Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bohemia Industries By Smith and Jones (updated in 2014 by Martin Quinn) At the beginning of September, Paul Owen, the new manager of a division

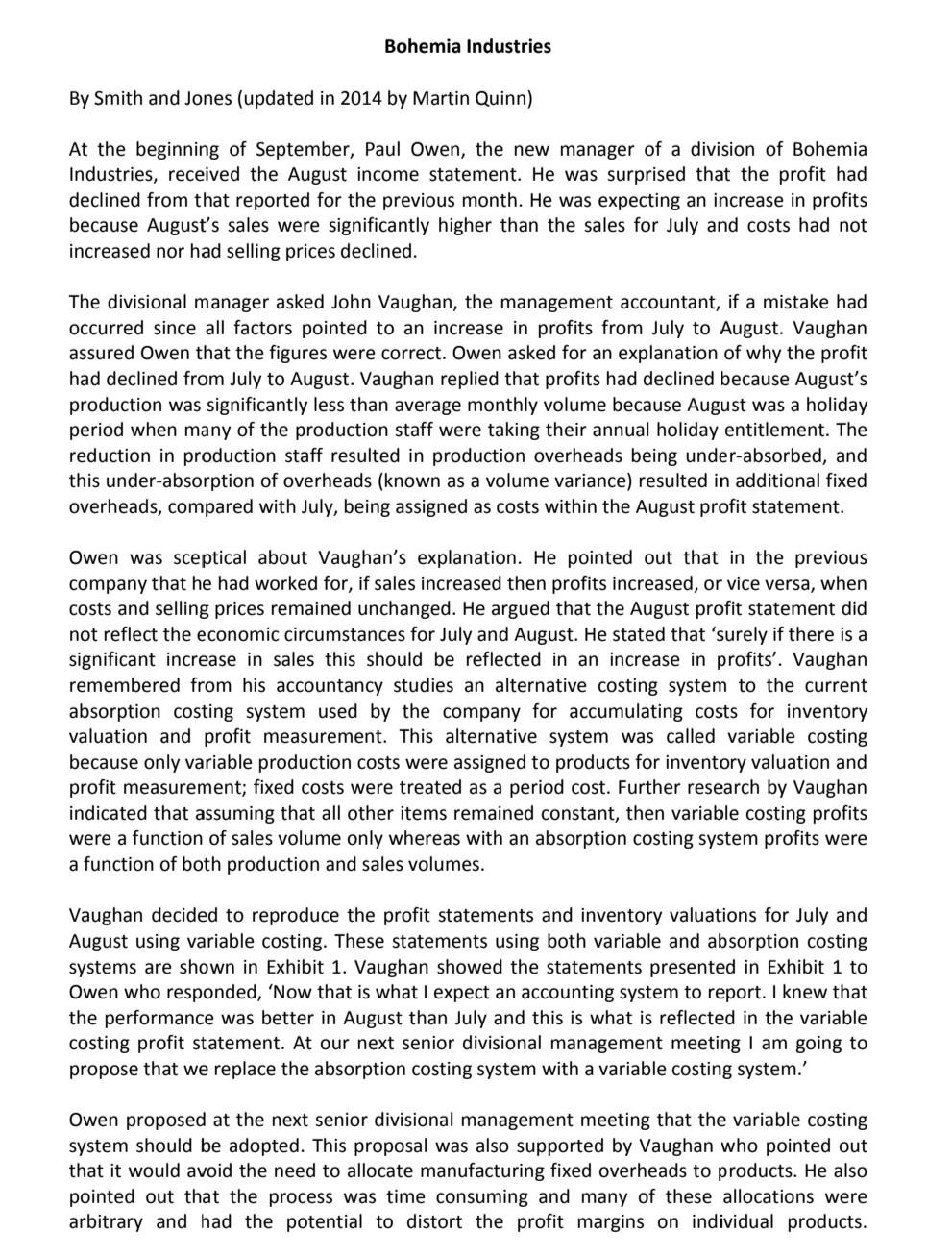

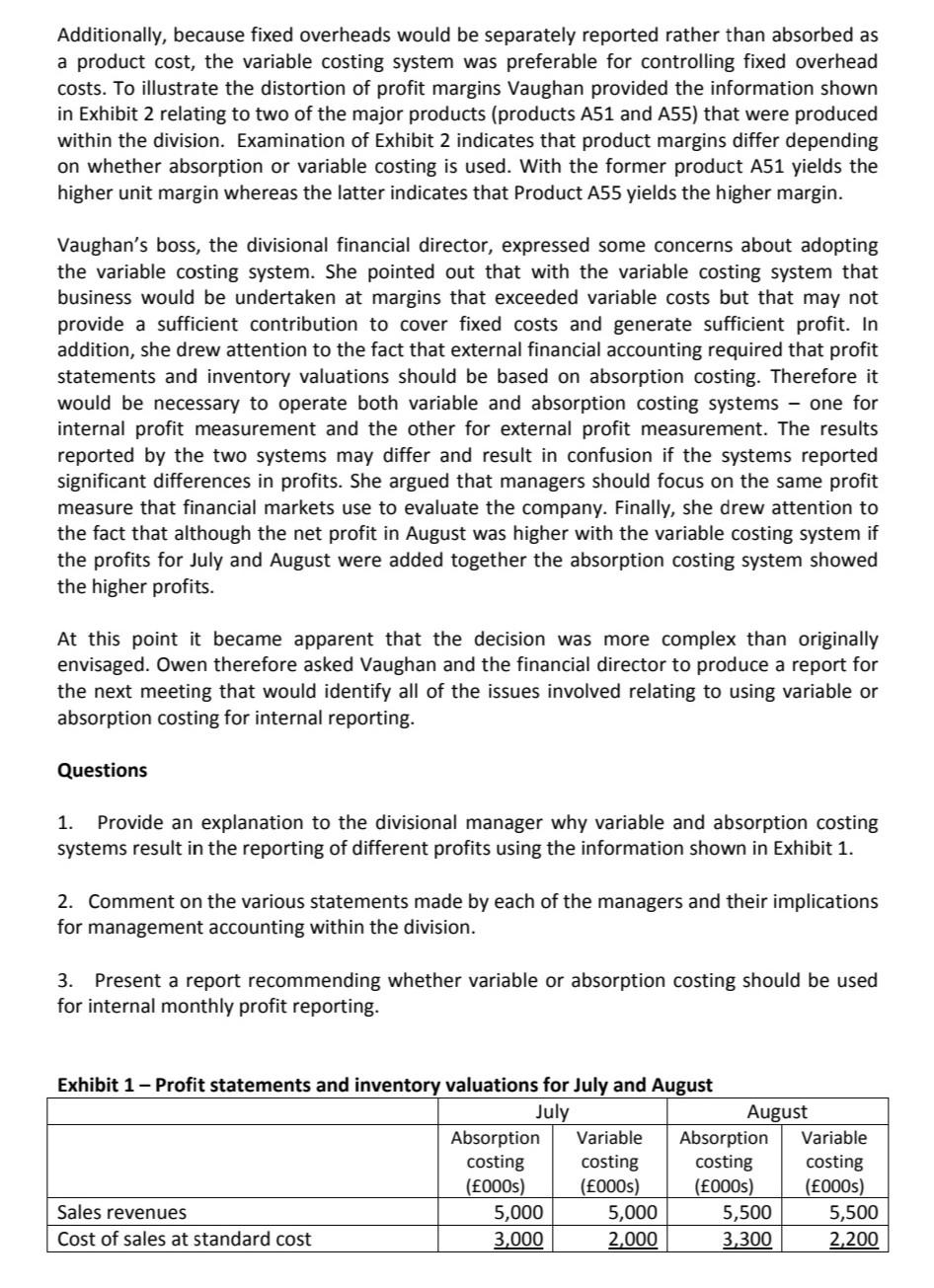

Bohemia Industries By Smith and Jones (updated in 2014 by Martin Quinn) At the beginning of September, Paul Owen, the new manager of a division of Bohemia Industries, received the August income statement. He was surprised that the profit had declined from that reported for the previous month. He was expecting an increase in profits because August's sales were significantly higher than the sales for July and costs had not increased nor had selling prices declined. The divisional manager asked John Vaughan, the management accountant, if a mistake had occurred since all factors pointed to an increase in profits from July to August. Vaughan assured Owen that the figures were correct. Owen asked for an explanation of why the profit had declined from July to August. Vaughan replied that profits had declined because August's production was significantly less than average monthly volume because August was a holiday period when many of the production staff were taking their annual holiday entitlement. The reduction in production staff resulted in production overheads being under-absorbed, and this under-absorption of overheads (known as a volume variance) resulted in additional fixed overheads, compared with July, being assigned as costs within the August profit statement. Owen was sceptical about Vaughan's explanation. He pointed out that in the previous company that he had worked for, if sales increased then profits increased, or vice versa, when costs and selling prices remained unchanged. He argued that the August profit statement did not reflect the economic circumstances for July and August. He stated that 'surely if there is a significant increase in sales this should be reflected in an increase in profits'. Vaughan remembered from his accountancy studies an alternative costing system to the current absorption costing system used by the company for accumulating costs for inventory valuation and profit measurement. This alternative system was called variable costing because only variable production costs were assigned to products for inventory valuation and profit measurement; fixed costs were treated as a period cost. Further research by Vaughan indicated that assuming that all other items remained constant, then variable costing profits were a function of sales volume only whereas with an absorption costing system profits were a function of both production and sales volumes. Vaughan decided to reproduce the profit statements and inventory valuations for July and August using variable costing. These statements using both variable and absorption costing systems are shown in Exhibit 1. Vaughan showed the statements presented in Exhibit 1 to Owen who responded, 'Now that is what I expect an accounting system to report. I knew that the performance was better in August than July and this is what is reflected in the variable costing profit statement. At our next senior divisional management meeting I am going to propose that we replace the absorption costing system with a variable costing system.' Owen proposed at the next senior divisional management meeting that the variable costing system should be adopted. This proposal was also supported by Vaughan who pointed out that it would avoid the need to allocate manufacturing fixed overheads to products. He also pointed out that the process was time