Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BOBO Limited purchased a machine on 1 January 2019 at $500,000. It has an expected useful life of 5 years and an estimated salvage

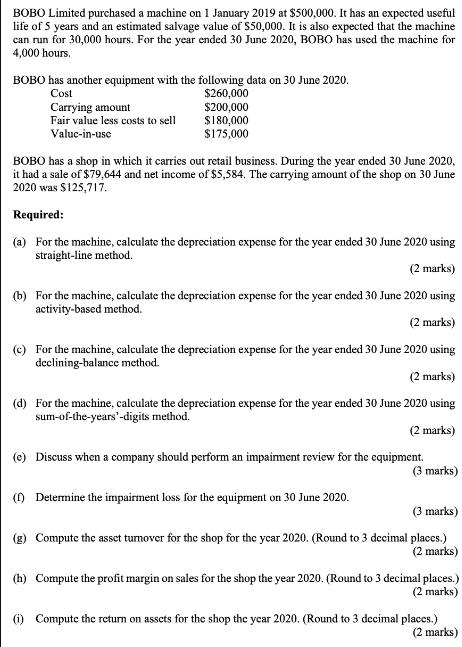

BOBO Limited purchased a machine on 1 January 2019 at $500,000. It has an expected useful life of 5 years and an estimated salvage value of $50,000. It is also expected that the machine can run for 30,000 hours. For the year ended 30 June 2020, BOBO has used the machine for 4,000 hours. BOBO has another equipment with the following data on 30 June 2020. $260,000 $200,000 $180,000 $175,000 Cost Carrying amount Fair value less costs to sell Valuc-in-use BOBO has a shop in which it carries out retail business. During the year ended 30 June 2020, it had a sale of $79,644 and net income of $5,584. The carrying amount of the shop on 30 June 2020 was $125,717. Required: (a) For the machine, calculate the depreciation expense for the year ended 30 June 2020 using straight-line method. (2 marks) (b) For the machine, calculate the depreciation expense for the year ended 30 June 2020 using activity-based method. (2 marks) (c) For the machine, calculate the depreciation expense for the year ended 30 June 2020 using declining-balance method. (2 marks) (d) For the machine, calculate the depreciation expense for the year ended 30 June 2020 using sum-of-the-years'-digits method. (2 marks) (e) Discuss when a company should perform an impaiment review for the cquipment. (3 marks) () Determine the impairment loss for the equipment on 30 June 2020. (3 marks) (g) Compute the asset turnover for the shop for the year 2020. (Round to 3 decimal places.) (2 marks) (h) Compute the profit margin on sales for the shop the year 2020. (Round to 3 decimal places.) (2 marks) (i) Compute the return on assets for the shop the year 2020. (Round to 3 decimal places.) (2 marks)

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started