Answered step by step

Verified Expert Solution

Question

1 Approved Answer

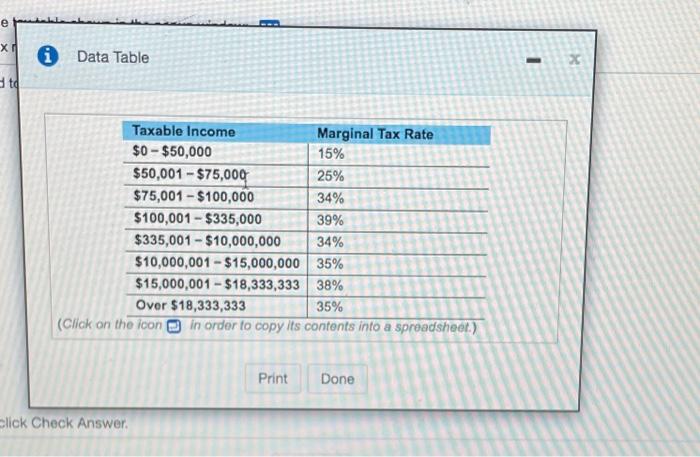

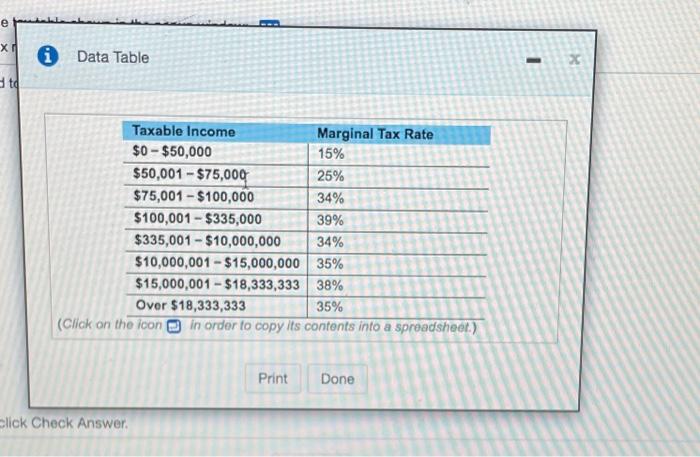

Boisjoly Productions had taxable income of $19.9 million. a. Calculate Boisjoly federal income taxes using the tax table shown. b. Now calculate Boisjoly average and

Boisjoly Productions had taxable income of $19.9 million.

(Corporate income tax) Boscy Productions had two income of $19.9 milion Calculate Bolly's federal income using the taxat shows in the pope window b. Now we see and montar Dita Tatie The time toxiability for the year is round the manust take Taxable Margin Tee 195.000 1996 550,001 - 575.000 205 $75,001 - $100.000 349 31000-30.000 3335.001 - 10.000,00 343 510,000.00 - 18.000.00035 115.00-110.333.333 Over 1, 34 Coordo com a Done Enter your answer in the box and then clice Chack Answer Corporate income tax Boy Prehadiron 519 Culote Bolsas e income taxes are not be shown in the powindow 1. Nicolae Bowls avenge and marginata a Them's tax bity for the year is Round to the rearest 0 Data Tatie Tablecom Margin Text $0-$50.000 350.001-ST.000 25 15.01 - 5100,00 10 $100.001-5315.000 395 $335.001 - 510.000.000 $10.000,001 - $15.000.000 $15.000,001 - 3331331 Over 1.333.300 P Done e xd 0 Data Table X sto Taxable income Marginal Tax Rate $0 - $50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.) Print Done Slick Check a. Calculate Boisjoly federal income taxes using the tax table shown.

b. Now calculate Boisjoly average and marginal tax rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started