Answered step by step

Verified Expert Solution

Question

1 Approved Answer

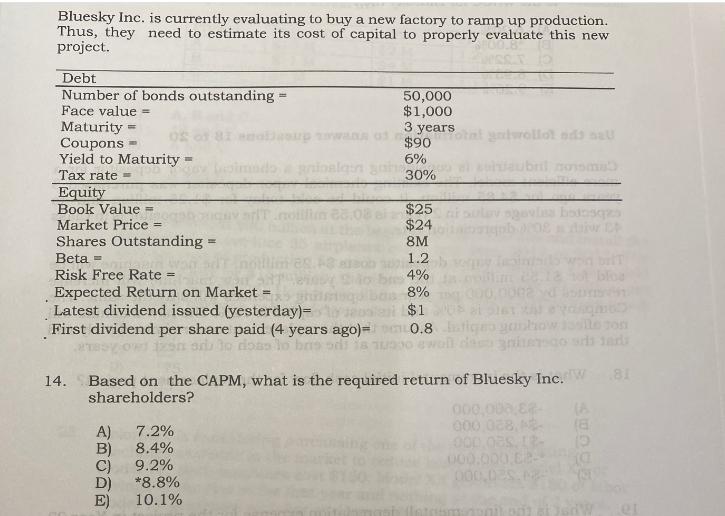

Bluesky Inc. is currently evaluating to buy a new factory to ramp up production. Thus, they need to estimate its cost of capital to

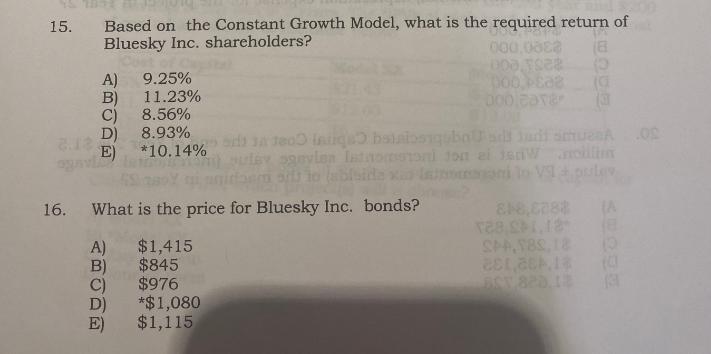

Bluesky Inc. is currently evaluating to buy a new factory to ramp up production. Thus, they need to estimate its cost of capital to properly evaluate this new project. Debt Number of bonds outstanding - Face value= Maturity= Coupons - Yield to Maturity Tax rate= Equity Book Value = Market Price Shares Outstanding = Beta = Risk Free Rate inalgin Expected Return on Market = Latest dividend issued (yesterday)= First dividend per share paid (4 years ago)= a to dos A) 7.2% B) 8.4% C) 9.2% D) *8.8% E) 10.1% 50,000 $1,000 3 years al twellot de sal $90 6% 30% $25 $24 8M pgavles boobsqzs 1.2 4% 8% $1 0.8 tiges ganhow issille son 000,0002 d 151612 14. Based on the CAPM, what is the required return of Bluesky Inc. W 81 shareholders? 000,008.88- 000,028,4- 000.038. 12- 100.000.82- (8 DsdW let 15. 1.13 og Based on the Constant Growth Model, what is the required return of Bluesky Inc. shareholders? 000,0882 A) B) C) D) E) A) B) C) 9.25% 11.23% D) E) 8.56% 8.93% *10.14% 16. What is the price for Bluesky Inc. bonds? $1,415 $845 $976 *$1,080 $1,115 DOO TER poo, PEas Doo Baver (G si 30 1800 intiqa baisiosigubo ad judi dey ogavlen Intnostoni jon el 15W cili JenA .00 128,091,12 SPP,589,18 28186.18 818,6288 (A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To estimate the cost of capital for Blu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started