consuming and many of these allocations were arbitrary and had the potential to distort the profit margins on individual products. Additionally, because fixed overheads would be separately reported rather than absorbed as a product cost, the variable costing system was preferable for controlling fixed overhead costs. To illustrate the distortion of profit margins Vaughan provided the information shown in Exhibit 2 relating to two of the major products (products A51 and A55) that were produced within the division. Examination of Exhibit 2 indicates that product margins differ depending on whether absorption or variable costing is used. With the former product A51 yields the higher unit margin whereas the latter indicates that Product A55 yields the higher margin. Vaughan's boss, the divisional financial director, expressed some concerns about adopting the variable costing system. She pointed out that with the variable costing system that business would be undertaken at margins that exceeded variable costs but that may not provide a sufficient contribution to cover fixed costs and generate sufficient profit. In addition, she drew attention to the fact that external financial accounting required that profit statements and inventory valuations should be based on absorption costing. Therefore it would be necessary to operate both variable and absorption costing systems - one for internal profit measurement and the other for external profit measurement. The results reported by the two systems may differ and result in confusion if the systems reported significant differences in profits. She argued that managers should focus on the same profit measure that financial markets use to evaluate the company. Finally, she drew attention to the fact that although the net profit in August was higher with the variable costing system if the profits for July and August were added together the absorption costing system showed the higher profits. At this point it became apparent that the decision was more complex than originally envisaged. Owen therefore asked Vaughan and the financial director to produce a report for the next meeting that would identify all of the issues involved relating to using variable or absorption costing for internal reporting. Questions 1. Provide an explanation to the divisional manager why variable and absorption costing systems result in the reporting of different profits using the information shown in Exhibit 1. 2. Comment on the various statements made by each of the managers and their implications for management accounting within the division. 3. Present a report recommending whether variable or absorption costing should be used for internal monthly profit reporting. Exhibit 1 - Profit statements and inventory valuations for July and August July August Absorption Variable Absorption Variable costing costing costing costing (000s) (000s) (000s) (000s) Sales revenues 5,000 5,000 5,500 5,500 Cost of sales at standard cost 3,000 2,000 3,300 2,200 2,000 3,000 2,200 3,300 Standard gross margin Under-/(over-)absorption of fixed production overheads (volume variance) Actual gross margin Fixed production overhead Non-manufacturing overheads Profit before taxes (10) 2,010 300 1,900 3,000 1,200 1,600 3,300 1,200 1,600 500 1,600 410 1,600 300 200 Inventory valuation 6,300 4,200 5,700 3,800 Note The remaining variances are insignificant and can be ignored for the case analysis and discussion. Exhibit 2 - Unit profit/contribution margins for products A51 and A55 Absorption costing Variable costing Product Product Product Product A51 () A55 () A51 () A55 () Selling price 500 