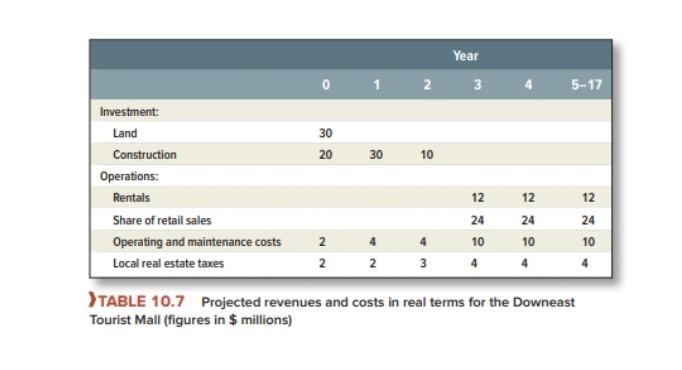

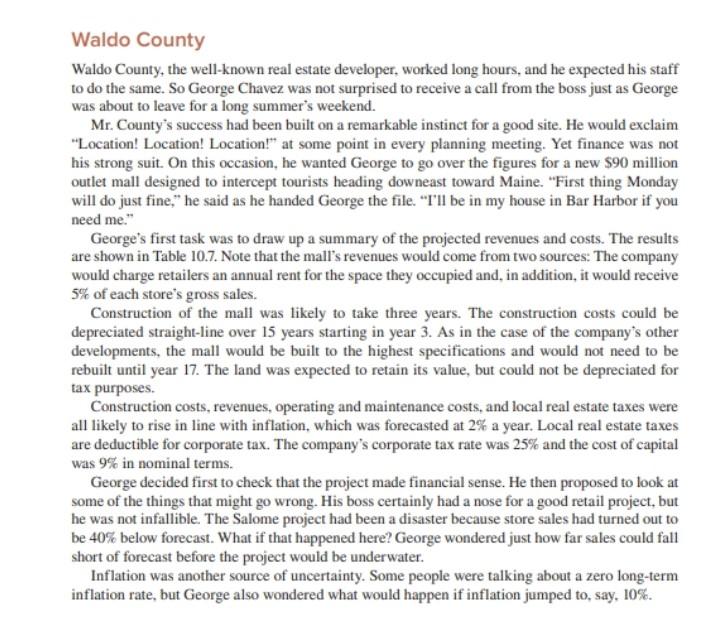

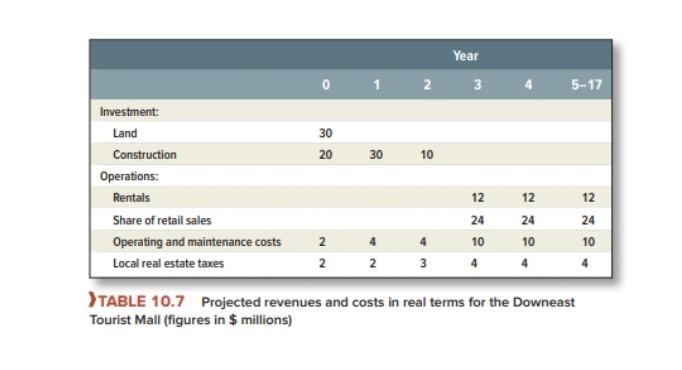

BMA Chapter 10 mini-case (Waldo County) General instructions: . Please present your responses to original case questions and additional questions shown below in a report format. Answering questions only would not be sufficient. Provide insights you gained from your analysis. Upload your report and spreadsheet files using Blackboard. Case questions (first two are the original questions): 1. What is the project's NPV, given the projection in the case? - see the case in the textbook. 2. Conduct a sensitivity and a scenario analysis of the project. What do these analyses reveal about the project's risk and potential value? 3. What is the break-even error in share of retail sales in no delay and delay with cost overrun scenarios? 4. Design Monte Carlo Simulations considering forecast error in share of retail sales in no delay and delay with cost overrun scenarios. What are the VaRs of the project at 5%? b. What are the tail VaRs at 5%? C. What are the Black Swan outcomes? d. What conclusions can you draw on the degree of operating leverage after the completion of construction in no delay and delay scenarios? 5. Based on your analyses, is this a project Mr. County should allocate capital? Justify your perspective. a. Case notes: 1. Create two models (scenarios); delay and no delay. Using if statements to consider delay will make the model overly complicated. 2. Do not consider any information in the case as certain. No one knows what future holds. 3. Make sure to adjust for inflation. Generally, discount nominal cash flows using a nominal rate and real cash flows using a real rate. Suggestion: convert all relevant items into nominal amounts. 4. Vary inflation in a sensitivity analysis only. In simulations, you may keep it constant at the given value. 5. Property tax is an operating expense and income tax deductible. 6. Assume that the company would get tax benefit from operating losses (not capital spending). The benefit is through the use of these losses to offset taxable income from other projects. The amount of tax savings is the product of losses and the tax rate. Waldo County Waldo County, the well-known real estate developer, worked long hours, and he expected his staff to do the same. So George Chavez was not surprised to receive a call from the boss just as George was about to leave for a long summer's weekend. Mr. County's success had been built on a remarkable instinct for a good site. He would exclaim "Location! Location! Location!" at some point in every planning meeting. Yet finance was not his strong suit. On this occasion, he wanted George to go over the figures for a new $90 million outlet mall designed to intercept tourists heading downeast toward Maine. "First thing Monday will do just fine," he said as he handed George the file. "I'll be in my house in Bar Harbor if you need me." George's first task was to draw up a summary of the projected revenues and costs. The results are shown in Table 10.7. Note that the mall's revenues would come from two sources: The company would charge retailers an annual rent for the space they occupied and, in addition, it would receive 5% of each store's gross sales. Construction of the mall was likely to take three years. The construction costs could be depreciated straight-line over 15 years starting in year 3. As in the case of the company's other developments, the mall would be built to the highest specifications and would not need to be rebuilt until year 17. The land was expected to retain its value, but could not be depreciated for tax purposes. Construction costs, revenues, operating and maintenance costs, and local real estate taxes were all likely to rise in line with inflation, which was forecasted at 2% a year. Local real estate taxes are deductible for corporate tax. The company's corporate tax rate was 25% and the cost of capital was 9% in nominal terms. George decided first to check that