Question

Bob just turned 25 and wants to retire at age 65 with $40,000 per month in retirement income. Bob estimates he can earn 11%

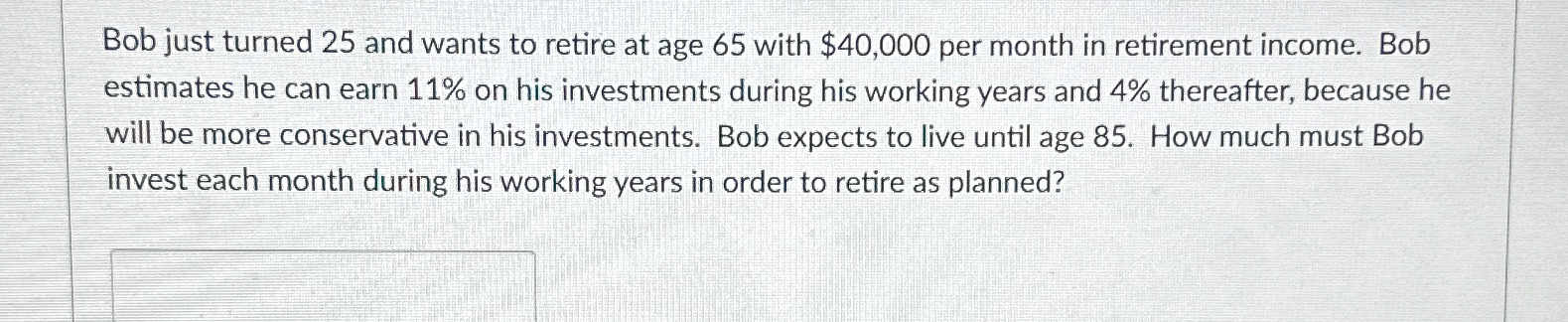

Bob just turned 25 and wants to retire at age 65 with $40,000 per month in retirement income. Bob estimates he can earn 11% on his investments during his working years and 4% thereafter, because he will be more conservative in his investments. Bob expects to live until age 85. How much must Bob invest each month during his working years in order to retire as planned?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount Bob must invest each month during his working years to retire as planned wel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: Philip J. Adelman; Alan M. Marks

6th edition

9780133099096, 133140512, 133099091, 978-0133140514

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App