Answered step by step

Verified Expert Solution

Question

1 Approved Answer

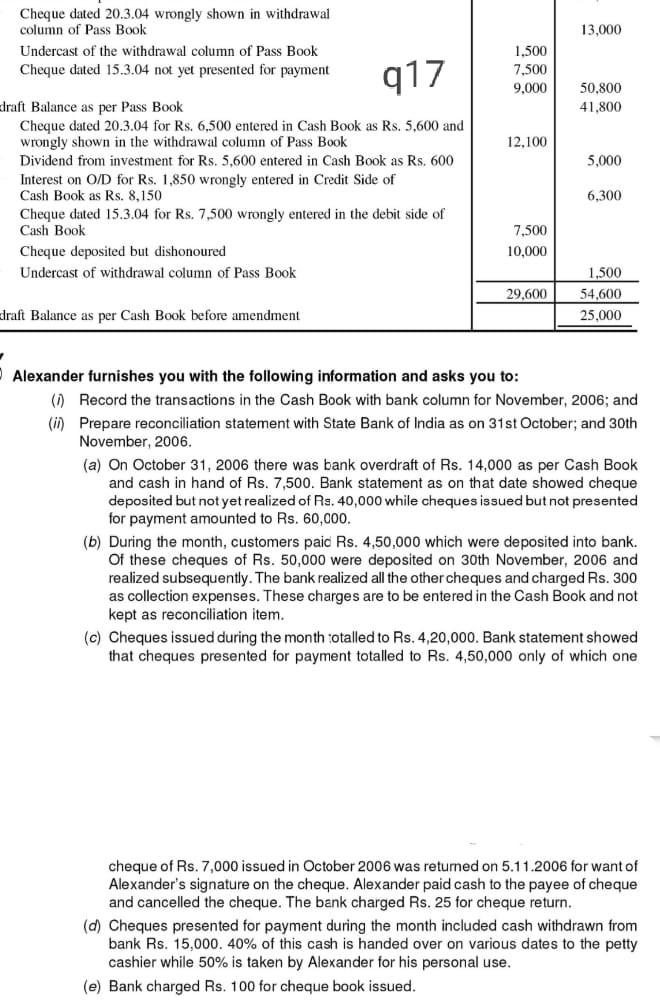

bnd 13,000 Cheque dated 20.3.04 wrongly shown in withdrawal column of Pass Book Undercast of the withdrawal column of Pass Book Cheque dated 15.3.04 not

bnd

13,000 Cheque dated 20.3.04 wrongly shown in withdrawal column of Pass Book Undercast of the withdrawal column of Pass Book Cheque dated 15.3.04 not yet presented for payment 917 1,500 7,500 9,000 50.800 41,800 12.100 5.000 draft Balance as per Pass Book Cheque dated 20.3.04 for Rs. 6.500 entered in Cash Book as Rs. 5,600 and wrongly shown in the withdrawal column of Pass Book Dividend from investment for Rs. 5,600 entered in Cash Book as Rs. 600 Interest on O/D for Rs. 1,850 wrongly entered in Credit Side of Cash Book as Rs. 8,150 Cheque dated 15.3.04 for Rs. 7,500 wrongly entered in the debit side of Cash Book Cheque deposited but dishonoured Undercast of withdrawal column of Pass Book 6,300 7,500 10,000 29,600 1,500 54.600 25.000 draft Balance as per Cash Book before amendment Alexander furnishes you with the following information and asks you to: (1) Record the transactions in the Cash Book with bank column for November, 2006; and (in) Prepare reconciliation statement with State Bank of India as on 31st October; and 30th November, 2006. (a) On October 31, 2006 there was bank overdraft of Rs. 14,000 as per Cash Book and cash in hand of Rs. 7,500. Bank statement as on that date showed cheque deposited but not yet realized of Rs. 40,000 while cheques issued but not presented for payment amounted to Rs. 60,000. (b) During the month, customers paid Rs. 4,50,000 which were deposited into bank. Of these cheques of Rs. 50,000 were deposited on 30th November, 2006 and realized subsequently. The bank realized all the other cheques and charged Rs. 300 as collection expenses. These charges are to be entered in the Cash Book and not kept as reconciliation item. (c) Cheques issued during the month totalled to Rs. 4,20,000. Bank statement showed that cheques presented for payment totalled to Rs. 4,50,000 only of which one cheque of Rs. 7,000 issued in October 2006 was returned on 5.11.2006 for want of Alexander's signature on the cheque. Alexander paid cash to the payee of cheque and cancelled the cheque. The bank charged Rs. 25 for cheque return. (d) Cheques presented for payment during the month included cash withdrawn from bank Rs. 15,000. 40% of this cash is handed over on various dates to the petty cashier while 50% is taken by Alexander for his personal use. (e) Bank charged Rs. 100 for cheque book issuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started