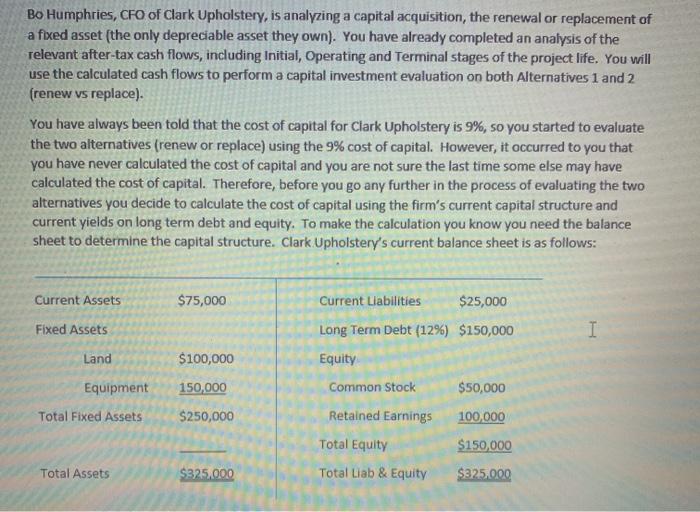

Bo Humphries, CFO of Clark Upholstery, is analyzing a capital acquisition, the renewal or replacement of a fixed asset (the only depreciable asset they own). You have already completed an analysis of the relevant after-tax cash flows, including Initial, Operating and Terminal stages of the project life. You will use the calculated cash flows to perform a capital investment evaluation on both Alternatives 1 and 2 (renew vs replace). You have always been told that the cost of capital for Clark Upholstery is 9%, so you started to evaluate the two alternatives (renew or replace) using the 9% cost of capital. However, it occurred to you that you have never calculated the cost of capital and you are not sure the last time some else may have calculated the cost of capital. Therefore, before you go any further in the process of evaluating the two alternatives you decide to calculate the cost of capital using the firm's current capital structure and current yields on long term debt and equity. To make the calculation you know you need the balance sheet to determine the capital structure. Clark Upholstery's current balance sheet is as follows: Current Assets $75,000 Current Liabilities $25,000 I Fixed Assets Land $100,000 Long Term Debt (12%) $150,000 Equity Common Stock $50,000 Equipment 150,000 Total Fixed Assets $250,000 Retained Earnings 100,000 Total Equity $150,000 Total Assets $325.000 Total Liab & Equity $325,000 You will use the balance sheet to determine the relative weight of debt vs equity in your long-term capital structure. You also know that you must determine the current yield/value on your debt and equity in order to determine the after-tax cost of both debt and equity. Having both the relative weights of your capital structure and after-tax rates you can then determine your Weighted Average Cost of Capital (WACC), which you will use to evaluate the two alternatives (renew vs replace). Your outstanding long-term bonds have a 12% coupon rate, but are selling at a discount on the publicly traded market. The current price is $88, that is $880 for a $1,000 face value bond. You need to determine the current yield/value of the current long-term debt. You are considering selling more bonds in the public market to finance the cost of the renewal or replacement. If you do this your investment banker is telling you that a 20-year bond would need a coupon rate of 13.6%, and to be sold Clark Upholstery would incur a $45 per bond discount and flotation costs of $32 per bond. Using this information, you calculate the cost of your current long-term bonds and also the cost if you sell $100,000 additional long-term bonds to finance the investment. The other portion of your capital structure is your equity, which is comprised of Common Stock and Retained Earnings. Your stock is not publicly traded, so you decide to use the Capital Asset Pricing Model (CAPM) to determine the cost of equity. To calculate the CAPM you need risk free rate (which you determine to be 4%) and also the markets expected return for the stock of companies like Clark (15%). Using historical information about Clark and also about the furniture Upholstery industry you determine that the firm's beta is 0.88. You use this information to determine the equity cost of both Common Stock and Retained earnings, Finally, you combine the debt and equity cost with the weights of debt and equity to determine Weighted Average Cost of Capital (WACC) assuming that Clark will finance the investment using the current mix of debt and use retained earnings (so no new equity is sold). You will also calculate the WACC assuming that Clark will finance $100,000 of the investment by issuing new bonds. Your Investment Banker advises you that taking on $100,000 of new long-term bonds will increase your Beta from 0.88 to 1.1. You now have two WACC, one for the current capital structure and one that assumes the investment is financed by $100,000 of new long-term bonds and the balance being funded by Retained Earnings. You will use both WACC to evaluate the two investment alternative (renew or replace). Now that you have all the calculations of incremental after-tax cash flow and WACC you are ready to evaluate the alternatives. To do this you decide to calculate all the classic evaluation methods, Payback Period, PV and its related Profitability Index and Internal Rate of Return. You have also heard about Modified Internal Rate of Return (MIRR) and aren't sure if you will need/use it, but you will calculate it just in case. The company is concerned about an economic downturn in the near future which could throw off the revenue projections, and therefore has established a 4-year payback period as a pre- qualification for any new investments. You will now complete your project evaluation and do an accept/reject determination and a ranking for the two alternatives at both WACC. The CEO, Jane Clark, has asked you to prepare a presentation to senior management and members of the Board of Directors. She expects that you will have completed the analysis correctly, so wants the presentation to focus on the main issues; (1) WACC and if and why the WACC may change if the investment is financed by $100,000 of new long term bonds, (2) ranking of investment alternatives and (3) your recommendation of which alternative, if any, will be used to renew or replace the asset and how it should be financed. (Note, if you find that MIRR is an important evaluation rather than the traditional IRR, you intend to include in your presentation to the Board of Directors why you want them to consider MIRR rather than IRR.) While the CEO wants the presentation to be focused on the main issues and not the detail of the calculations, you know that she is a stickler for detail so you will be submitting to her as a separate document, your excel spreadsheet that shows the way you calculated WACC and the Evaluation results of Payback, PV, PI, NPV, IRR and MIRR