Blurry photo, if unable to read I can retake

Updated photos

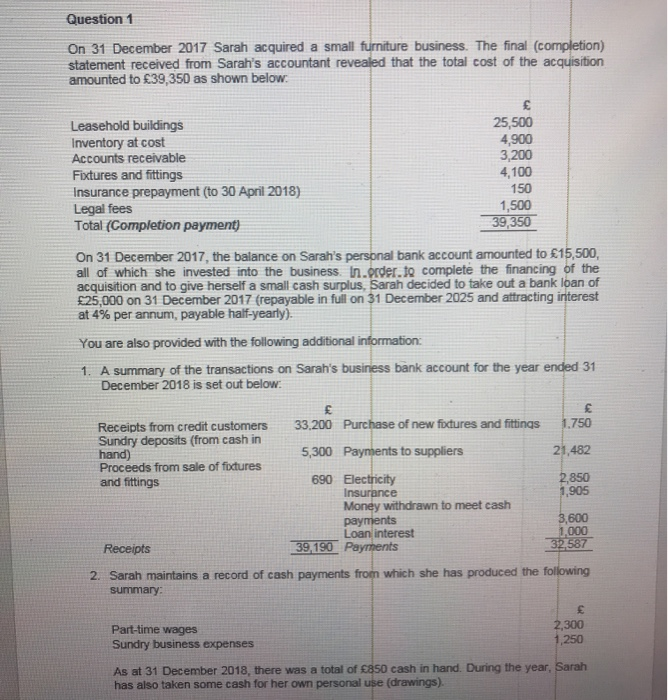

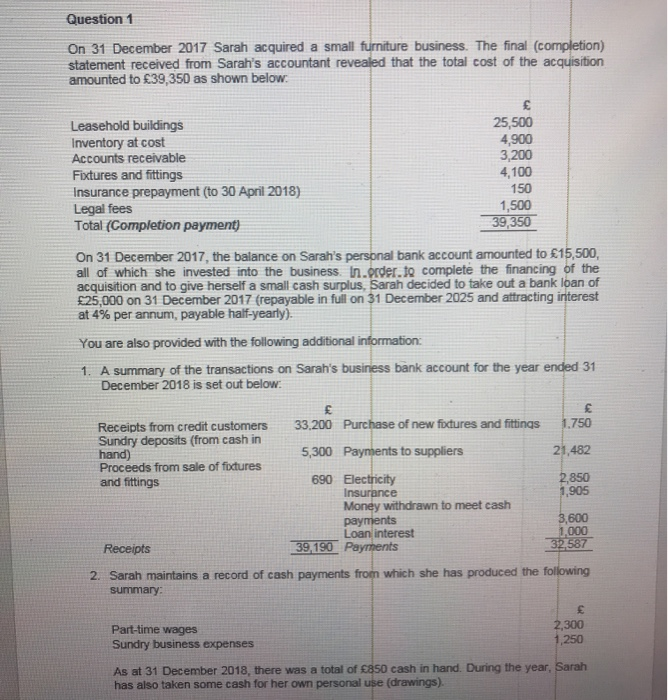

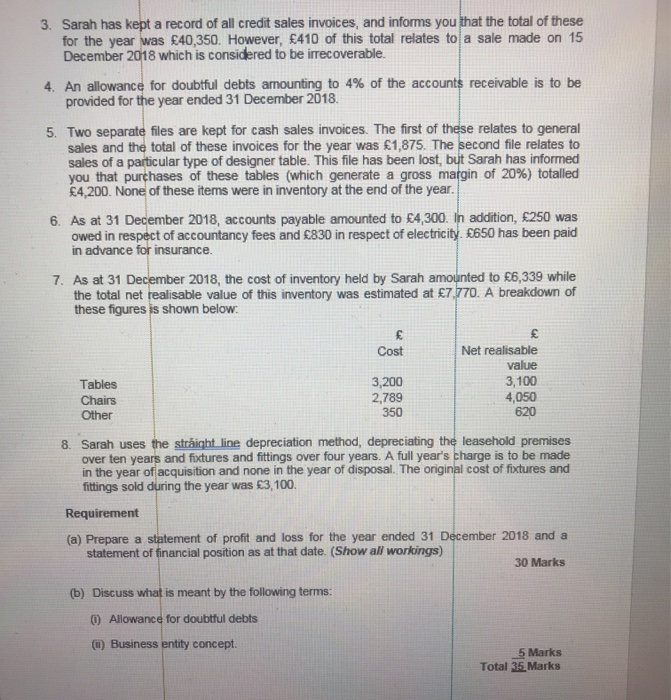

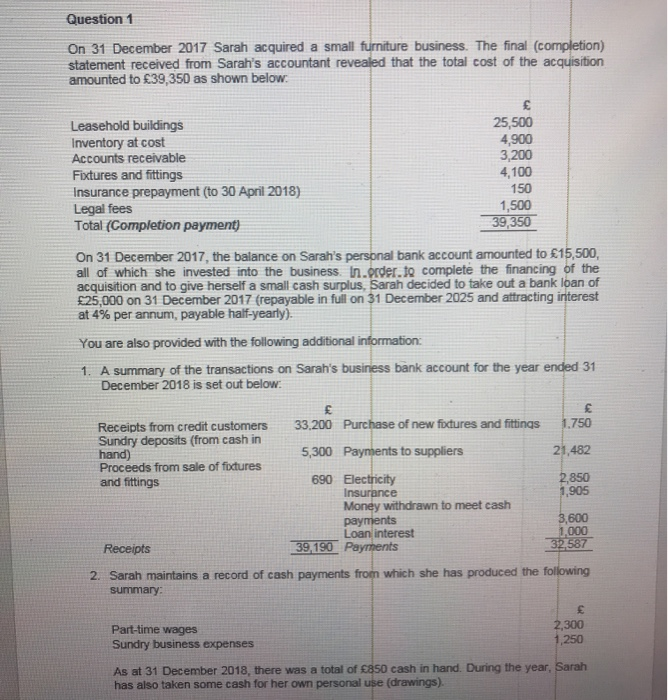

SECTION A COMPULSORY) Question 1 On 31 December 2017 Swahquired a small furniture business. The final completion) statement received from Sarah's account revealed that the total cost of the scoustion amounted to 3.350 as shown below Leasehold building 25.500 Inventory Most 6000 Accounts receivable 3.200 Fixtures and rings 4,100 Insurance prepayment 10 30 April 2016) 150 Legales 1.100 Tol Completion payment 300 On 31 December 2017, the balance on w's personal bank women to 18.00 of which she went the business, complete the finante acquisition and to give her alcashurplus Sarande suta bar loan of 126.000 on 31 December 2017 repaya on 31 December 2025 and there 14% perum, pytle heart You are we provided with the following on womation 1. A summary of the ansactions on Sara's business bank account for the year ended 31 December 2018 is set out below SECTION A COMPULSORY) 3. Surah has kept a reord of all credit sales invoices and informs you that the total of these for the year was $40.350. However, 6410 of this restos made on 15 December 2018 which i powiedbe irrecoverable 4. An allowance for doubtful debts amounting to 45 of the accounts receivable to be provided for the year anded 31 December 2010 5. The parties are kept for cash sales involves The first of these res general sales and the total of these is for the year was 1.75 The second hates to sales of a wote. This has been lost but Sarah has informed you that purchases of these was with generate a gross margin of 205 Wed 4.200. None of them were in inventory at the end of the year As at 31 December 2011 counts payable amounted to 4300 EO was wed in respect of accountancy fees and respect of what in advance for insurance 7. As at 31 December 2011 out of tory held by Shad to wie the one e value of the very was med 7.770. A breadows Cost Notre satile 2100 Chains 2,79 400 Other 350 do & Sarah when depreciation method depreciating the premises years and free and as our four years. A w's charge to be made the year of antion and one in the year of sposal. The original cost offres and is sold in the year was 3.100 Receipts from croitustomers 3.200 Purchase of newfours and 1750 Sundry deposits from cash in handi 5.30 Parts to woliers 21.450 Proceeds from sale of fictures and fittings 