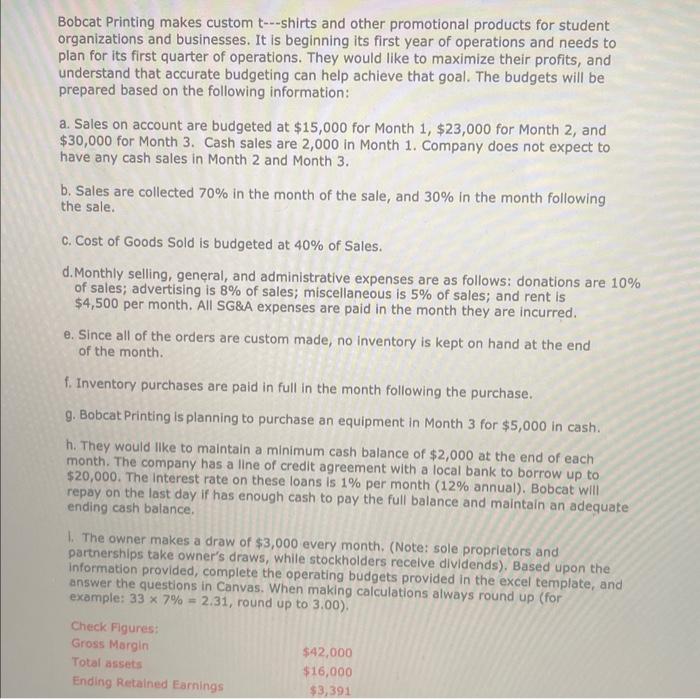

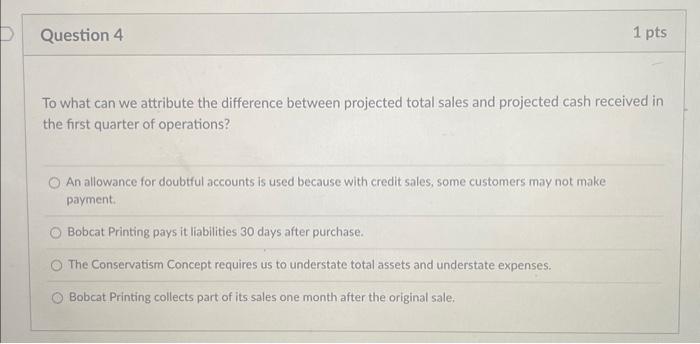

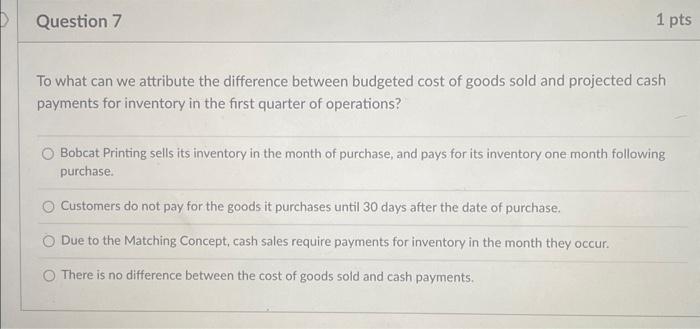

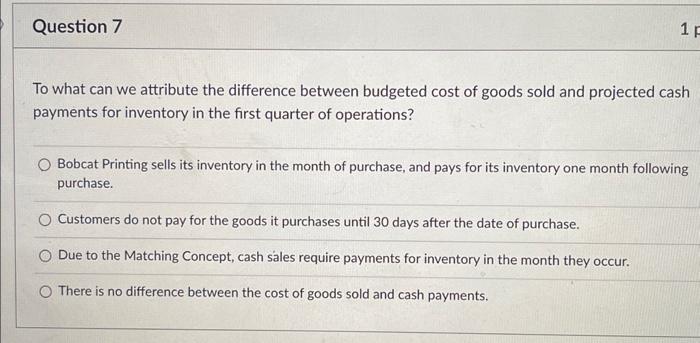

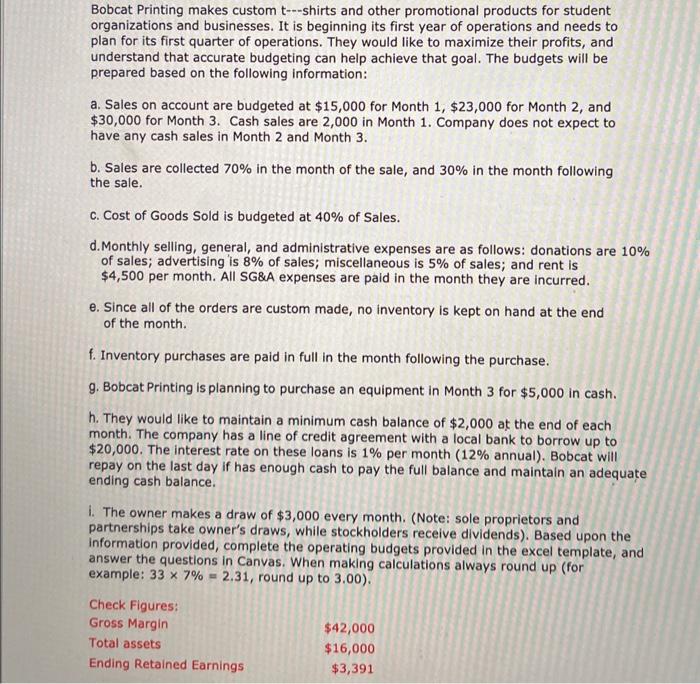

Bobcat Printing makes custom t---shirts and other promotional products for student organizations and businesses. It is beginning its first year of operations and needs to plan for its first quarter of operations. They would like to maximize their profits, and understand that accurate budgeting can help achieve that goal. The budgets will be prepared based on the following information: a. Sales on account are budgeted at $15,000 for Month 1, $23,000 for Month 2, and $30,000 for Month 3. Cash sales are 2,000 in Month 1. Company does not expect to have any cash sales in Month 2 and Month 3. b. Sales are collected 70% in the month of the sale, and 30% in the month following the sale. c. Cost of Goods Sold is budgeted at 40% of Sales. d. Monthly selling, general, and administrative expenses are as follows: donations are 10% of sales; advertising is 8% of sales; miscellaneous is 5% of sales; and rent is $4,500 per month. All SG\&A expenses are paid in the month they are incurred. e. Since all of the orders are custom made, no inventory is kept on hand at the end of the month. f. Inventory purchases are paid in full in the month following the purchase. 9. Bobcat Printing is planning to purchase an equipment in Month 3 for $5,000 in cash. h. They would Ilke to maintain a minimum cash balance of $2,000 at the end of each month. The company has a line of credit agreement with a local bank to borrow up to $20,000. The interest rate on these loans is 1% per month ( 12% annual). Bobcat wilI repay on the last day if has enough cash to pay the full balance and maintain an adequate 1. The owner makes a draw of $3,000 every month. (Note: sole proprietors and partnerships take owner's draws, while stockholders recelve dividends). Based upon the information provided, complete the operating budgets provided in the excel template, and answer the questions in Canvas. When making calculations always round up (for example: 337%=2.31, round up to 3.00 ). To what can we attribute the difference between projected total sales and projected cash received in the first quarter of operations? An allowance for doubtful accounts is used because with credit sales, some customers may not make payment. Bobcat Printing pays it liabilities 30 days after purchase. The Conservatism Concept requires us to understate total assets and understate expenses. Bobcat Printing collects part of its sales one month after the original sale. To what can we attribute the difference between budgeted cost of goods sold and projected cash payments for inventory in the first quarter of operations? Bobcat Printing sells its inventory in the month of purchase, and pays for its inventory one month following purchase. Customers do not pay for the goods it purchases until 30 days after the date of purchase. Due to the Matching Concept, cash sales require payments for inventory in