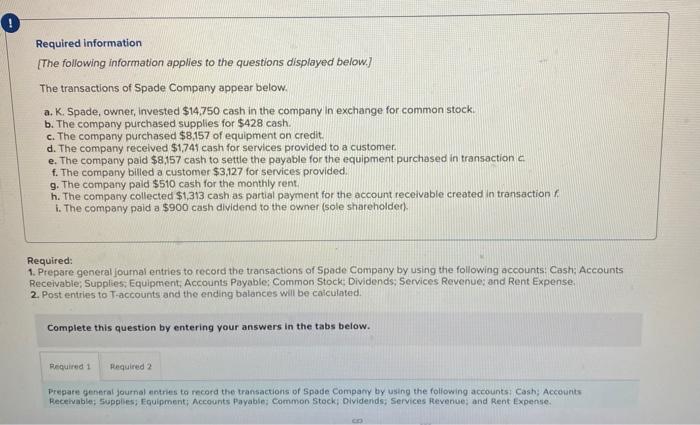

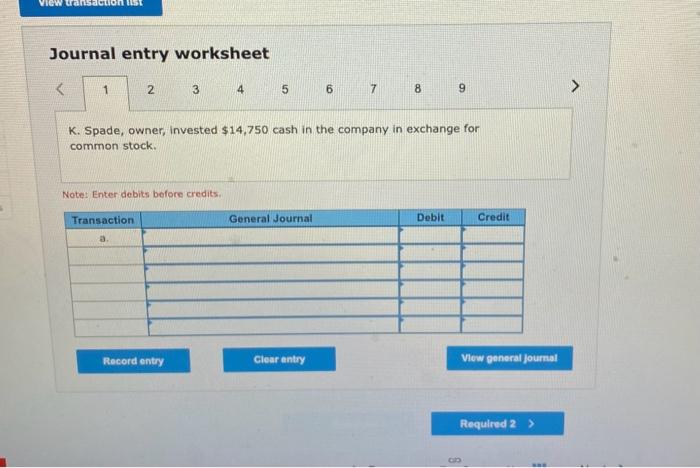

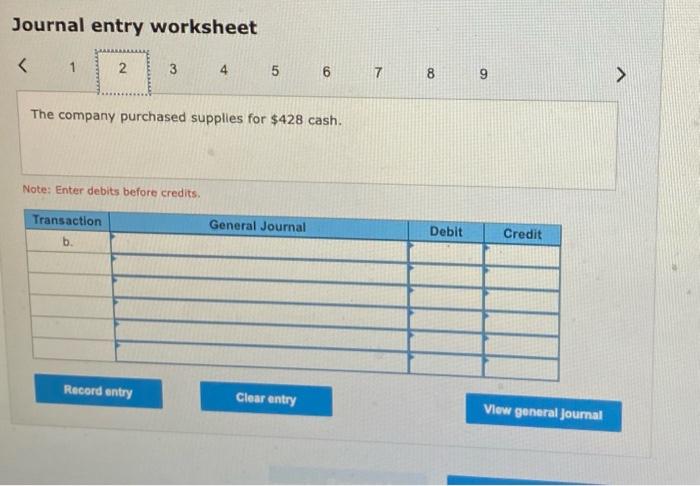

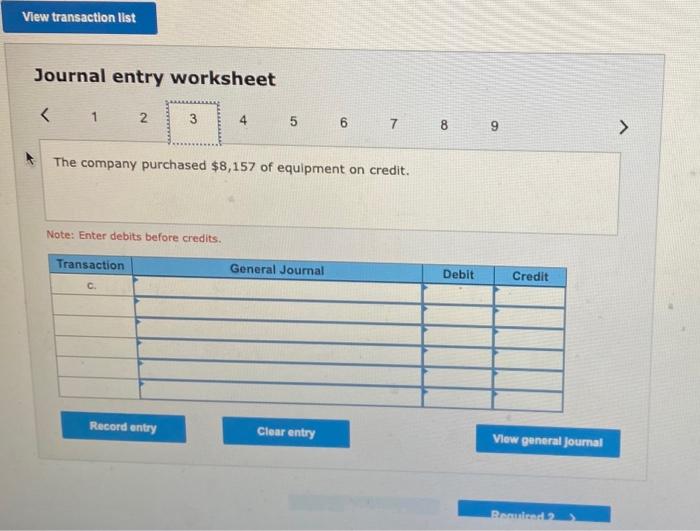

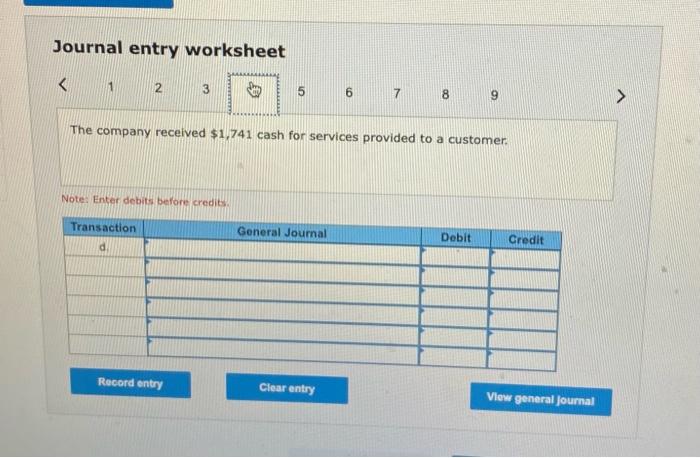

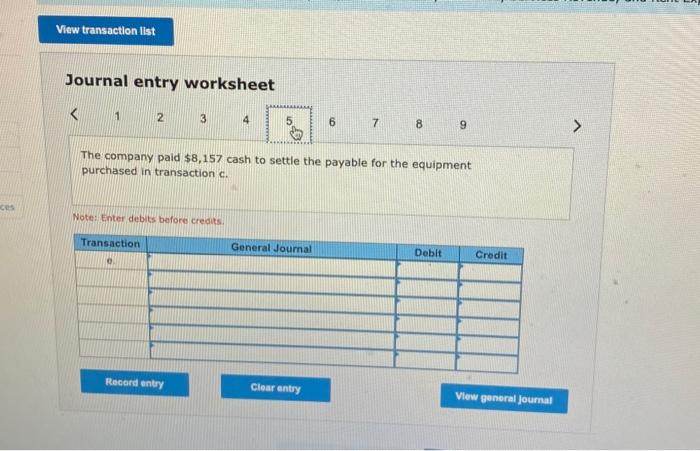

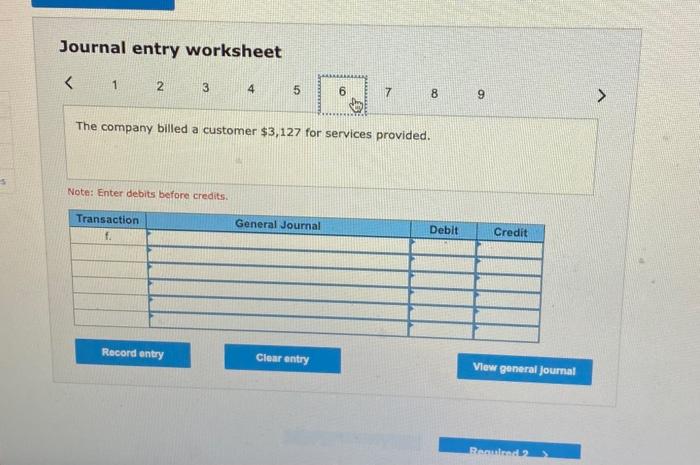

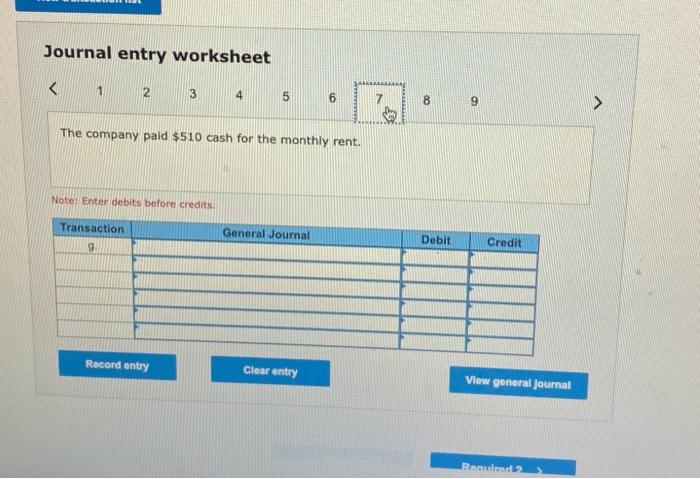

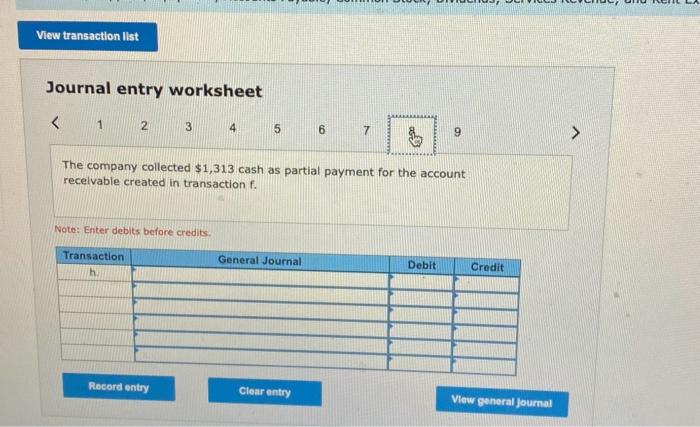

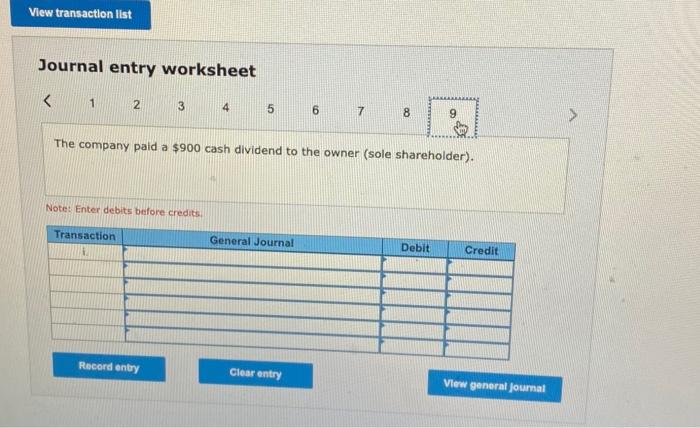

Required information [The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $14.750 cash in the company in exchange for common stock. b. The company purchased supplies for $428 cash. c. The company purchased $8,157 of equipment on credit. d. The company recelved $1,741 cash for services provided to a customer. e. The company paid $8,157 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,127 for services provided. 