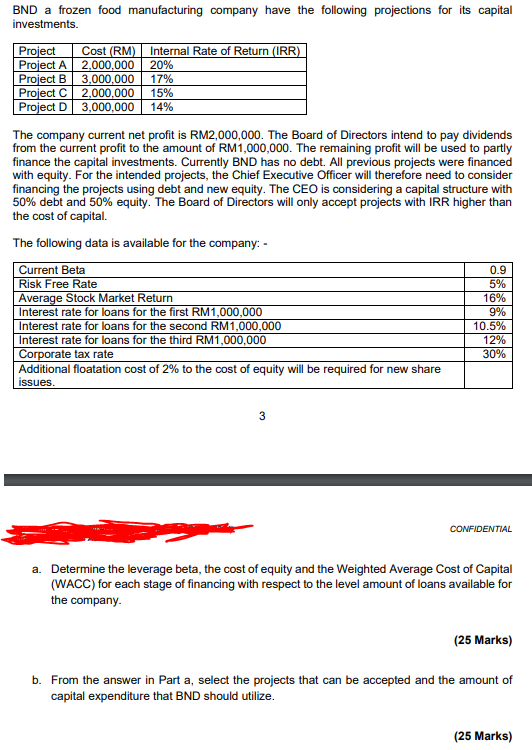

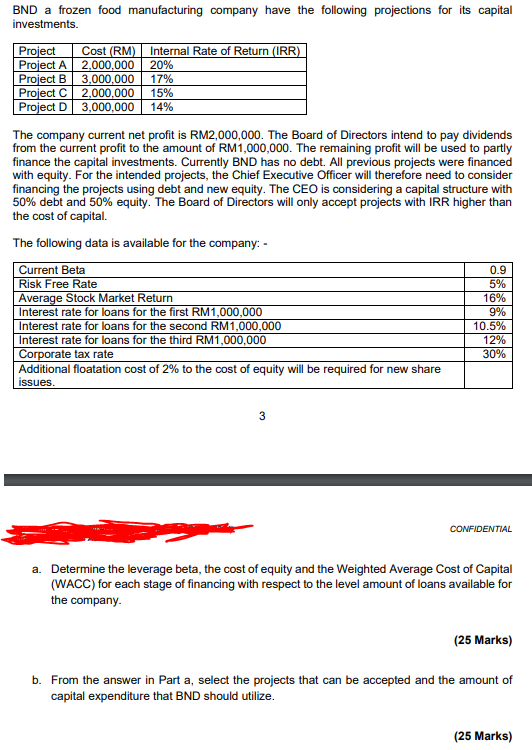

BND a frozen food manufacturing company have the following projections for its capital investments. The company current net profit is RM2,000,000. The Board of Directors intend to pay dividends from the current profit to the amount of RM1,000,000. The remaining profit will be used to partly finance the capital investments. Currently BND has no debt. All previous projects were financed with equity. For the intended projects, the Chief Executive Officer will therefore need to consider financing the projects using debt and new equity. The CEO is considering a capital structure with 50% debt and 50% equity. The Board of Directors will only accept projects with IRR higher than the cost of capital. The following data is available for the company: - 3 a. Determine the leverage beta, the cost of equity and the Weighted Average Cost of Capital (WACC) for each stage of financing with respect to the level amount of loans available for the company. (25 Marks) b. From the answer in Part a, select the projects that can be accepted and the amount of capital expenditure that BND should utilize. BND a frozen food manufacturing company have the following projections for its capital investments. The company current net profit is RM2,000,000. The Board of Directors intend to pay dividends from the current profit to the amount of RM1,000,000. The remaining profit will be used to partly finance the capital investments. Currently BND has no debt. All previous projects were financed with equity. For the intended projects, the Chief Executive Officer will therefore need to consider financing the projects using debt and new equity. The CEO is considering a capital structure with 50% debt and 50% equity. The Board of Directors will only accept projects with IRR higher than the cost of capital. The following data is available for the company: - 3 a. Determine the leverage beta, the cost of equity and the Weighted Average Cost of Capital (WACC) for each stage of financing with respect to the level amount of loans available for the company. (25 Marks) b. From the answer in Part a, select the projects that can be accepted and the amount of capital expenditure that BND should utilize