Answered step by step

Verified Expert Solution

Question

1 Approved Answer

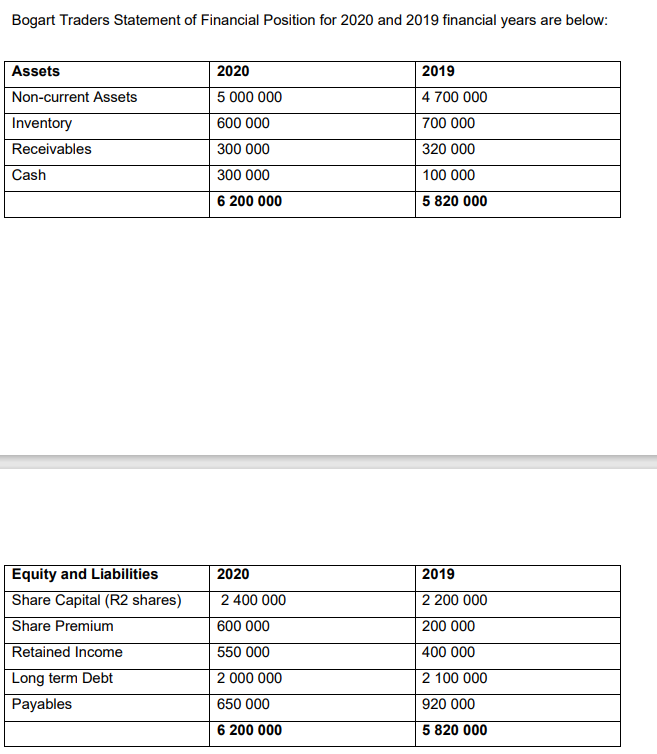

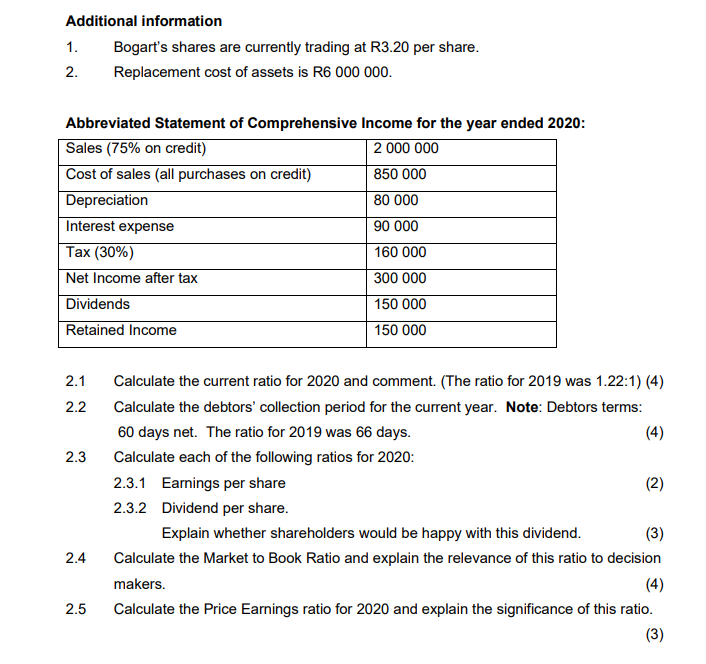

Bogart Traders Statement of Financial Position for 2020 and 2019 financial years are below: Additional information 1. Bogart's shares are currently trading at R3.20 per

Bogart Traders Statement of Financial Position for 2020 and 2019 financial years are below: Additional information 1. Bogart's shares are currently trading at R3.20 per share. 2. Replacement cost of assets is R6000000. Abbreviated Statement of Comprehensive Income for the year ended 2020: 2.1 Calculate the current ratio for 2020 and comment. (The ratio for 2019 was 1.22:1 ) (4) 2.2 Calculate the debtors' collection period for the current year. Note: Debtors terms: 60 days net. The ratio for 2019 was 66 days. 2.3 Calculate each of the following ratios for 2020 : 2.3.1 Earnings per share 2.3.2 Dividend per share. Explain whether shareholders would be happy with this dividend. 2.4 Calculate the Market to Book Ratio and explain the relevance of this ratio to decision makers. 2.5 Calculate the Price Earnings ratio for 2020 and explain the significance of this ratio. (3)

Bogart Traders Statement of Financial Position for 2020 and 2019 financial years are below: Additional information 1. Bogart's shares are currently trading at R3.20 per share. 2. Replacement cost of assets is R6000000. Abbreviated Statement of Comprehensive Income for the year ended 2020: 2.1 Calculate the current ratio for 2020 and comment. (The ratio for 2019 was 1.22:1 ) (4) 2.2 Calculate the debtors' collection period for the current year. Note: Debtors terms: 60 days net. The ratio for 2019 was 66 days. 2.3 Calculate each of the following ratios for 2020 : 2.3.1 Earnings per share 2.3.2 Dividend per share. Explain whether shareholders would be happy with this dividend. 2.4 Calculate the Market to Book Ratio and explain the relevance of this ratio to decision makers. 2.5 Calculate the Price Earnings ratio for 2020 and explain the significance of this ratio. (3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started