Answered step by step

Verified Expert Solution

Question

1 Approved Answer

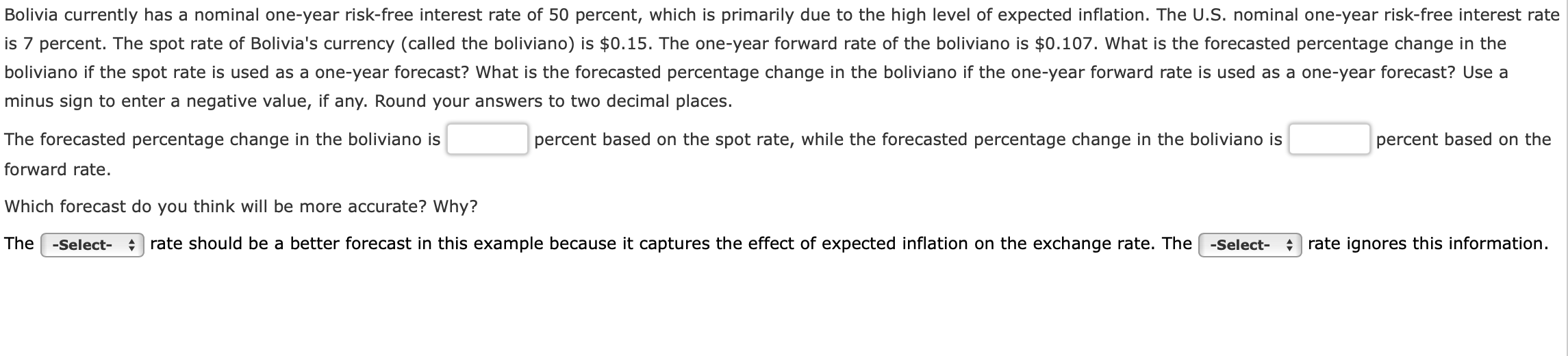

Bolivia currently has a nominal one - year risk - free interest rate of 5 0 percent, which is primarily due to the high level

Bolivia currently has a nominal oneyear riskfree interest rate of percent, which is primarily due to the high level of expected inflation. The US nominal oneyear riskfree interest rate

is percent. The spot rate of Bolivia's currency called the boliviano is $ The oneyear forward rate of the boliviano is $ What is the forecasted percentage change in the

boliviano if the spot rate is used as a oneyear forecast? What is the forecasted percentage change in the boliviano if the oneyear forward rate is used as a oneyear forecast? Use a

minus sign to enter a negative value, if any. Round your answers to two decimal places.

The forecasted percentage change in the boliviano is

percent based on the spot rate, while the forecasted percentage change in the boliviano is

percent based on the

forward rate.

Which forecast do you think will be more accurate? Why?

The

rate should be a better forecast in this example because it captures the effect of expected inflation on the exchange rate. The

rate ignores this information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started