the project made financial sense. He then proposed to look at some of the things that might go wrong. His boss certainly had a nose for a good retail project, but he was not infallible. The Salome project had been a disaster because store sales had turned out to be 40% below forecast. What if that happened here? George wondered just how far sales could fall short of forecast before the project would be underwater. Inflation was another source of uncertainty. Some people were talking about a zero long-term inflation rate, but George also wondered what would happen if inflation jumped to say, 10%. Year 3 1 2 LAJ 5-17 30 20 30 10 Investment: Land Construction Operations: Rentals Share of retail sales Operating and maintenance costs Local real estate taxes 12 12 12 24 24 10 24 10 10 2 2 2 3 > TABLE 10.7 Projected revenues and costs in real terms for the Downeast Tourist Mall (figures in $ millions) Chapter 10 Project Analysis A third concern was possible construction cost overruns and delays due to required zoning changes and environmental approvals. George had seen cases of 25% construction cost overruns and delays up to 12 months between purchase of the land and the start of construction. He decided that he should examine the effect that this scenario would have on the project's profitability. "Hey, this might be fun," George exclaimed to Mr. Waldo's secretary, Fifi, who was heading for Old Orchard Beach for the weekend. "I might even try Monte Carlo." Waldo went to Monte Carlo once," Fifi replied. Lost a bundle at the roulette table. I wouldn't remind him. Just show him the bottom line. Will it make money or lose money? That's the bottom line." "OK, no Monte Carlo," George agreed. But he realized that building a spreadsheet and running scenarios was not enough. He had to figure out how to summarize and present his results to Mr. County. QUESTIONS 1. What is the project's NPV, given the projections in Table 10.72 2. Conduct a sensitivity and a scenario analysis of the project. What do these analyses reveal about the project's risks and potential value? BMA Chapter 10 mini-case (Waldo County) General instructions: . Please present your responses to original case questions and additional questions shown below in a report format. Answering questions only would not be sufficient. Provide insights you gained from your analysis. Upload your report and spreadsheet files using Blackboard. Case questions (first two are the original questions): 1. What is the project's NPV, given the projection in the case? - see the case in the textbook. 2. Conduct a sensitivity and a scenario analysis of the project. What do these analyses reveal about the project's risk and potential value? 3. What is the break-even error in share of retail sales in no delay and delay with cost overrun scenarios? 4. Design Monte Carlo Simulations considering forecast error in share of retail sales in no delay and delay with cost overrun scenarios. What are the VaRs of the project at 5%? b. What are the tail VaRs at 5%? C. What are the Black Swan outcomes? d. What conclusions can you draw on the degree of operating leverage after the completion of construction in no delay and delay scenarios? 5. Based on your analyses, is this a project Mr. County should allocate capital? Justify your perspective. a. Case notes: 1. Create two models (scenarios); delay and no delay. Using if statements to consider delay will make the model overly complicated. 2. Do not consider any information in the case as certain. No one knows what future holds. 3. Make sure to adjust for inflation. Generally, discount nominal cash flows using a nominal rate and real cash flows using a real rate. Suggestion: convert all relevant items into nominal amounts. 4. Vary inflation in a sensitivity analysis only. In simulations, you may keep it constant at the given value. 5. Property tax is an operating expense and income tax deductible. 