Question

RevHeads Ltd has a policy of adjusting the net book value of its non-current assets to fair value if the two values are significantly different.

RevHeads Ltd has a policy of adjusting the net book value of its non-current assets to fair value if the two values are significantly different. The only asset that required revaluing prior

to 1 July 2019 was land, which had been revalued upwards by $100 000.

The following selected account balances are taken from the general ledger of RevHeads Ltd on 1 July 2019.

DR CR

Land 500 000

Plant & Equipment 920 000

Accumulated depreciation - Plant & Equipment 320 000

Plant & Equipment is being depreciated on a straight-line basis over 10 years, with an expected residual value of $120 000.

The following events took place during the year ended 30 June 2020:

2019

1 July Purchased Motor Vehicles on credit for $140 000 plus $10 000 was paid in cash to cover transport costs and $1200 in cash for registration. Motor Vehicles are not expected to have a residual value.

2 July Paid $30 000 cash to modify the new vehicles so that they were suitable for business use. Reducing balance depreciation is to be charged at 20% per annum on motor vehicles

25 Oct Rev Head Ltd spent a total of $4 300 cash for maintenance and repairs on the motor vehicles. Fuel expense was paid $10 500.

2020

1 Jan Traded-in the existing plant and equipment for new plant and equipment costing $1 500 000. RevHead Ltd received a trade-in of $600 000 on the old plant and equipment. Loan for replacement plant and equipment financed by Honest Abe's Loan Company. The new plant and equipment is to be depreciated on a straight-line basis over 5 years with an expected residual value of $400 000.

30 June Calculate Depreciation Charge for Motor Vehicles and for Plant and Equipment

30 June After assessing the fair values of the non-current assets of the business land needs to be revalued to a fair value of $920 000.

Required

a Prepare entries in general journal form to record the events described above.

b Identify when a valuation of Property Plant & Equipment is sent to the Asset Revaluation Surplus account, and explain why.

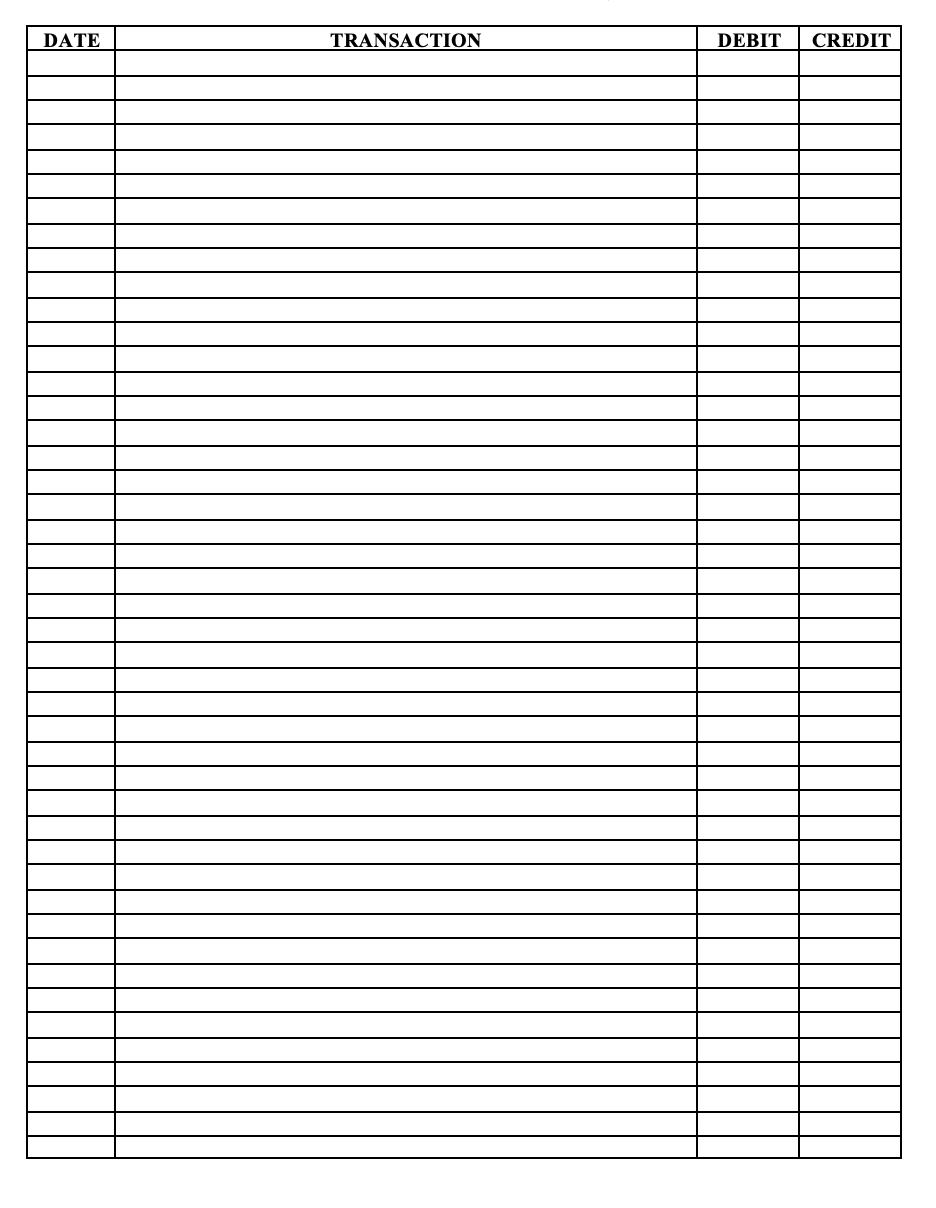

DATE TRANSACTION DEBIT CREDIT

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare entries in general journal form to record the events described above 1 July 1 2019 Land DR 100000 Revaluation Surplus CR 100000 To record th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started