Answered step by step

Verified Expert Solution

Question

1 Approved Answer

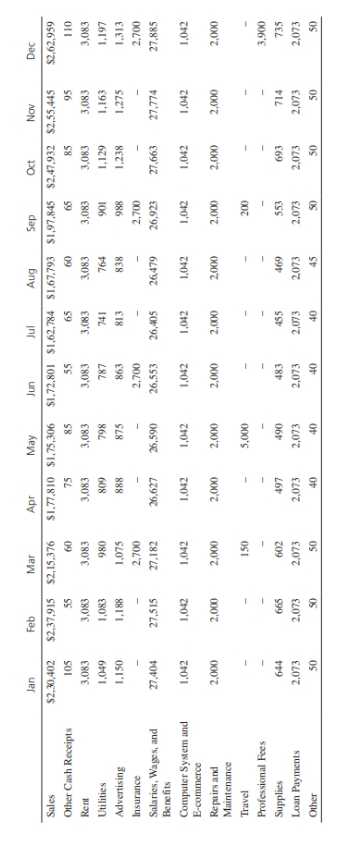

Bluffton Pharmacy Part 2 How should the owners of a small pharmacy create a cash flow forecast for their business? Although Crawford and Rodriguez have

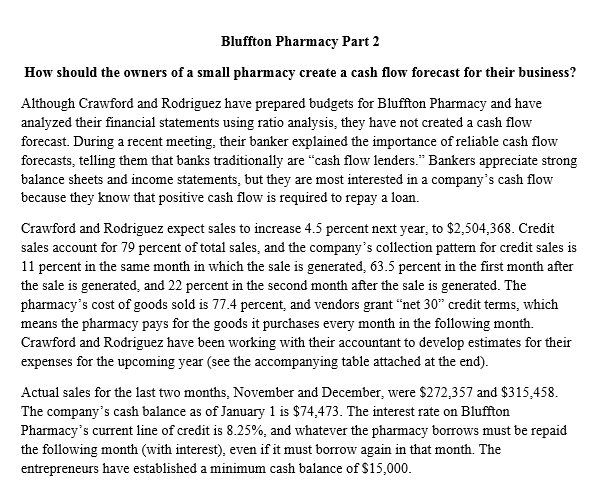

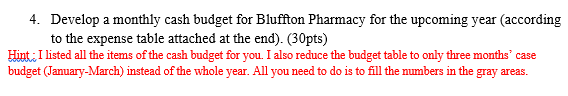

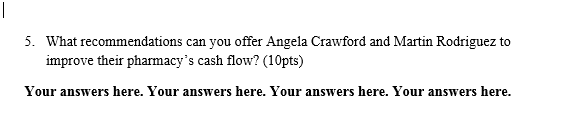

Bluffton Pharmacy Part 2 How should the owners of a small pharmacy create a cash flow forecast for their business? Although Crawford and Rodriguez have prepared budgets for Bluffton Pharmacy and have analyzed their financial statements using ratio analysis, they have not created a cash flow forecast. During a recent meeting, their banker explained the importance of reliable cash flow forecasts, telling them that banks traditionally are "cash flow lenders." Bankers appreciate strong balance sheets and income statements, but they because they know that positive cash flow is required to repay a loan most interested in a company's cash flow are n Crawford and Rodriguez expect sales to increase 4.5 percent next year, to $2,504,368. Credit sales account for 79 percent of total sales, and the company's collection pattern for credit sales is 11 percent in the same month in which the sale is generated, 63.5 percent in the first month after the sale is generated, and 22 percent in the second month after the sale is generated. The pharmacy's cost of goods sold is 77.4 percent, and vendors grant "net 30" credit terms, which means the pharmacy pays for the goods it purchases every month in the following month Crawford and Rodriguez have been working with their accountant to develop estimates for their expenses for the upcoming year (see the accompanying table attached at the end) $272,357 and $315,458 Actual sales for the last two months, November and December, were The company's cash balance as of January 1 is $74,473. The interest rate on Bluffton Pharmacy's current line of credit is 8.25%, and whatever the pharmacy borrows must be repaid the following month (with interest), entrepreneurs have established a minimum cash balance of $15,000. even if it must borrow again in that month. The 4. Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year (according to the expense table attached at the end). (30pts) Hint I d ll the items of the cash budget for you. I also reduce the budget table to only three months' case budget (January-March) instead of the whole year. All you need to do is to fill the numbers in the gray areas. February March November December January Sales $230,402 $272,357 $315,458 $237,915 S215,376 $215,162 $249,212 $182,017 $187,953 Credit Salcs S170,147 Cash Receipts Collections Same Month Next Month Two Months Cash Sales Other Cash Receipts Tolal Cash Receipts Cash sements Purchases Rent Utilities Advertising Insurance Salarics, Wagcs, and Bencfits Computer System and E-commerce Repairs and Maintenance Travel ProfessionalFecs Supplics Loan Paymcnts Other Tolal Cash Disbursements you offer Angela Crawford and Martin Rodriguez to 5. What recommendations can improve their pharmacy's cash flow? (10pts) Your answers here. Your answers here. Your answers here. Your answers here. May das $1,97,845 $2,47,932 $2,55,445 uer JeW unr nr Po AON Sales $2,30,402 $2,37,915 9L5SIZS $1,77,810 $1,75,306 $1,72,801 $1,62,784 $1,67,793 $2,62,959 Other Cash Receipts 09 3,083 S6 3,083 011 3,083 09 3,083 3,083 3,083 3,083 3,083 3,083 3,083 E80' 80' 1,197 60 086 608 86L L8L ItL 9L 106 6 9I' Advertising OSI'I SLO'I 888 98 88I' E18 8E8 886 SL aoueinsu Salaries, Wages, and 00L 26,553 00L' 27,663 00L7 27,885 00LZ 27,404 27,515 26,627 26,590 26479 26,923 27,774 28I'LZ SOt92 Computer System and 1,042 1,042 auoo- pue suday aoueuaju 000 000 000 000 0007 0007 000 000' 000 000 000'Z 000 OSI 000'S 002 Professional Fees Supplies 006 999 2,073 709 2,073 69t 2073 E69 2,073 FIL 2,073 06t Loan Payments 2,073 2,073 2,073 2,073 2,073 2,073 2,073 OS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started