6. Assume that the company would get tax benefit from operating losses (not capital spending). The benefit is through the use of these losses to offset taxable income from other projects. The amount of tax savings is the product of losses and the tax rate. Waldo County Waldo County, the well-known real estate developer, worked long hours, and he expected his staff to do the same. So George Chavez was not surprised to receive a call from the boss just as George was about to leave for a long summer's weekend. Mr. County's success had been built on a remarkable instinct for a good site. He would exclaim "Location! Location! Location!" at some point in every planning meeting. Yet finance was not his strong suit. On this occasion, he wanted George to go over the figures for a new $90 million outlet mall designed to intercept tourists heading downeast toward Maine. "First thing Monday will do just fine," he said as he handed George the file. "I'll be in my house in Bar Harbor if you need me." George's first task was to draw up a summary of the projected revenues and costs. The results are shown in Table 10.7. Note that the mall's revenues would come from two sources: The company would charge retailers an annual rent for the space they occupied and, in addition, it would receive 5% of each store's gross sales. Construction of the mall was likely to take three years. The construction costs could be depreciated straight-line over 15 years starting in year 3. As in the case of the company's other developments, the mall would be built to the highest specifications and would not need to be rebuilt until year 17. The land was expected to retain its value, but could not be depreciated for tax purposes. Construction costs, revenues, operating and maintenance costs, and local real estate taxes were all likely to rise in line with inflation, which was forecasted at 2% a year. Local real estate taxes are deductible for corporate tax. The company's corporate tax rate was 25% and the cost of capital was 9% in nominal terms. George decided first to check that the project made financial sense. He then proposed to look at some of the things that might go wrong. His boss certainly had a nose for a good retail project, but he was not infallible. The Salome project had been a disaster because store sales had turned out to be 40% below forecast. What if that happened here? George wondered just how far sales could fall short of forecast before the project would be underwater. Inflation was another source of uncertainty. Some people were talking about a zero long-term inflation rate, but George also wondered what would happen if inflation jumped to say, 10%. Year 3 1 2 LAJ 5-17 30 20 30 10 Investment: Land Construction Operations: Rentals Share of retail sales Operating and maintenance costs Local real estate taxes 12 12 12 24 24 10 24 10 10 2 2 2 3 > TABLE 10.7 Projected revenues and costs in real terms for the Downeast Tourist Mall (figures in $ millions) Chapter 10 Project Analysis A third concern was possible construction cost overruns and delays due to required zoning changes and environmental approvals. George had seen cases of 25% construction cost overruns and delays up to 12 months between purchase of the land and the start of construction. He decided that he should examine the effect that this scenario would have on the project's profitability. "Hey, this might be fun," George exclaimed to Mr. Waldo's secretary, Fifi, who was heading for Old Orchard Beach for the weekend. "I might even try Monte Carlo." Waldo went to Monte Carlo once," Fifi replied. Lost a bundle at the roulette table. I wouldn't remind him. Just show him the bottom line. Will it make money or lose money? That's the bottom line." "OK, no Monte Carlo," George agreed. But he realized that building a spreadsheet and running scenarios was not enough. He had to figure out how to summarize and present his results to Mr. County. QUESTIONS 1. What is the project's NPV, given the projections in Table 10.72 2. Conduct a sensitivity and a scenario analysis of the project. What do these analyses reveal about the project's risks and potential value