Question

Bob and Jack have formed a partnership and contributed a capital of 150,000$ and 250,000$ respectively (Total capital 400,000$). During their first year of

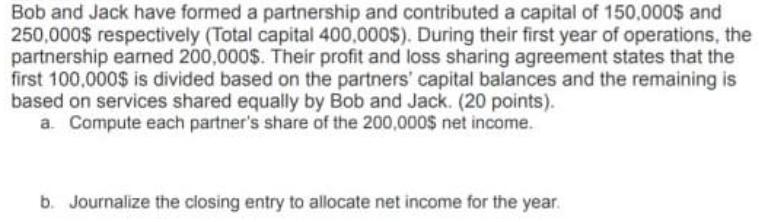

Bob and Jack have formed a partnership and contributed a capital of 150,000$ and 250,000$ respectively (Total capital 400,000$). During their first year of operations, the partnership earned 200,000$. Their profit and loss sharing agreement states that the first 100,000$ is divided based on the partners' capital balances and the remaining is based on services shared equally by Bob and Jack. (20 points). a. Compute each partner's share of the 200,000S net income. b. Journalize the closing entry to allocate net income for the year.

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Bob Jack Q2 First 100000 1525 37500 62500 100000x...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

IFRS edition volume 2

978-0470613474, 470613475, 978-0470616314

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App