Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob borrows some money from Betty. Every 6 months for 2 years he will pay her coupons of $900, $1200, $800, and $300 in

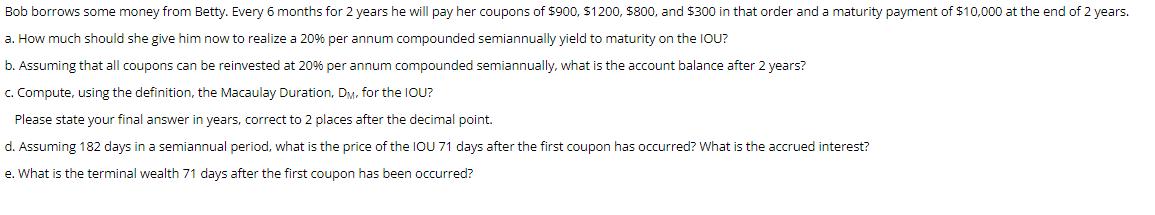

Bob borrows some money from Betty. Every 6 months for 2 years he will pay her coupons of $900, $1200, $800, and $300 in that order and a maturity payment of $10,000 at the end of 2 years. a. How much should she give him now to realize a 20% per annum compounded semiannually yield to maturity on the IOU? b. Assuming that all coupons can be reinvested at 20% per annum compounded semiannually, what is the account balance after 2 years? c. Compute, using the definition, the Macaulay Duration, DM, for the IOU? Please state your final answer in years, correct to 2 places after the decimal point. d. Assuming 182 days in a semiannual period, what is the price of the IOU 71 days after the first coupon has occurred? What is the accrued interest? e. What is the terminal wealth 71 days after the first coupon has been occurred?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the present value of the IOU to realize a 20 per annum compounded semiannually yield ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started