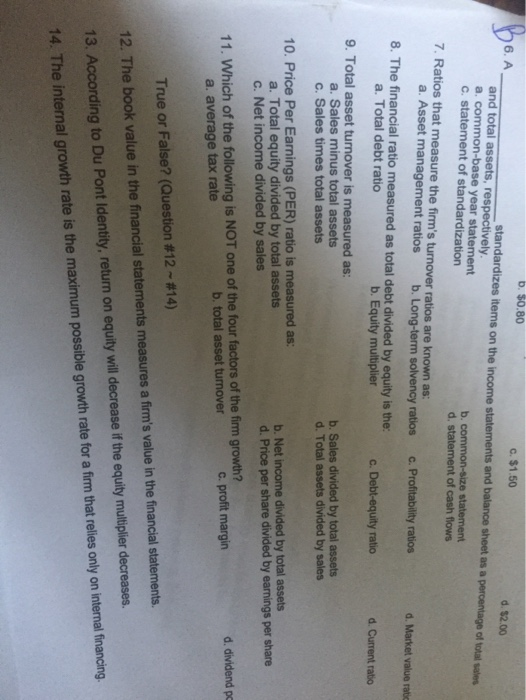

Boa_ b. $0.80 c. $1.50 d. $2.00 standardizes items on the income statements and balance sheet as a percentage of total sales and total assets, respectively. a common-base year statement c. statement of standardization b. common-size statement d. statement of cash flows 7. Ratios that measure the firm's turnover ratios are known as: a. Asset management ratios b. Long-term solvency ratios c. Profitability ratios d. Market value ratic 8. The financial ratio measured as total debt divided by equity is the a. Total debt ratio b. Equity multiplier c. Debt-equity ratio d. Current ratio 9. Total asset turnover is measured as: a. Sales minus total assets b. Sales divided by total assets c. Sales times total assets d. Total assets divided by sales 10. Price Per Earnings (PER) ratio is measured as: a. Total equity divided by total assets b. Net income divided by total assets c. Net income divided by sales d. Price per share divided by earnings per share 11. Which of the following is NOT one of the four factors of the firm growth? d. dividend po a. average tax rate c. profit margin b. total asset turnover True or False? (Question #12 - #14) 12. The book value in the financial statements measures a firm's value in the financial statements. 13. According to Du Pont Identity, return on equity will decrease if the equity multiplier decreases. 14. The internal growth rate is the maximum possible growth rate for a firm that relies only on internal financing, Boa_ b. $0.80 c. $1.50 d. $2.00 standardizes items on the income statements and balance sheet as a percentage of total sales and total assets, respectively. a common-base year statement c. statement of standardization b. common-size statement d. statement of cash flows 7. Ratios that measure the firm's turnover ratios are known as: a. Asset management ratios b. Long-term solvency ratios c. Profitability ratios d. Market value ratic 8. The financial ratio measured as total debt divided by equity is the a. Total debt ratio b. Equity multiplier c. Debt-equity ratio d. Current ratio 9. Total asset turnover is measured as: a. Sales minus total assets b. Sales divided by total assets c. Sales times total assets d. Total assets divided by sales 10. Price Per Earnings (PER) ratio is measured as: a. Total equity divided by total assets b. Net income divided by total assets c. Net income divided by sales d. Price per share divided by earnings per share 11. Which of the following is NOT one of the four factors of the firm growth? d. dividend po a. average tax rate c. profit margin b. total asset turnover True or False? (Question #12 - #14) 12. The book value in the financial statements measures a firm's value in the financial statements. 13. According to Du Pont Identity, return on equity will decrease if the equity multiplier decreases. 14. The internal growth rate is the maximum possible growth rate for a firm that relies only on internal financing