Answered step by step

Verified Expert Solution

Question

1 Approved Answer

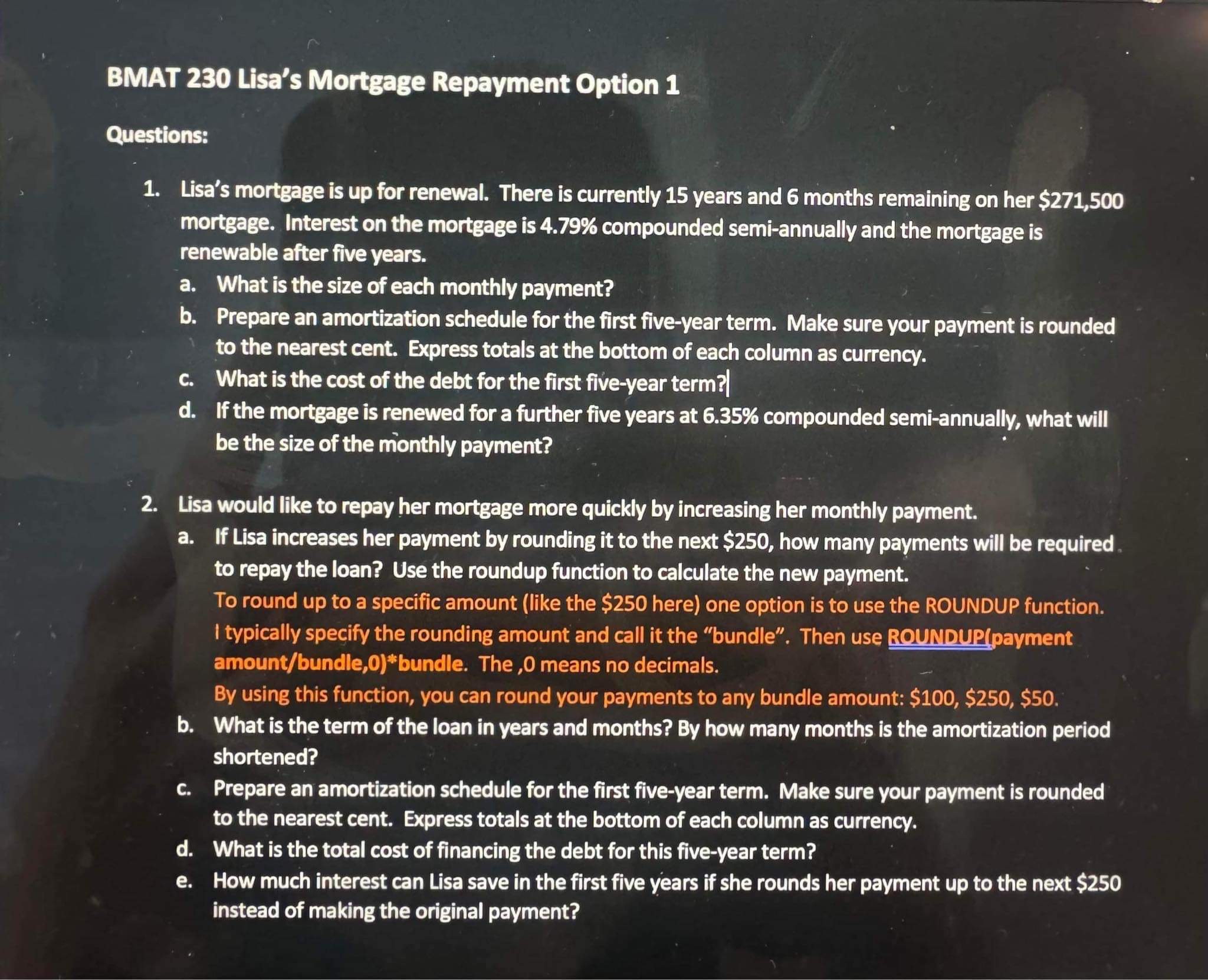

BMAT 2 3 0 Lisa's Mortgage Repayment Option 1 Questions: Lisa's mortgage is up for renewal. There is currently 1 5 years and 6 months

BMAT Lisa's Mortgage Repayment Option

Questions:

Lisa's mortgage is up for renewal. There is currently years and months remaining on her $ mortgage. Interest on the mortgage is compounded semiannually and the mortgage is renewable after five years.

a What is the size of each monthly payment?

b Prepare an amortization schedule for the first fiveyear term. Make sure your payment is rounded to the nearest cent. Express totals at the bottom of each column as currency.

c What is the cost of the debt for the first fiveyear term?

d If the mortgage is renewed for a further five years at compounded semiannually, what will be the size of the monthly payment?

Lisa would like to repay her mortgage more quickly by increasing her monthly payment.

a If Lisa increases her payment by rounding it to the next $ how many payments will be required. to repay the loan? Use the roundup function to calculate the new payment.

To round up to a specific amount like the $ here one option is to use the ROUNDUP function. I typically specify the rounding amount and call it the "bundle". Then use ROUNDUPpayment amountbundlebundle The, means no decimals.

By using this function, you can round your payments to any bundle amount: $$$

b What is the term of the loan in years and months? By how many months is the amortization period shortened?

c Prepare an amortization schedule for the first fiveyear term. Make sure your payment is rounded to the nearest cent. Express totals at the bottom of each column as currency.

d What is the total cost of financing the debt for this fiveyear term?

e How much interest can Lisa save in the first five years if she rounds her payment up to the next $ instead of making the original payment?

Please answer with complete solution and answers and not procedures, thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started