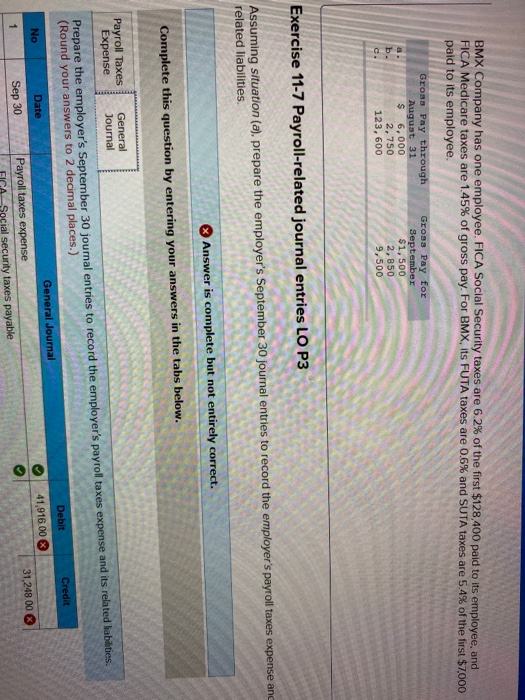

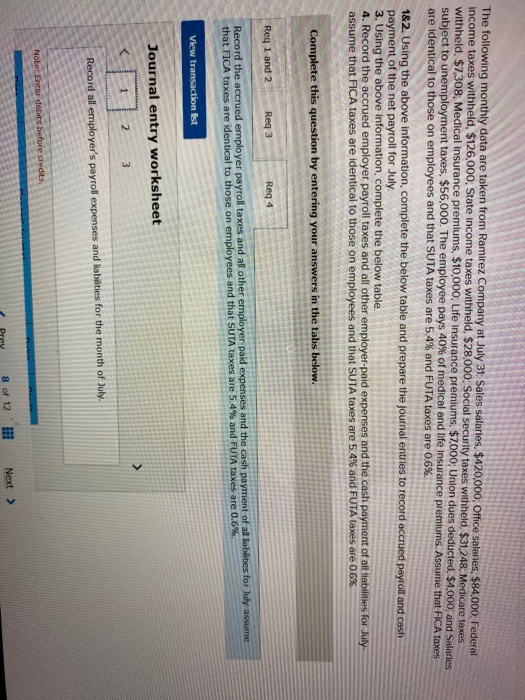

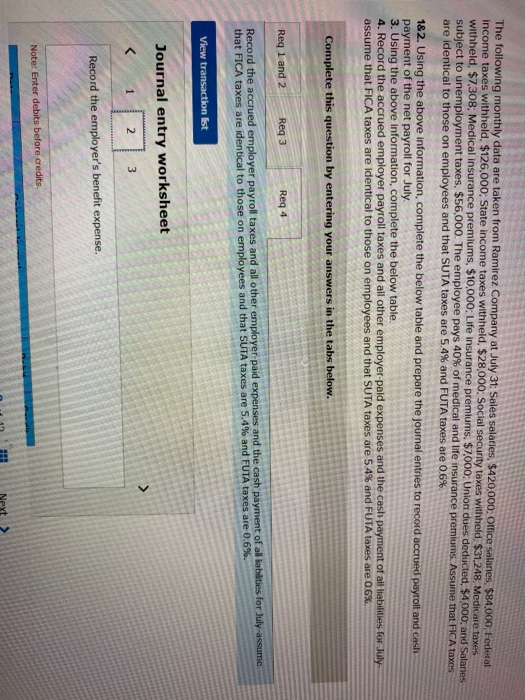

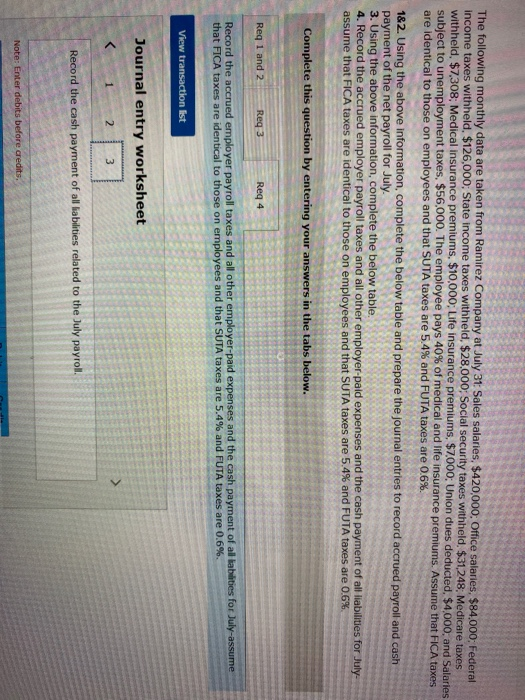

BMX Company has one employee, FICA Social Security taxes are 6.2% of the first $128.400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 $ 6,000 2,750 123,600 Gross Pay for September $1,500 2,850 9,500 Exercise 11-7 Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and related liabilities Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Payroll Taxes Expense General Journal Prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related habities. (Round your answers to 2 decimal places.) Debit Credit General Journal No Date 41,916.00 31,248.00 1 Sep 30 Payroll taxes expense Social security taxes payable The following monthly data are taken from Ramirez Company at July 31: Sales salaries. $420,000, Office salaries. $84,000, Federal Income taxes withheld, $126,000: State income taxes withheld, $28,000. Social security taxes withheld $31,248, Medicare taxes withheld $7,308 Medical insurance premiums, $10,000; Life insurance premiums, $7,000; Union dues deducted, $1,000 and Salaries subject to unemployment taxes, $56,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% 1&2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll and cash payment of the net payroll for July 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of a fiabities for July-assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% View transaction list Journal entry worksheet 2 3 Record all employer's payroll expenses and liabilities for the month of July. Note: Enter debits before credits 8 of 12 Next > The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $420,000: Office salaries $84,000; Federal income taxes withheld. $126,000: State income taxes withheld, $28,000: Social security taxes withheld $31,248 Medicare taxes withheld, $7,308; Medical insurance premiums, $10,000: Life insurance premiums. $7,000, Union dues deducted, $4,000, and Salaries subject to unemployment taxes, $56,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 182. Using the above information, complete the below table and prepare the journal entries to record accrued payroll and cash payment of the net payroll for July 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6% Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Reg 4 Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July-assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. View transaction list Journal entry worksheet 2 3 Record the cash payment of all liabilities related to the July payroll. Note: Enter debits before credits