Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bombardier Inc. is one of the largest manufacturers of planes and trains in the world. The company's long-lived assets exceed $12 billion. As a result,

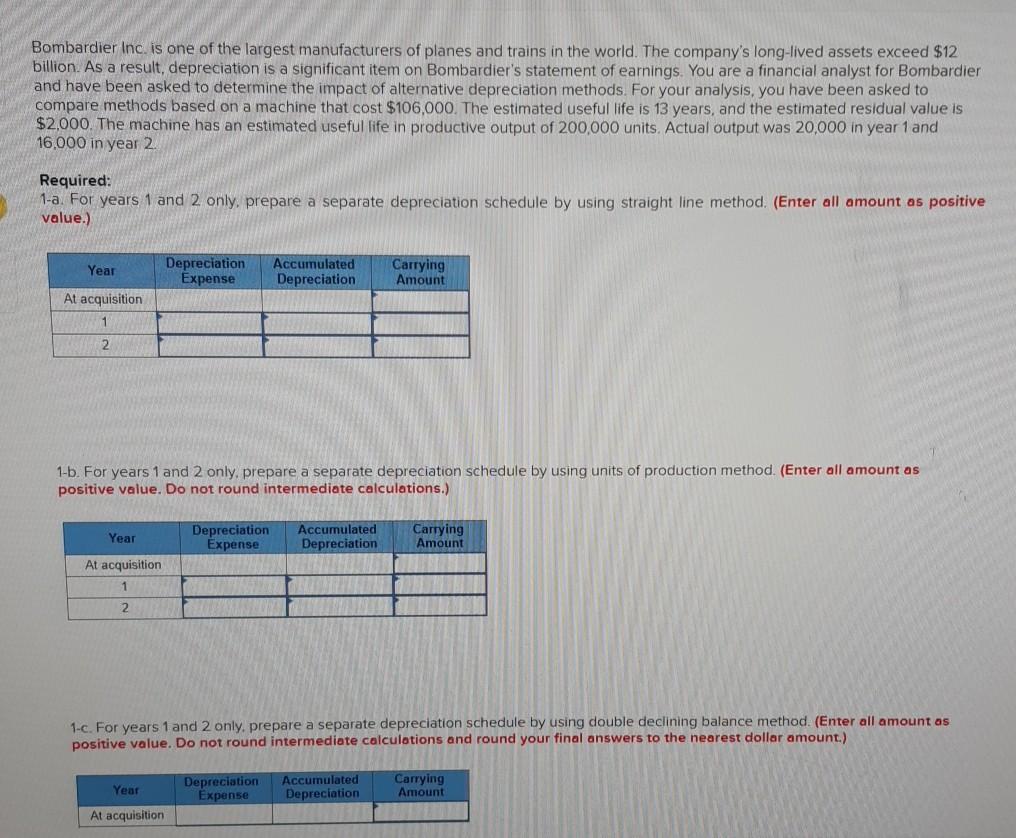

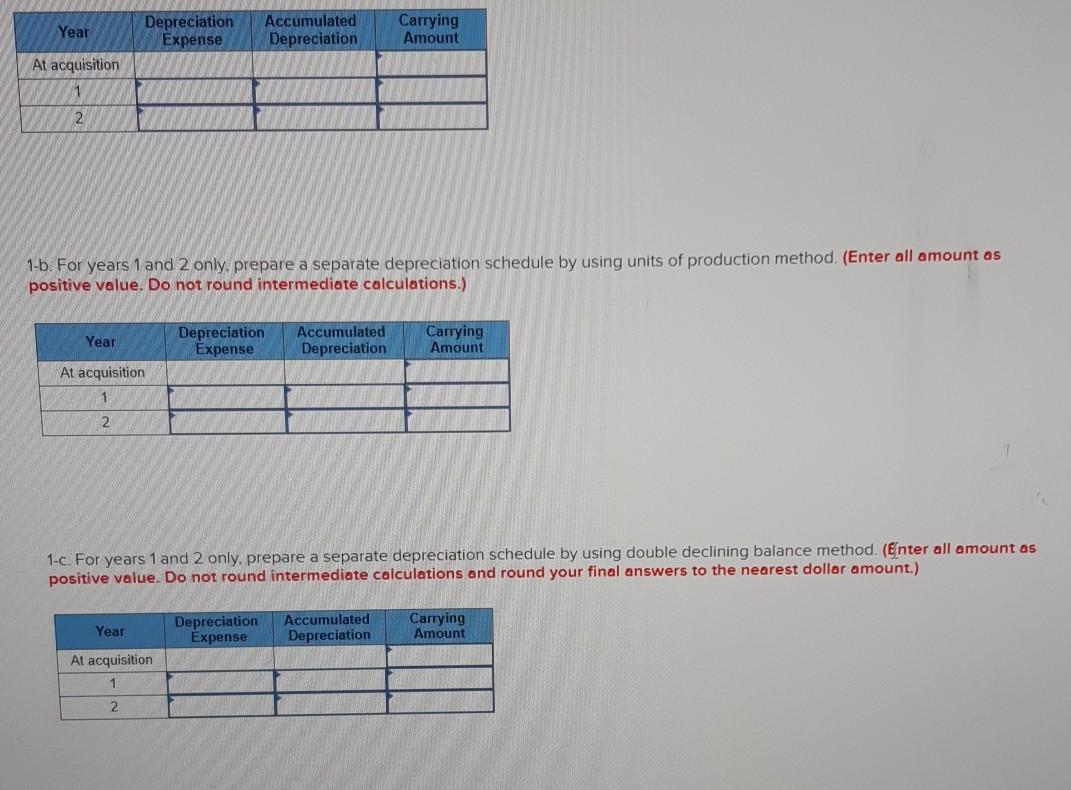

Bombardier Inc. is one of the largest manufacturers of planes and trains in the world. The company's long-lived assets exceed $12 billion. As a result, depreciation is a significant item on Bombardier's statement of earnings. You are a financial analyst for Bombardier and have been asked to determine the impact of alternative depreciation methods. For your analysis, you have been asked to compare methods based on a machine that cost $106,000. The estimated useful life is 13 years, and the estimated residual value is $2,000. The machine has an estimated useful life in productive output of 200,000 units. Actual output was 20,000 in year 1 and 16,000 in year 2 Required: 1-a. For years 1 and 2 only, prepare a separate depreciation schedule by using straight line method. (Enter all amount as positive value.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2 1-b. For years 1 and 2 only, prepare a separate depreciation schedule by using units of production method. (Enter all amount as positive value. Do not round intermediate calculations.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2 1-c. For years 1 and 2 only, prepare a separate depreciation schedule by using double declining balance method. (Enter all amount as positive value. Do not round intermediate calculations and round your final answers to the nearest dollar amount.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2 1-b. For years 1 and 2 only prepare a separate depreciation schedule by using units of production method. (Enter all amount as positive value. Do not round intermediate calculations.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2 1-c. For years 1 and 2 only, prepare a separate depreciation schedule by using double declining balance method. (Enter all amount as positive value. Do not round intermediate calculations and round your final answers to the nearest dollar amount.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started