Question

Bob Burgers allocates manufacturing overhead to jobs based on machine hours. The company has the following estimated costs for the upcorming year Direct materials

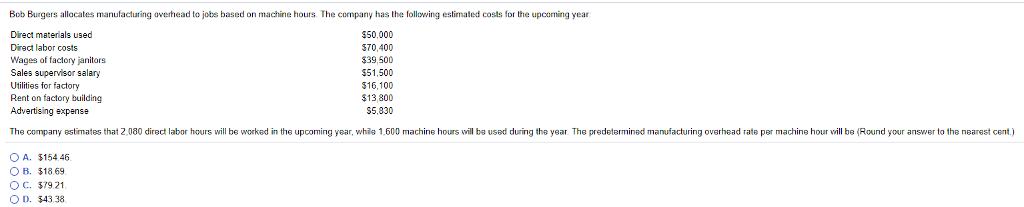

Bob Burgers allocates manufacturing overhead to jobs based on machine hours. The company has the following estimated costs for the upcorming year Direct materials used $50,000 Direct labor costs Wages of factory janitors Sales supervisor salary Utilities for factory Rent on factory building Advertising expense S70,400 $39,500 $51.500 $16,100 $13 800 $5,830 The company estimates that 2,080 direct labor hours will be worked in the upcoming year, whiis 1,600 machine hours will be used during tha year The predetermined manufacturing overhead rate per machine hour vill be (Round your answer to the nearest cent. O A. $154.46. O B. $18.69 OC. $7921. O D. $43 38

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option D 4338 predetermined manufacturing overhead rate pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App