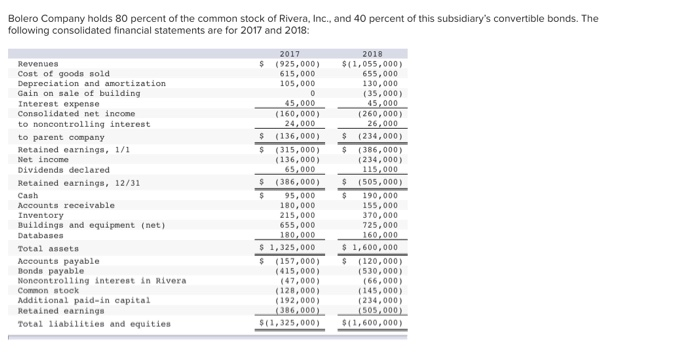

Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary's convertible bonds. The following consolidated financial statements are for 2017 and 2018: Revenues Cost of goods sold Depreciation and amortization Gain on sale of building Interest expense Consolidated net incone to noncontrolling interest to parent company Retained earnings, 1/1 Net income Dividends declared (925,000) $1,055,000) 615, 000 655,000 130,000 (35,000) 45,000 (260,000) 26,000 (234,000) 105,000 45,000 (160,000) (136,000) (136,000) ,000 $(315, 000) $ (386,000 (234,000) 115,000 (505,000) 65,000 $ (386,000) $ 95,000 Retained earnings, 12/31 $190,000 Accounts receivable Inventory Buildings and equipment (net) 180,000 215,000 655,000 55,000 370,000 725,000 1,600,000 S (120,000) Total assets 1,325,000 Accounts payable Bonds payable Noncontrolling interest in Rivera Common stock Additional paid-in capital Retained earnings (157,000) (415,000) 47,000) (128,000) 192,000) 386,000)05,000 325,000) (530,000) (66,000 (145,000) (234,000 Total 1iabilities and equities $1,600,000) Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary's convertible bonds. The following consolidated financial statements are for 2017 and 2018: Revenues Cost of goods sold Depreciation and amortization Gain on sale of building Interest expense Consolidated net incone to noncontrolling interest to parent company Retained earnings, 1/1 Net income Dividends declared (925,000) $1,055,000) 615, 000 655,000 130,000 (35,000) 45,000 (260,000) 26,000 (234,000) 105,000 45,000 (160,000) (136,000) (136,000) ,000 $(315, 000) $ (386,000 (234,000) 115,000 (505,000) 65,000 $ (386,000) $ 95,000 Retained earnings, 12/31 $190,000 Accounts receivable Inventory Buildings and equipment (net) 180,000 215,000 655,000 55,000 370,000 725,000 1,600,000 S (120,000) Total assets 1,325,000 Accounts payable Bonds payable Noncontrolling interest in Rivera Common stock Additional paid-in capital Retained earnings (157,000) (415,000) 47,000) (128,000) 192,000) 386,000)05,000 325,000) (530,000) (66,000 (145,000) (234,000 Total 1iabilities and equities $1,600,000)