Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bo Jensen Is a bond trader at Pimco. He just acquired a portfolio of 200 bonds from 2 different Issues: - 100 bonds from a

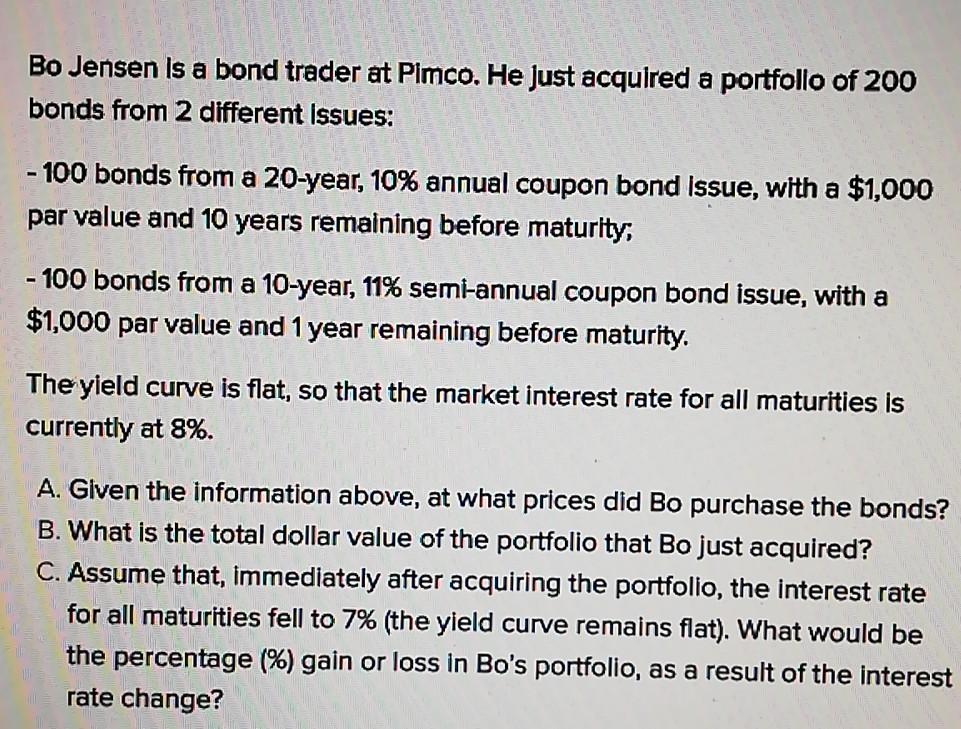

Bo Jensen Is a bond trader at Pimco. He just acquired a portfolio of 200 bonds from 2 different Issues: - 100 bonds from a 20-year, 10% annual coupon bond issue, with a $1,000 par value and 10 years remaining before maturity, - 100 bonds from a 10-year, 11% semi-annual coupon bond issue, with a $1,000 par value and 1 year remaining before maturity. The yield curve is flat, so that the market interest rate for all maturities is currently at 8%. A. Given the information above, at what prices did Bo purchase the bonds? B. What is the total dollar value of the portfolio that Bo just acquired? C. Assume that, immediately after acquiring the portfolio, the interest rate for all maturities fell to 7% (the yield curve remains flat). What would be the percentage (%) gain or loss in Bo's portfolio, as a result of the interest rate change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started