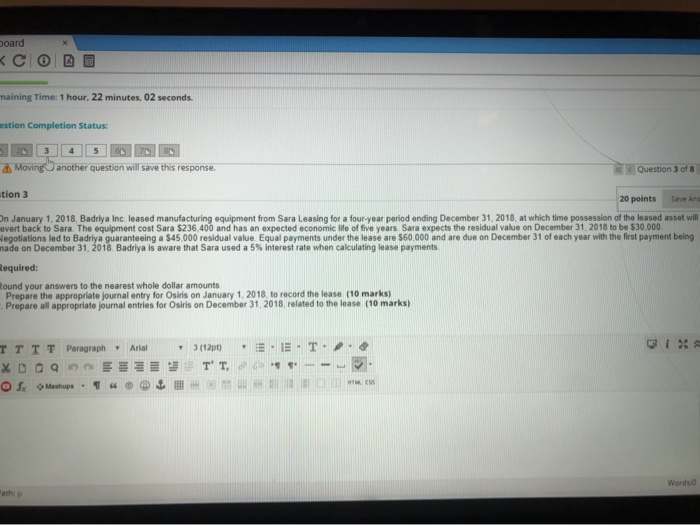

board x naining Time: 1 hour. 22 minutes. 02 seconds. estion Completion Status: 3 4 5 70 8 Moving another question will save this response. Question 3 of 8 Save Ar tion 3 20 points on January 1, 2018, Badriya Inc leased manufacturing equipment from Sara Leasing for a four-year period ending December 31, 2018 at which time possession of the leased asset will evert back to Sara. The equipment cost Sara 5236,400 and has an expected economic life of five years. Sara expects the residual value on December 31, 2018 to be $30.000 Negotiations led to Badriya guaranteeing a $45,000 residual value Equal payments under the lease are 560.000 and are due on December 31 of each year with the first payment being nade on December 31, 2018. Badriya is aware that Sara used a 5% interest rate when calculating lease payments Required: Round your answers to the nearest whole dollar amounts Prepare the appropriate journal entry for Osiris on January 1, 2018 to record the lease (10 marks) Prepare all appropriate journal entries for Osiris on December 31, 2018, related to the lease (10 marks) Arial TTTT Paragraph %DOQE OS Mashup T 6 3 (12pt) E.E.T. T' T. -- Words "achip board x naining Time: 1 hour. 22 minutes. 02 seconds. estion Completion Status: 3 4 5 70 8 Moving another question will save this response. Question 3 of 8 Save Ar tion 3 20 points on January 1, 2018, Badriya Inc leased manufacturing equipment from Sara Leasing for a four-year period ending December 31, 2018 at which time possession of the leased asset will evert back to Sara. The equipment cost Sara 5236,400 and has an expected economic life of five years. Sara expects the residual value on December 31, 2018 to be $30.000 Negotiations led to Badriya guaranteeing a $45,000 residual value Equal payments under the lease are 560.000 and are due on December 31 of each year with the first payment being nade on December 31, 2018. Badriya is aware that Sara used a 5% interest rate when calculating lease payments Required: Round your answers to the nearest whole dollar amounts Prepare the appropriate journal entry for Osiris on January 1, 2018 to record the lease (10 marks) Prepare all appropriate journal entries for Osiris on December 31, 2018, related to the lease (10 marks) Arial TTTT Paragraph %DOQE OS Mashup T 6 3 (12pt) E.E.T. T' T. -- Words "achip