.

(i) Calculate the NPV of the future cash flows for the period 20X5-20X9

(ii) Comment on the relevance of your answer in the evaluation of future performance.

Turnover Operating costs Selling costs Depreciation Interest Profit/(loss) Average Net Assets (NBV) Average Long Term debt Year End Share Price (30) (335) 463 2,347 20X1 20X2 20X3 173 491 747 76 301 376 87 169 293 40 153 273 203 336 (531) (1,268) 6,318 12,261 $5 20X4 1,591 813 566 1,529 4,214 $34 $76 791 689 8,997 $110

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The financial performance of UKCOM from 20X1 to 20X4 from the perspective of the parent company is as follows 20X1 Revenue 1591 Operating costs 813 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started