000 Electric 2850 Insurance 10 Money withdrawn to mech 3.000 Loan interest 1000 Rece Payments 2. Sarah maintains a record of cash payment from which she has produced the following Summary Requirement Prepare rent of prot and loss for the year anded 31 December 20 Men of financial postos as that date Show all warial Dus what is meant by the following terms Allowance for det det Business tyconcept Marke Total Marks Part-time wages 2.300 Sundry is expenses As 31 December 2013, there was a lot to cash in hand. During the yaw. Sarah has who take some cash for her own personal use (wings 3. Sarah has kept a record of all credit sales invoices, and informs you that the total of these for the year was 40,350. However, 410 of this total relates to a sale made on 15 December 2018 which is considered to be irrecoverable. 4. An allowance for doubtful debts amounting to 4% of the accounts receivable is to be provided for the year ended 31 December 2018 5. Two separate files are kept for cash sales invoices. The first of these relates to general sales and the total of these invoices for the year was 1,875. The second file relates to sales of a particular type of designer table. This file has been lost, but Sarah has informed you that purchases of these tables (which generate a gross margin of 20%) totalled 4,200. None of these items were in inventory at the end of the year. 6. As at 31 December 2018, accounts payable amounted to 4,300. In addition, 250 was owed in respect of accountancy fees and 830 in respect of electricity. 650 has been paid in advance for insurance. 7. As at 31 December 2018, the cost of inventory held by Sarah amounted to 6,339 while the total net realisable value of this inventory was estimated at 7.770. A breakdown of these figures is shown below: Cost Net realisable value Tables 3,200 3,100 Chairs 2,789 4,050 Other 350 620 8. Sarah uses the straight line depreciation method, depreciating the leasehold premises over ten years and fixtures and fittings over four years. A full year's charge is to be made in the year of acquisition and none in the year of disposal. The original cost of fixtures and fittings sold during the year was 3,100. Requirement (a) Prepare a statement of profit and loss for the year ended 31 December 2018 and a statement of financial position as at that date. (Show all workings) 30 Marks (b) Discuss what is meant by the following terms: O Allowance for doubtful debts (1) Business entity concept. 5 Marks Total 35 Marks