Question: Bob is project manager for WrenMarts third-party distribution and logistics deal.WrenMarts estimated cost of capital, appropriate for this project, is 8.30% per year. The projects

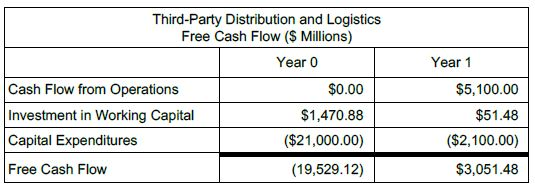

Bob is project manager for WrenMarts third-party distribution and logistics deal.WrenMarts estimated cost of capital, appropriate for this project, is 8.30% per year. The projects free cash flows are estimated as follows:

Thereafter, free cash flow is expected to grow at a rate of 3.50% per year.

Bob has asked for your help in computing the IRR of the project. Also, he would like your opinion on whether WrenMart should accept or reject the project.

Please include steps on how to manually calculate this. Thanks!

Third-Party Distribution and Logistics Free Cash Flow Millions) Year 0 $0.00 Cash Flow from Operations $1,470.88 Investment in Working Capital ($21,000.00) Capital Expenditures (19,529.12) Free Cash Flow Year 1 $5,100.00 $51.48 ($2,100.00) $3,051.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts