Answered step by step

Verified Expert Solution

Question

1 Approved Answer

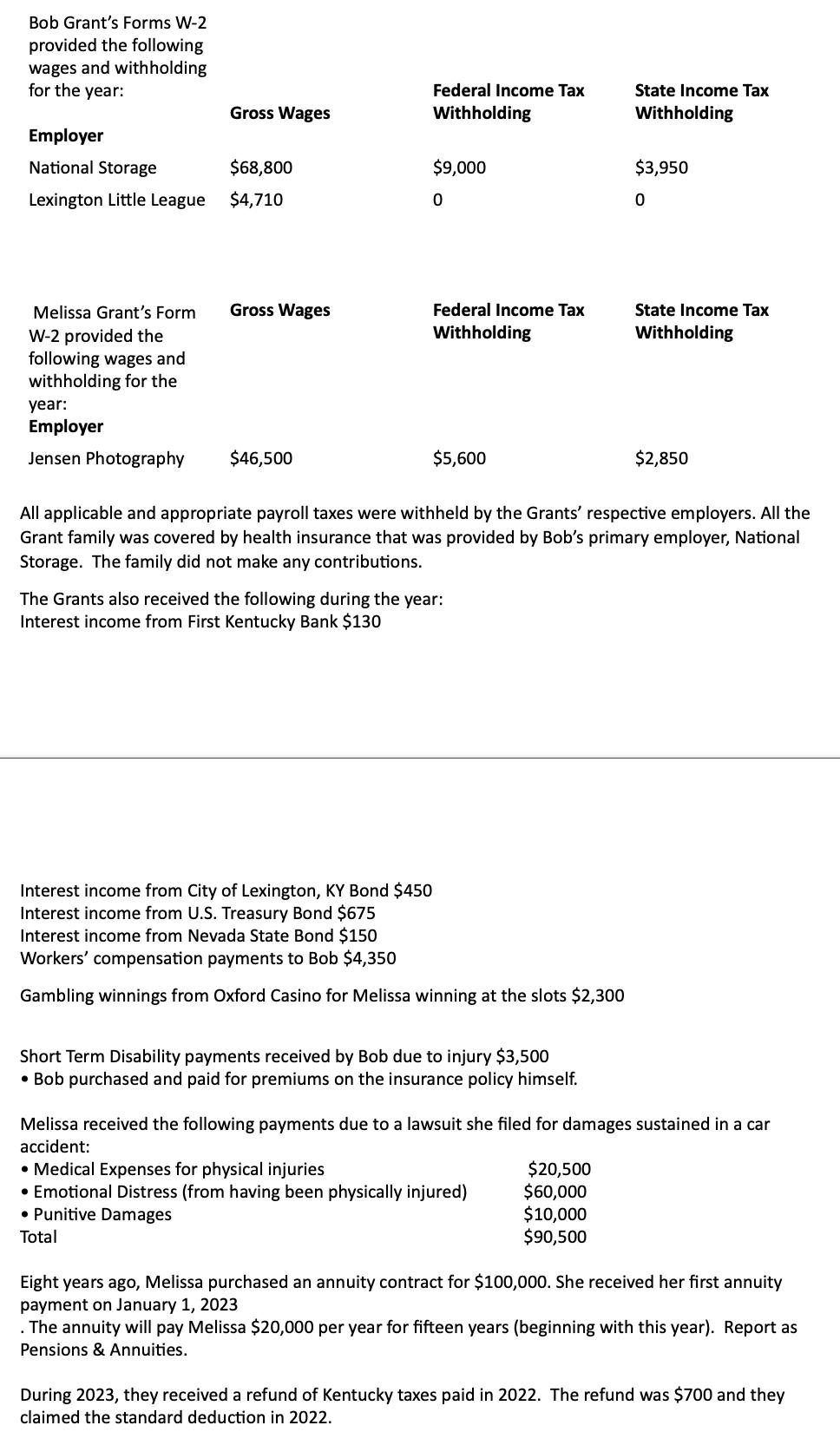

Bob Grant's Forms W-2 provided the following wages and withholding for the year: Gross Wages Federal Income Tax Withholding Employer National Storage $68,800 $9,000

Bob Grant's Forms W-2 provided the following wages and withholding for the year: Gross Wages Federal Income Tax Withholding Employer National Storage $68,800 $9,000 Lexington Little League $4,710 0 State Income Tax Withholding $3,950 0 Melissa Grant's Form Gross Wages W-2 provided the Federal Income Tax Withholding State Income Tax Withholding following wages and withholding for the year: Employer Jensen Photography $46,500 $5,600 $2,850 All applicable and appropriate payroll taxes were withheld by the Grants' respective employers. All the Grant family was covered by health insurance that was provided by Bob's primary employer, National Storage. The family did not make any contributions. The Grants also received the following during the year: Interest income from First Kentucky Bank $130 Interest income from City of Lexington, KY Bond $450 Interest income from U.S. Treasury Bond $675 Interest income from Nevada State Bond $150 Workers' compensation payments to Bob $4,350 Gambling winnings from Oxford Casino for Melissa winning at the slots $2,300 Short Term Disability payments received by Bob due to injury $3,500 Bob purchased and paid for premiums on the insurance policy himself. Melissa received the following payments due to a lawsuit she filed for damages sustained in a car accident: Medical Expenses for physical injuries $20,500 Emotional Distress (from having been physically injured) $60,000 Punitive Damages Total $10,000 $90,500 Eight years ago, Melissa purchased an annuity contract for $100,000. She received her first annuity payment on January 1, 2023 . The annuity will pay Melissa $20,000 per year for fifteen years (beginning with this year). Report as Pensions & Annuities. During 2023, they received a refund of Kentucky taxes paid in 2022. The refund was $700 and they claimed the standard deduction in 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started