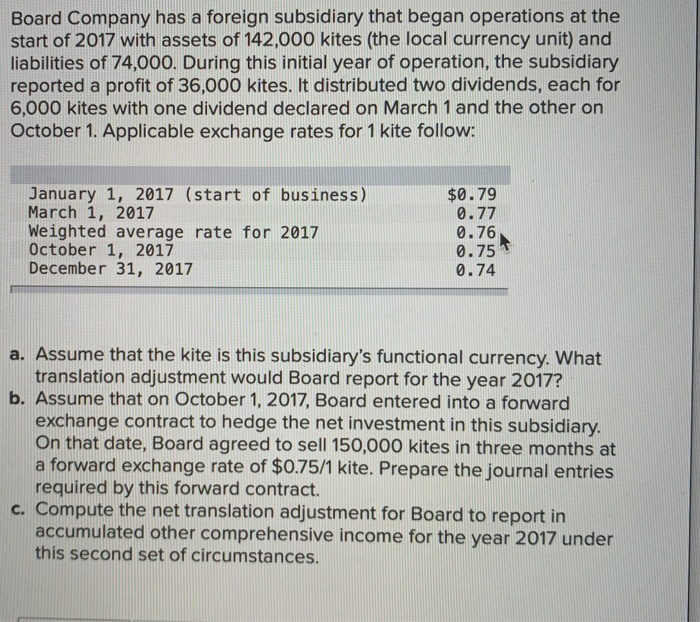

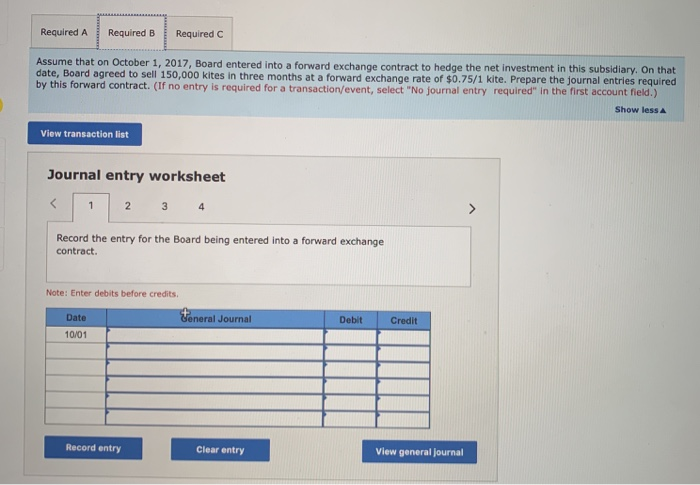

Board Company has a foreign subsidiary that began operations at the start of 2017 with assets of 142,000 kites (the local currency unit) and liabilities of 74,000. During this initial year of operation, the subsidiary reported a profit of 36,000 kites. It distributed two dividends, each for 6,000 kites with one dividend declared on March 1 and the other on October 1. Applicable exchange rates for 1 kite follow: January 1, 2017 (start of business) March 1, 2017 Weighted average rate for 2017 October 1, 2017 December 31, 2017 $0.79 0.77 0.76 0.75 0.74 a. Assume that the kite is this subsidiary's functional currency. What translation adjustment would Board report for the year 2017? b. Assume that on October 1, 2017, Board entered into a forward exchange contract to hedge the net investment in this subsidiary. On that date, Board agreed to sell 150,000 kites in three months at a forward exchange rate of $0.75/1 kite. Prepare the journal entries required by this forward contract. c. Compute the net translation adjustment for Board to report in accumulated other comprehensive income for the year 2017 under this second set of circumstances. Required A Required B Required C Assume that the kite is this subsidiary's functional currency. What translation adjustment would Board report for the year 2017? Translation adjustment Required A Required B Required C Assume that on October 1, 2017, Board entered into a forward exchange contract to hedge the net investment in this subsidiary. On that date, Board agreed to sell 150,000 kites in three months at a forward exchange rate of $0.75/1 kite. Prepare the journal entries required by this forward contract. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet 2 3 4 Record the entry for the Board being entered into a forward exchange contract. Note: Enter debits before credits Date General Journal Debit Credit 10/01 Record entry Clear entry View general journal Required A Required B Required Compute the net translation adjustment for Board to report in accumulated other comprehensive income for the year 2017 under this second set of circumstances. Net translation adjustment