9. The company paid $510 cash for the monthly rent. h. The company collected $1,313 cash as partial payment for the account receivable created in transaction f. i. The company paid a $900 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cashi: Accounts Receivabie; Supplies, Equipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense, 2. Post entries to T-accounts and the ending balances will be caiculated. Complete this question by entering your answers in the tabs below. Prepare general journal entries to recora the transactions of Spade Company by using the foliowing accounts: Cash; Accounts Receivable; Supplies; Fquipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense. Journal entry worksheet 789 K. Spade, owner, invested $14,750 cash in the company in exchange for common stock. Note: Enter debits before credits. Journal entry worksheet 6 The company purchased supplies for $428 cash. Note: Enter debits before credits. Journal entry worksheet The company purchased $8,157 of equipment on credit. Note: Enter debits before credits. Journal entry worksheet The company received $1,741 cash for services provided to a customer. Note: Enter debits belore credits. Journal entry worksheet 789 The company paid $8,157 cash to settle the payable for the equipment purchased in transaction c. Note: Enter debits before creats. Journal entry worksheet The company billed a customer $3,127 for services provided. Note: Enter debits before credits. Journal entry worksheet The company paid $510 cash for the monthly rent. Notes. Envar debits before credits. Journal entry worksheet 12356 The company collected $1,313 cash as partial payment for the account recelvable created in transaction f. Note: Enter debits before credits. Journal entry worksheet 67 The company paid a $900 cash dividend to the owner (sole shareholder). Note: Enter debits before credits