Question

Bob Jensen Incorporated purchased a $1,050,000 machine to manufacture specialty taps for electrical equipment. Jensen expects to sell all it can manufacture in the next

Bob Jensen Incorporated purchased a $1,050,000 machine to manufacture specialty taps for electrical equipment. Jensen expects to sell all it can manufacture in the next 10 years. The machine is expected to have a 10-year useful life with no salvage value. Jensen uses straight-line depreciation. The net cash inflow is expected to be $242,000 each year for 10 years. Jensen uses a 12% discount rate in evaluating capital investments. Assume, for simplicity, that MACRS depreciation rules do not apply.

Required:

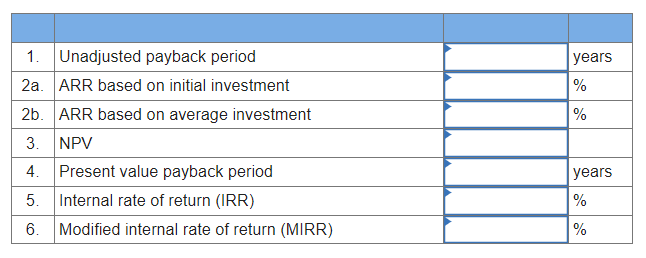

Using Excel (including built-in functions for NPV, IRR, and MIRR), compute the following for the above-referenced investment:

1. The payback period, under the assumption that cash inflows occur evenly throughout the year. (Do not round intermediate calculations. Round your final answer to 1 decimal place.)

2. The accounting (book) rate of return based on (a) initial investment, and (b) average investment. (Round your final answers to 1 decimal place (i.e. 0.123 = 12.3%).)

3. The net present value (NPV) of the proposed investment under the assumption that cash inflows occur at year-end. (Do not round intermediate calculations. Round your final answer to nearest whole dollar amount.)

4. The present value payback period, in years, of the proposed investment under the assumption that cash inflows occur evenly throughout the year. (Note: because of this assumption, the present value calculations will be approximate, not exact.) To calculate present value amounts, use the appropriate factors from Appendix C, Table 1. (Do not round intermediate calculations. Round your final answer to 1 decimal place.)

5. The internal rate of return (IRR). (Do not round intermediate calculations. Round your final answer to 1 decimal place (i.e. 0.123 = 12.3%).)

6. The modified internal rate of return (MIRR). (Do not round intermediate calculations. Round your final answer to 1 decimal place (i.e. 0.123 = 12.3%).) (In conjunction with this requirement, you might want to consult either of the following two references: MIRR Function and/or IRR in Excel.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started