the month they occur. There is no difference between the cost of goods sold and cash payments. To what can we attribute the difference between projected total sales and projected cash received in the first quarter of operations? An allowance for doubtful accounts is used because with credit sales, some customers may not make payment. Bobcat Printing pays it liabilities 30 days after purchase. The Conservatism Concept requires us to understate total assets and understate expenses. Bobcat Printing collects part of its sales one month after the original sale. To what can we attribute the difference between budgeted cost of goods sold and projected cash payments for inventory in the first quarter of operations? Bobcat Printing sells its inventory in the month of purchase, and pays for its inventory one month following purchase. Customers do not pay for the goods it purchases until 30 days after the date of purchase. Due to the Matching Concept, cash sales require payments for inventory in the month they occur. There is no difference between the cost of goods sold and cash payments. Bobcat Printing makes custom t---shirts and other promotional products for student organizations and businesses. It is beginning its first year of operations and needs to plan for its first quarter of operations. They would like to maximize their profits, and understand that accurate budgeting can help achieve that goal. The budgets will be prepared based on the following information: a. Sales on account are budgeted at $15,000 for Month 1, $23,000 for Month 2, and $30,000 for Month 3. Cash sales are 2,000 in Month 1 . Company does not expect to have any cash sales in Month 2 and Month 3. b. Sales are collected 70% in the month of the sale, and 30% in the month following the sale. c. Cost of Goods Sold is budgeted at 40% of Sales. d. Monthly selling, general, and administrative expenses are as follows: donations are 10% of sales; advertising is 8% of sales; miscellaneous is 5% of sales; and rent is $4,500 per month. All SG\&A expenses are paid in the month they are incurred. e. Since all of the orders are custom made, no inventory is kept on hand at the end of the month. f. Inventory purchases are paid in full in the month following the purchase. g. Bobcat Printing is planning to purchase an equipment in Month 3 for $5,000 in cash. h. They would like to maintain a minimum cash balance of $2,000 at the end of each month. The company has a line of credit agreement with a local bank to borrow up to $20,000. The interest rate on these loans is 1% per month ( 12% annual). Bobcat will repay on the last day if has enough cash to pay the full balance and maintain an adequate ending cash balance. i. The owner makes a draw of $3,000 every month. (Note: sole proprietors and partnerships take owner's draws, while stockholders receive dividends). Based upon the information provided, complete the operating budgets provided in the excel template, and answer the questions in Canvas. When making calculations always round up (for example: 337%=2.31, round up to 3.00 )