Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob Jenkins has come in to meet with you to discuss some possible refinancing options. So far for his debts you have collected the

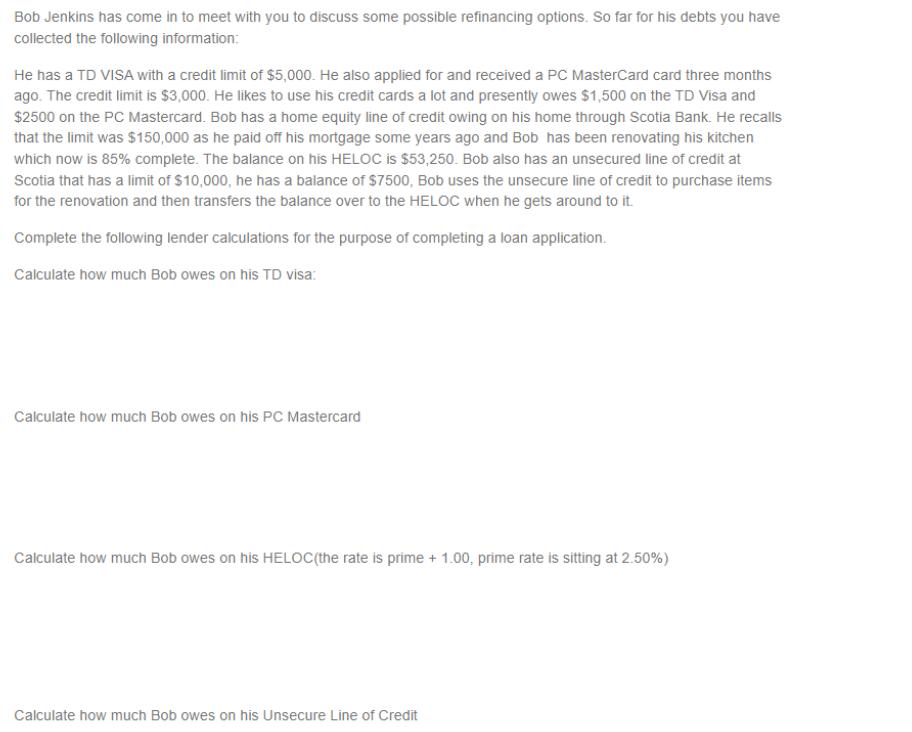

Bob Jenkins has come in to meet with you to discuss some possible refinancing options. So far for his debts you have collected the following information: He has a TD VISA with a credit limit of $5,000. He also applied for and received a PC MasterCard card three months ago. The credit limit is $3,000. He likes to use his credit cards a lot and presently owes $1,500 on the TD Visa and $2500 on the PC Mastercard. Bob has a home equity line of credit owing on his home through Scotia Bank. He recalls that the limit was $150,000 as he paid off his mortgage some years ago and Bob has been renovating his kitchen which now is 85% complete. The balance on his HELOC is $53,250. Bob also has an unsecured line of credit at Scotia that has a limit of $10,000, he has a balance of $7500, Bob uses the unsecure line of credit to purchase items for the renovation and then transfers the balance over to the HELOC when he gets around to it. Complete the following lender calculations for the purpose of completing a loan application. Calculate how much Bob owes on his TD visa: Calculate how much Bob owes on his PC Mastercard Calculate how much Bob owes on his HELOC (the rate is prime + 1.00, prime rate is sitting at 2.50%) Calculate how much Bob owes on his Unsecure Line of Credit

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 TD VISA Bob owes 1500 on his TD VISA 2 PC MasterCard Bob owes 2500 on his PC MasterCard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started