Answered step by step

Verified Expert Solution

Question

1 Approved Answer

bolde Ltd owns all the share capital of Annabelle Ltd. The income tax rate n 304, and all income on sale of assets is tazable

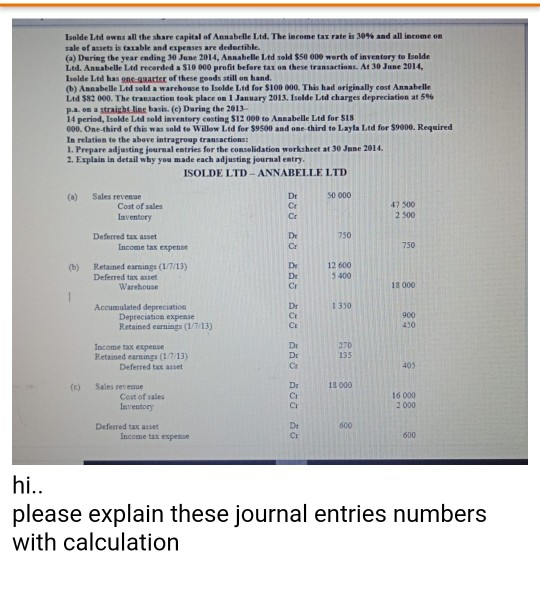

bolde Ltd owns all the share capital of Annabelle Ltd. The income tax rate n 304, and all income on sale of assets is tazable and expenses are dedectible. (a) During the year ending 30 June 2014, Annabelle Ltd sold $50 000 werth of inventory to Isolde Ltd. Annabelle Ltd recorded $10 000 profit before tax on these transactions. At 30 June 2014, ielde Ltd has ons.qnarter of these goods still on hand. (b) Annabelle Ltd seld a warehouse to Iselde Ltd for $100 000. This had originally cost Anmabelle Ltd S82 000. The transaction took place on 1 January 2013. Isolde Ltd charges depreciation at 5% p.a on a atraight ling basis. (c) Daring the 2013 14 period, Isolde Ltd sold inventery costing $12 000 to Anmabelle Ltd for $18 000. One-third of this was sold to Willew Led for $9500 and one-third to Layla Ltd for $9000. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the conselidation worksheet at 30 June 2014 2. Explain in detail why you made each adjusting journal entry. ISOLDE LTD-ANNABELLE LTD Dr C 50 000 Cr (o) Sales revense Cost of sales laventory 47 300 2 500 Deferred tax asset Income tax expense Cr 750 12 600 3 400 (b) Retained earnings (1/7/13) Dr Deferred tax asset Warehouste 18 000 Dr Ct Ct Accumulated depreciation 1 350 Depreciation expense Retained earnings (1/7/13) 900 450 Income tax expense Retained earnings (17/13) Dr Dr 270 135 Deferred tax asset (c) Sales rereaue Dr 13 000 Cost of sales Inrentory 16 000 2 000 Cr Deferred tas asset Income tax expense 500 hi please explain these journal entries numbers with calculation bolde Ltd owns all the share capital of Annabelle Ltd. The income tax rate n 304, and all income on sale of assets is tazable and expenses are dedectible. (a) During the year ending 30 June 2014, Annabelle Ltd sold $50 000 werth of inventory to Isolde Ltd. Annabelle Ltd recorded $10 000 profit before tax on these transactions. At 30 June 2014, ielde Ltd has ons.qnarter of these goods still on hand. (b) Annabelle Ltd seld a warehouse to Iselde Ltd for $100 000. This had originally cost Anmabelle Ltd S82 000. The transaction took place on 1 January 2013. Isolde Ltd charges depreciation at 5% p.a on a atraight ling basis. (c) Daring the 2013 14 period, Isolde Ltd sold inventery costing $12 000 to Anmabelle Ltd for $18 000. One-third of this was sold to Willew Led for $9500 and one-third to Layla Ltd for $9000. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the conselidation worksheet at 30 June 2014 2. Explain in detail why you made each adjusting journal entry. ISOLDE LTD-ANNABELLE LTD Dr C 50 000 Cr (o) Sales revense Cost of sales laventory 47 300 2 500 Deferred tax asset Income tax expense Cr 750 12 600 3 400 (b) Retained earnings (1/7/13) Dr Deferred tax asset Warehouste 18 000 Dr Ct Ct Accumulated depreciation 1 350 Depreciation expense Retained earnings (1/7/13) 900 450 Income tax expense Retained earnings (17/13) Dr Dr 270 135 Deferred tax asset (c) Sales rereaue Dr 13 000 Cost of sales Inrentory 16 000 2 000 Cr Deferred tas asset Income tax expense 500 hi please explain these journal entries numbers with calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started