550 500 550 Standard absorption/variable cost 320 538 225 240 Unit profit/contribution margin 180 165 275 310 Bohemia Industries By Smith and Jones (updated in 2014 by Martin Quinn) At the beginning of September, Paul Owen, the new manager of a division of Bohemia Industries, received the August income statement. He was surprised that the profit had declined from that reported for the previous month. He was expecting an increase in profits because August's sales were significantly higher than the sales for July and costs had not increased nor had selling prices declined. The divisional manager asked John Vaughan, the management accountant, if a mistake had occurred since all factors pointed to an increase in profits from July to August. Vaughan assured Owen that the figures were correct. Owen asked for an explanation of why the profit had declined from July to August. Vaughan replied that profits had declined because August's production was significantly less than average monthly volume because August was a holiday period when many of the production staff were taking their annual holiday entitlement. The reduction in production staff resulted in production overheads being under-absorbed, and this under-absorption of overheads (known as a volume variance) resulted in additional fixed overheads, compared with July, being assigned as costs within the August profit statement. Owen was sceptical about Vaughan's explanation. He pointed out that in the previous company that he had worked for, if sales increased then profits increased, or vice versa, when costs and selling prices remained unchanged. He argued that the August profit statement did not reflect the economic circumstances for July and August. He stated that 'surely if there is a significant increase in sales this should be reflected in an increase in profits'. Vaughan remembered from his accountancy studies an alternative costing system to the current absorption costing system used by the company for accumulating costs for inventory valuation and profit measurement. This alternative system was called variable costing because only variable production costs were assigned to products for inventory valuation and profit measurement; fixed costs were treated as a period cost. Further research by Vaughan indicated that assuming that all other items remained constant, then variable costing profits were a function of sales volume only whereas with an absorption costing system profits were a function of both production and sales volumes. Vaughan decided to reproduce the profit statements and inventory valuations for July and August using variable costing. These statements using both variable and absorption costing systems are shown in Exhibit 1. Vaughan showed the statements presented in Exhibit 1 to Owen who responded, 'Now that is what I expect an accounting system to report. I knew that the performance was better in August than July and this is what is reflected in the variable costing profit statement. At our next senior divisional management meeting I am going to propose that we replace the absorption costing system with a variable costing system.' Owen proposed at the next senior divisional management meeting that the variable costing system should be adopted. This proposal was also supported by Vaughan who pointed out that it would avoid the need to allocate manufacturing fixed overheads to products. He also pointed out that the process was time consuming and many of these allocations were arbitrary and had the potential to distort the profit margins on individual products. Additionally, because fixed overheads would