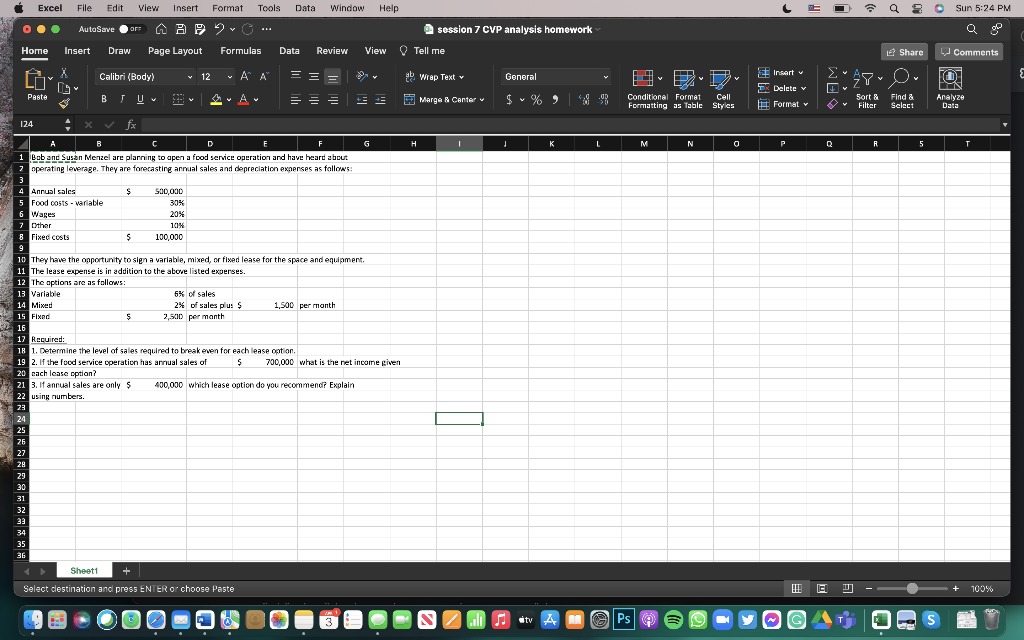

| Bob and Susan Menzel are planning to open a food service operation and have heard about |

| operating leverage. They are forecasting annual sales and depreciation expenses as follows: |

| | | | | | | |

| Annual sales | $ 500,000 | | | | |

| Food costs - variable | 30% | | | | |

| Wages | | 20% | | | | |

| Other | | 10% | | | | |

| Fixed costs | | $ 100,000 | | | | |

| | | | | | | |

| They have the opportunity to sign a variable, mixed, or fixed lease for the space and equipment. |

| The lease expense is in addition to the above listed expenses. | | |

| The options are as follows: | | | | |

| Variable | | 6% | of sales | | | |

| Mixed | | 2% | of sales plus | $ 1,500 | per month | |

| Fixed | | $ 2,500 | per month | | | |

| | | | | | | |

| Required: | | | | | | |

| 1. Determine the level of sales required to break even for each lease option. | | |

| 2. If the food service operation has annual sales of | $ 700,000 | what is the net income given |

| each lease option? | | | | | |

| 3. If annual sales are only | $ 400,000 | which lease option do you recommend? Explain |

| using numbers. | | | | | |

Excel File Edit View insert Format Tools Data Window Help a 2 Sun 5:24 PM AutoSave OF LI session 7 CVP analysis homework APO Page Layout Formulas Home Insert Draw Data Review View Tell me ? Share Comments Calibri (Body) 12 - A A = ab Wrap Text General = E y y O F Insert I Delete v Format Paste BTU A. = = = Marge & Carter $ % ) Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data 124 fx H 1 K M N 0 P R 5 A B C D E F G Bob and Susan Menzel are planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and depreciation expenses as follows: 3 4 Annual sales $ 500,000 5 Food costs - variable 30% 6 Wages 20% 3 Other 101 8 Fixed costs $ 100,000 9 10 They have the opportunity to sign a variable, mixed, or fixed lease for the space and equipment The lease expense is in addition to the above listed expenses. 12 The options are as follows: : 13 Variable 5% of sales 14 Mixed 2% of sales plu: $ 1,500 per month 15 Fixed s 2,500 per month 16 17 Recuired: 1. Determine the level of sales required to break even for each lease option 19 2. If the food service operation has annual sales of $ $ 700,000 what is the net income given 20 cach lease option? 21 3. If annual sales are only 5 400,000 which lease option do you recommend? Explain 22 using numbers. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Sheet1 Select destination and press ENTER or choose Paste IEI 100% A otv Am Ps e Excel File Edit View insert Format Tools Data Window Help a 2 Sun 5:24 PM AutoSave OF LI session 7 CVP analysis homework APO Page Layout Formulas Home Insert Draw Data Review View Tell me ? Share Comments Calibri (Body) 12 - A A = ab Wrap Text General = E y y O F Insert I Delete v Format Paste BTU A. = = = Marge & Carter $ % ) Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select Analyze Data 124 fx H 1 K M N 0 P R 5 A B C D E F G Bob and Susan Menzel are planning to open a food service operation and have heard about operating leverage. They are forecasting annual sales and depreciation expenses as follows: 3 4 Annual sales $ 500,000 5 Food costs - variable 30% 6 Wages 20% 3 Other 101 8 Fixed costs $ 100,000 9 10 They have the opportunity to sign a variable, mixed, or fixed lease for the space and equipment The lease expense is in addition to the above listed expenses. 12 The options are as follows: : 13 Variable 5% of sales 14 Mixed 2% of sales plu: $ 1,500 per month 15 Fixed s 2,500 per month 16 17 Recuired: 1. Determine the level of sales required to break even for each lease option 19 2. If the food service operation has annual sales of $ $ 700,000 what is the net income given 20 cach lease option? 21 3. If annual sales are only 5 400,000 which lease option do you recommend? Explain 22 using numbers. 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Sheet1 Select destination and press ENTER or choose Paste IEI 100% A otv Am Ps e