Answered step by step

Verified Expert Solution

Question

1 Approved Answer

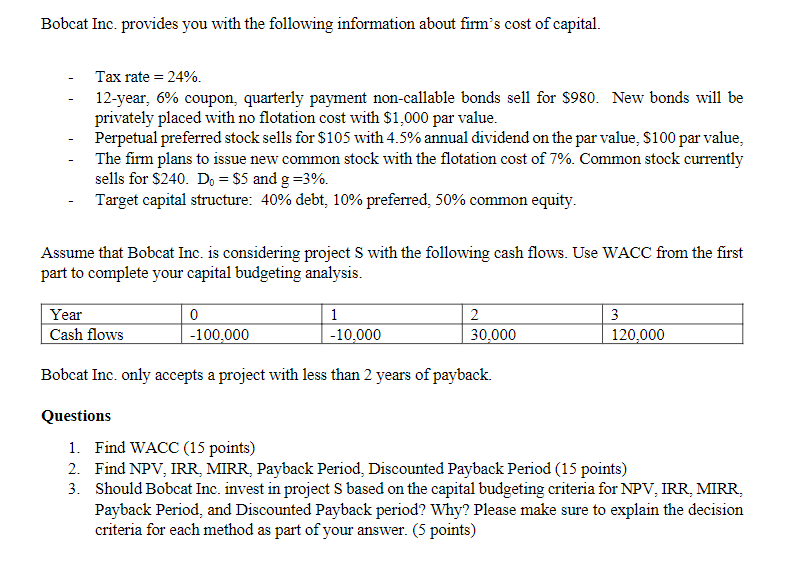

Bobcat Inc. provides you with the following information about firm's cost of capital. Tax rate = 2 4 % . 1 2 - year, 6

Bobcat Inc. provides you with the following information about firm's cost of capital.

Tax rate

year, coupon, quarterly payment noncallable bonds sell for $ New bonds will be

privately placed with no flotation cost with $ par value.

Perpetual preferred stock sells for $ with annual dividend on the par value, $ par value,

The firm plans to issue new common stock with the flotation cost of Common stock currently

sells for $$ and

Target capital structure: debt, preferred, common equity.

Assume that Bobcat Inc. is considering project with the following cash flows. Use WACC from the first

part to complete your capital budgeting analysis.

Bobcat Inc. only accepts a project with less than years of payback.

Questions

Find WACC points

Find NPV IRR, MIRR, Payback Period, Discounted Payback Period points

Should Bobcat Inc. invest in project based on the capital budgeting criteria for NPV IRR, MIRR,

Payback Period, and Discounted Payback period? Why? Please make sure to explain the decision

criteria for each method as part of your answer. points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started