be separately reported rather than absorbed as a product cost, the variable costing system was preferable for controlling fixed overhead costs. To illustrate the distortion of profit margins Vaughan provided the information shown in Exhibit 2 relating to two of the major products (products A51 and A55) that were produced within the division. Examination of Exhibit 2 indicates that product margins differ depending on whether absorption or variable costing is used. With the former product A51 yields the higher unit margin whereas the latter indicates that Product A55 yields the higher margin. Vaughan's boss, the divisional financial director, expressed some concerns about adopting the variable costing system. She pointed out that with the variable costing system that business would be undertaken at margins that exceeded variable costs but that may not provide a sufficient contribution to cover fixed costs and generate sufficient profit. In addition, she drew attention to the fact that external financial accounting required that profit statements and inventory valuations should be based on absorption costing. Therefore it would be necessary to operate both variable and absorption costing systems - one for internal profit measurement and the other for external profit measurement. The results reported by the two systems may differ and result in confusion if the systems reported significant differences in profits. She argued that managers should focus on the same profit measure that financial markets use to evaluate the company. Finally, she drew attention to the fact that although the net profit in August was higher with the variable costing system if the profits for July and August were added together the absorption costing system showed the higher profits. At this point it became apparent that the decision was more complex than originally envisaged. Owen therefore asked Vaughan and the financial director to produce a report for the next meeting that would identify all of the issues involved relating to using variable or absorption costing for internal reporting. Questions 1. Provide an explanation to the divisional manager why variable and absorption costing systems result in the reporting of different profits using the information shown in Exhibit 1. 2. Comment on the various statements made by each of the managers and their implications for management accounting within the division. 3. Present a report recommending whether variable or absorption costing should be used for internal monthly profit reporting. Exhibit 1 - Profit statements and inventory valuations for July and August July August Absorption Variable Absorption Variable costing costing costing costing (000s) (000s) (000s) (000s) Sales revenues 5,000 5,000 5,500 5,500 Cost of sales at standard cost 3,000 2,000 3,300 2,200 2,000 3,000 2,200 3,300 Standard gross margin Under-/(over-)absorption of fixed production overheads (volume variance) Actual gross margin Fixed production overhead Non-manufacturing overheads Profit before taxes (10) 2,010 300 1,900 3,000 1,200 1,600 3,300 1,200 1,600 500 1,600 410 1,600 300 200 Inventory valuation 6,300 4,200 5,700 3,800 Note The remaining variances are insignificant and can be ignored for the case analysis and discussion. Exhibit 2 - Unit profit/contribution margins for products A51 and A55 Absorption costing Variable costing Product Product Product Product A51 () A55 () A51 () A55 () Selling price 500 550 500 550 Standard absorption/variable cost 320 538 225 240 Unit profit/contribution margin 180 165 275 310

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started